Month: January 2016

Cebuana Lhuillier Microinsurance advocates for disaster resilience

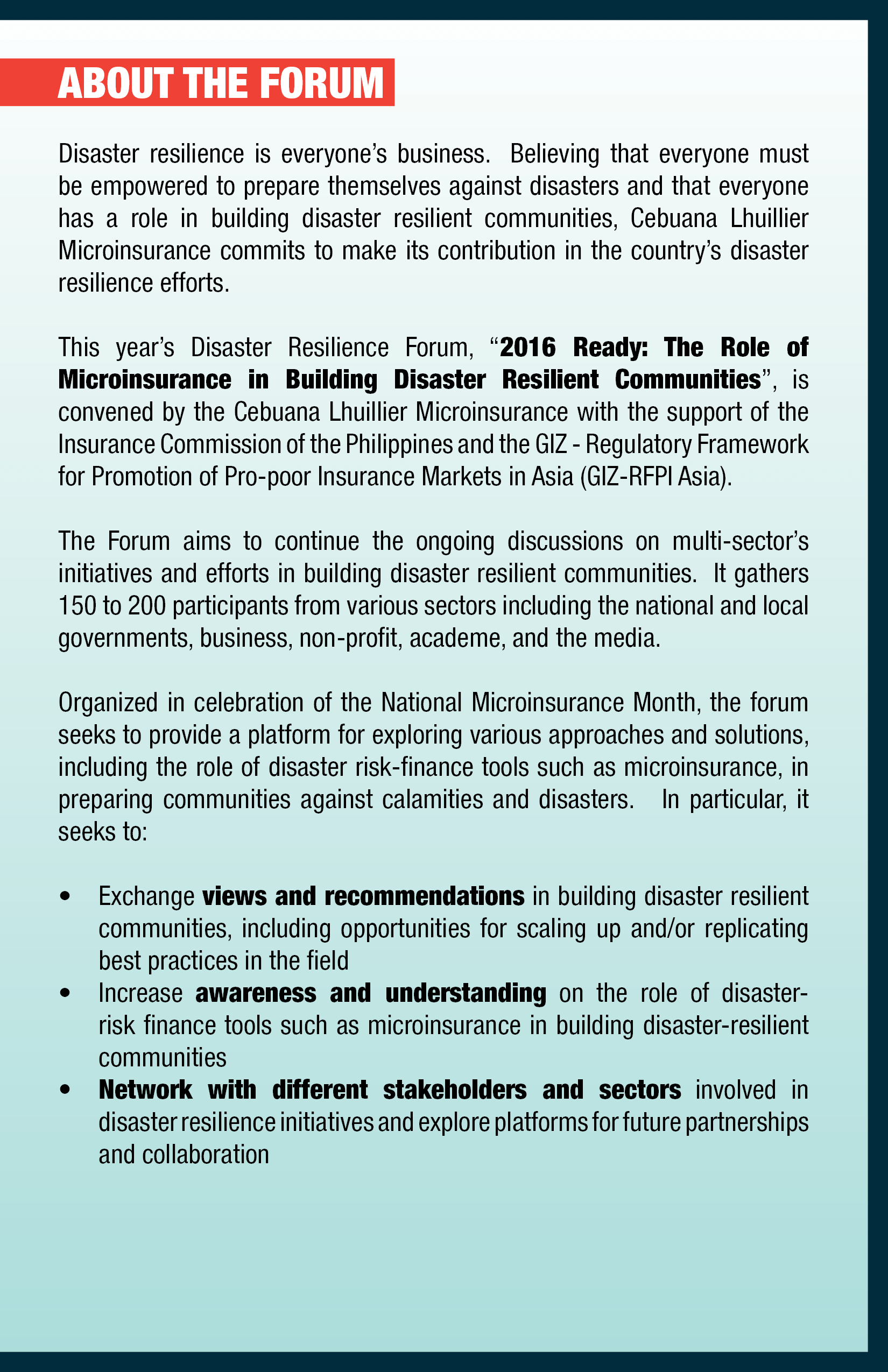

Gearing up for the onslaught of possible disasters and calamities this 2016, Cebuana Lhuillier Microinsurance has pledged to bolster disaster resilience in the Philippines and promote disaster preparedness among Filipinos during the 2016 Ready: Disaster Resilience Forum – The Role of Microinsurance in Building Disaster-Resilient Communities held on January 27, 2016 at Makati Shangri-La Hotel.

Stressing the importance of personal readiness and security to alleviate massive losses and damages during disasters, Cebuana Lhuillier President and CEO Jean Henri Lhuillier urged attendees to understand their possible roles in disaster management.

“Calamities and disasters impact everyone, especially the poor and most vulnerable communities.

Everyone has a role to play in building Filipino communities’ resilience against disasters and calamities, and Cebuana Lhuillier Microinsurance believes everyone must be empowered to prepare themselves against these kinds of crises, thus, we decided to embark on this mission for our country and for our people,” he said.

Known for advocating education and sports development for the youth, Cebuana Lhuillier has long been helping Filipinos uplift their lives through its microfinancial solutions services and various CSR programs.

“This time, we would like to instigate a whole new advocacy that would benefit a larger number of Filipinos. Today, we are giving our full commitment to contribute to our country’s disaster resilience through the microinsurance products and services we offer in Cebuana Lhuillier and by actively promoting it for public awareness,” he added.

Collaborative Effort

During the forum, Lhuillier also encouraged multi-stakeholder partnerships and collaborations among organizations that share the same objective of building disaster-resilient communities.

“We recognize the importance of having a collaborative effort and support from relevant institutions to achieve the most impactful end result. Through this forum, we hope to open more doors for possible partnerships and encourage more organizations to join our mission—hand-in-hand,” he said.

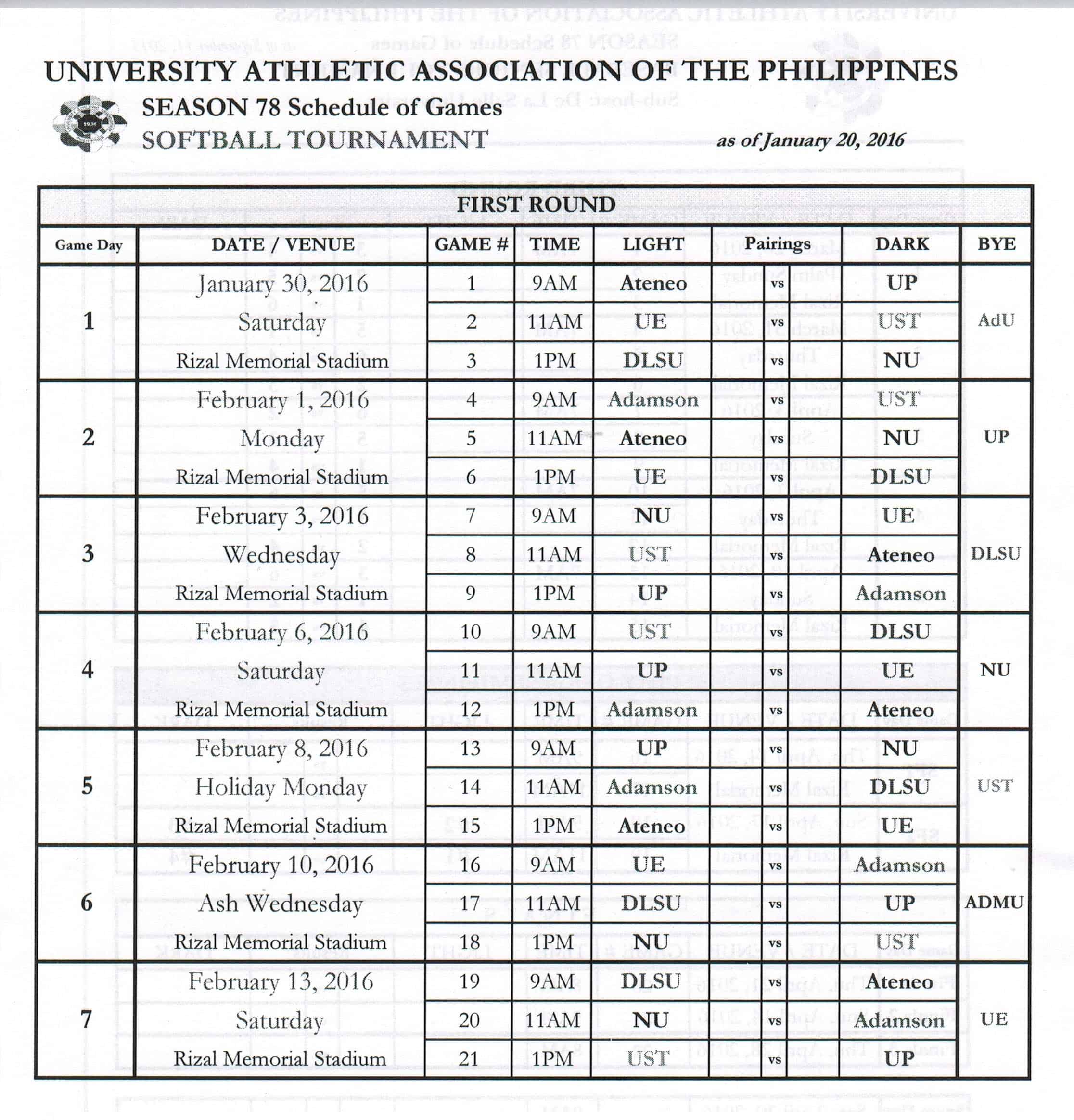

Presented in three parts—Ready to Initiate, Ready to Collaborate, and Ready to Innovate—the disaster resilience forum is spearheaded by Cebuana Lhuillier in an attempt to emphasize the importance of preparedness and provide means on how Filipinos can rebuild their lives after such events.

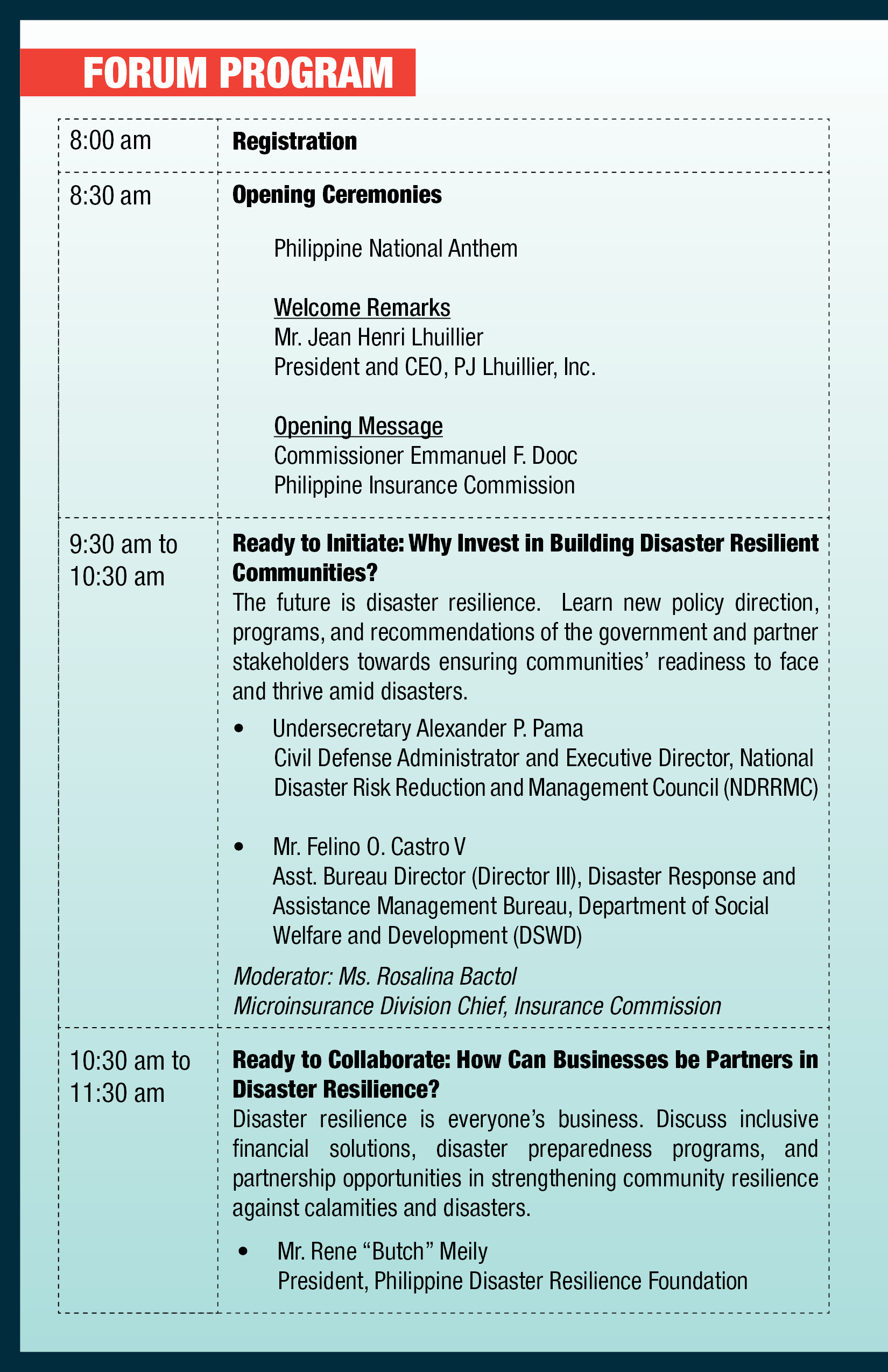

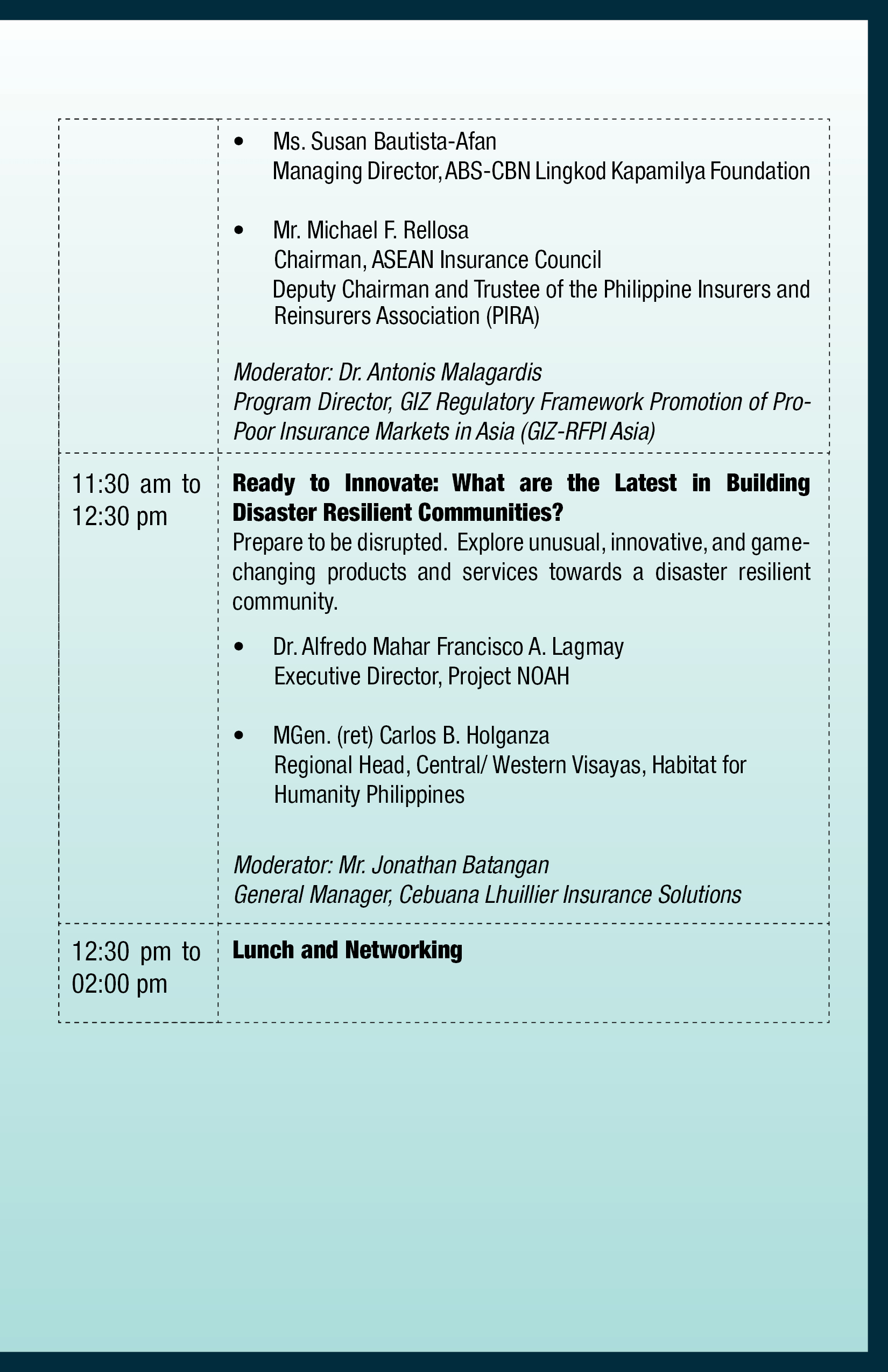

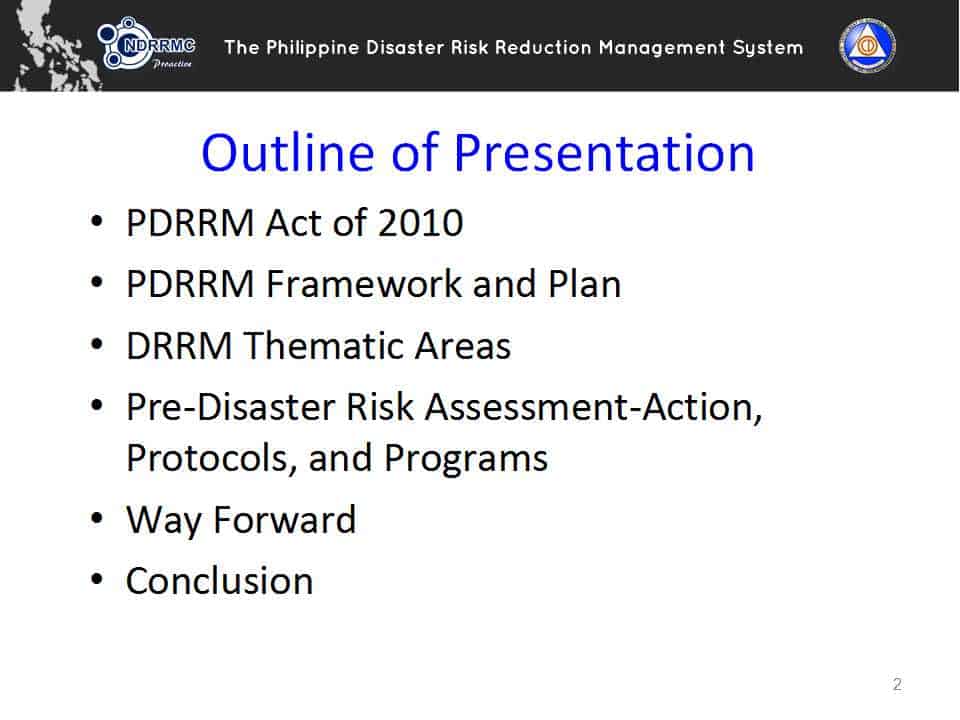

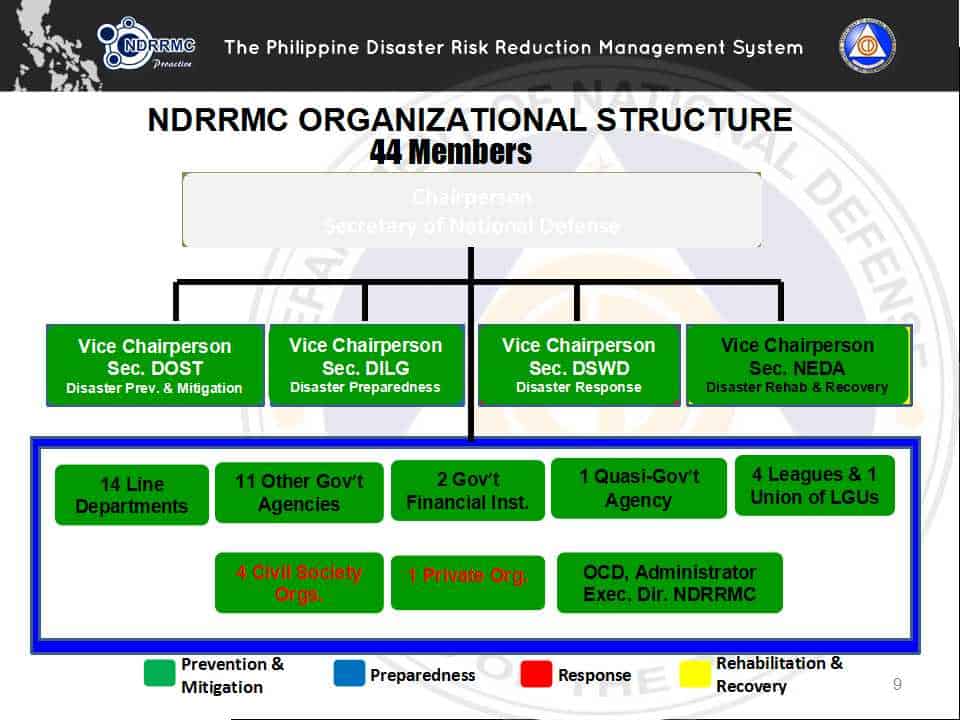

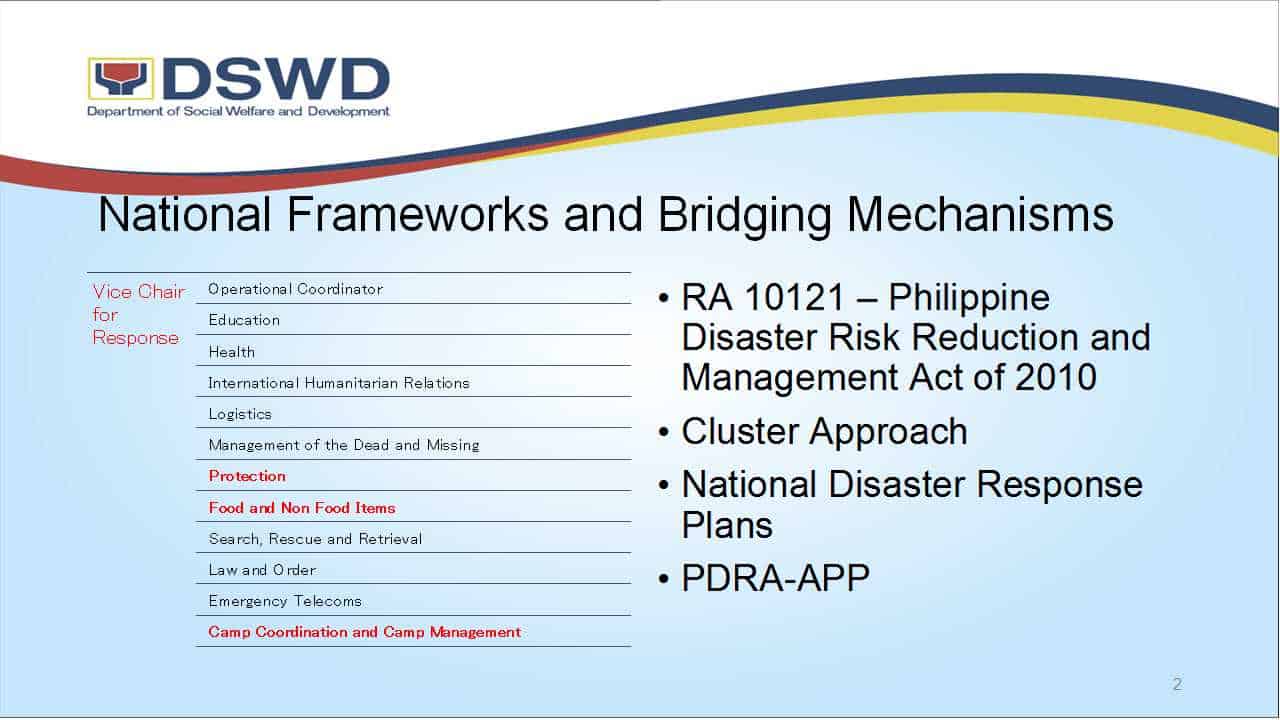

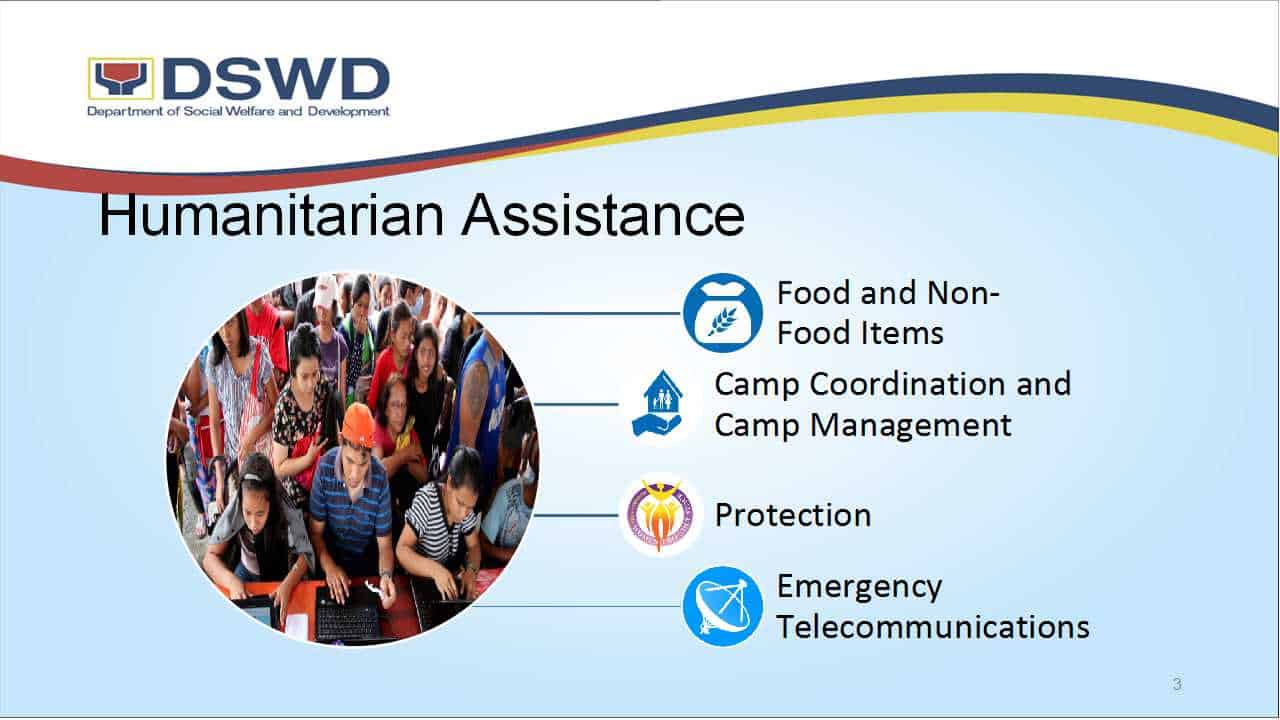

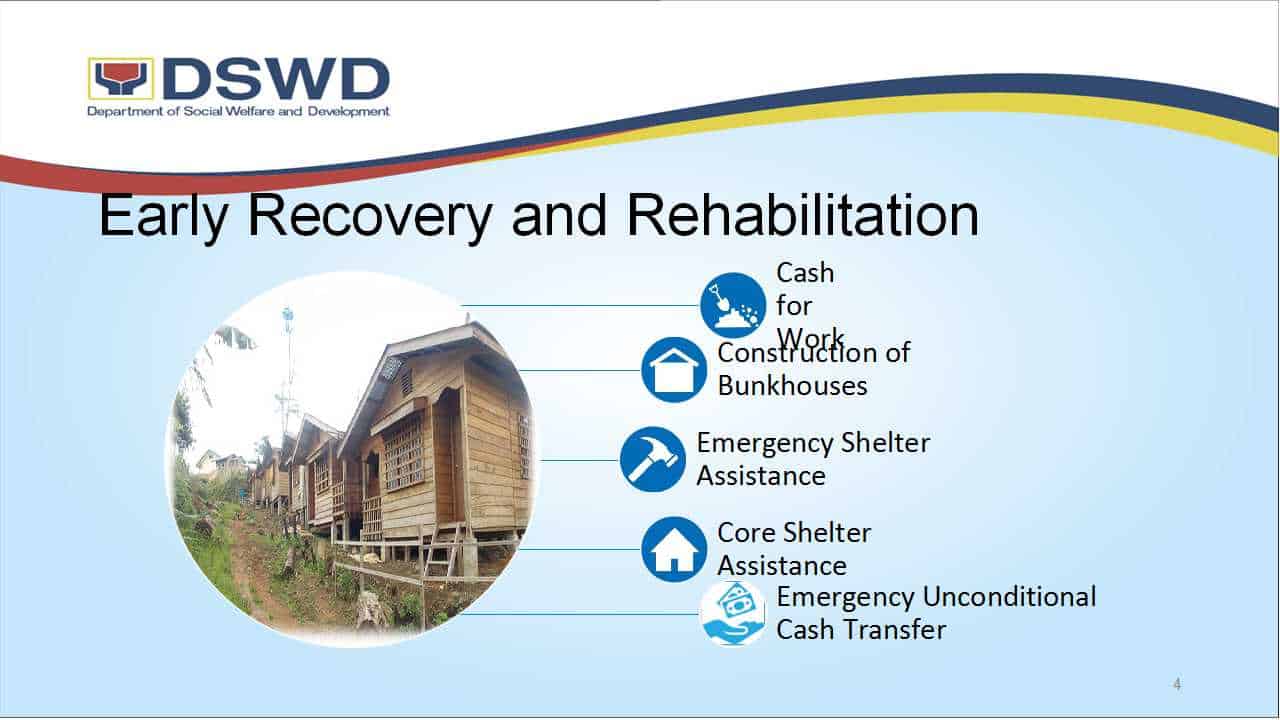

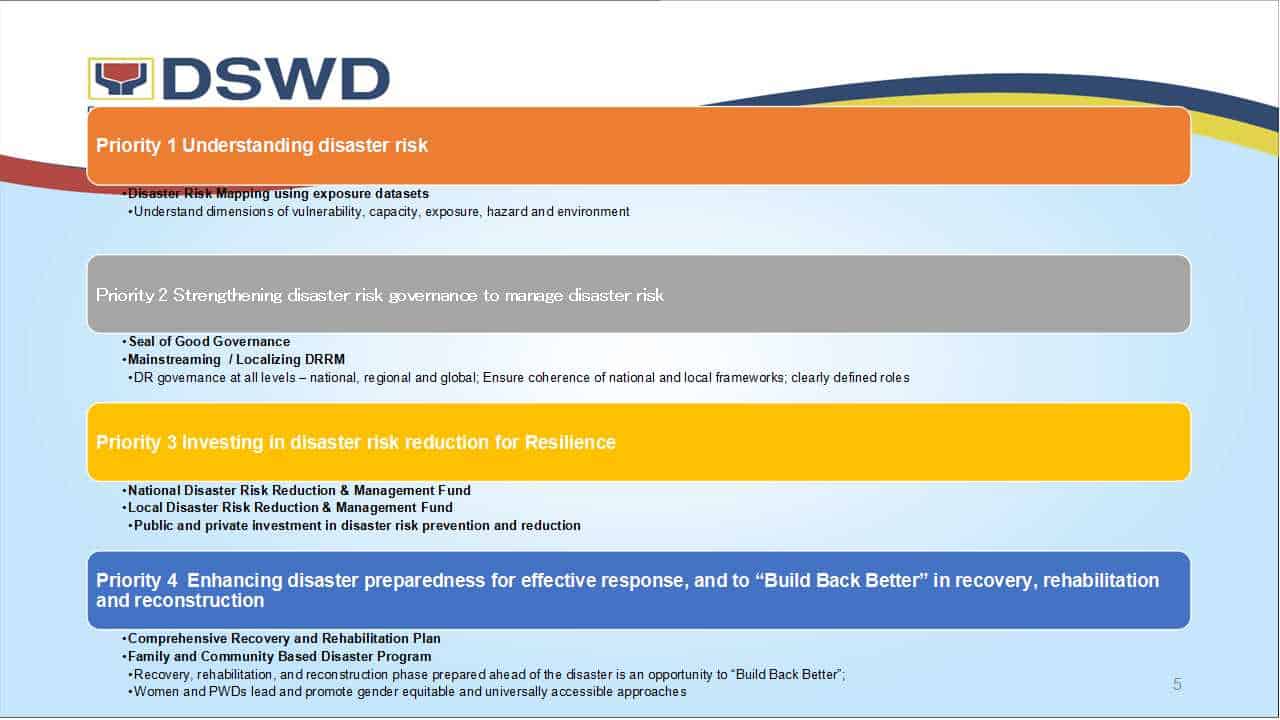

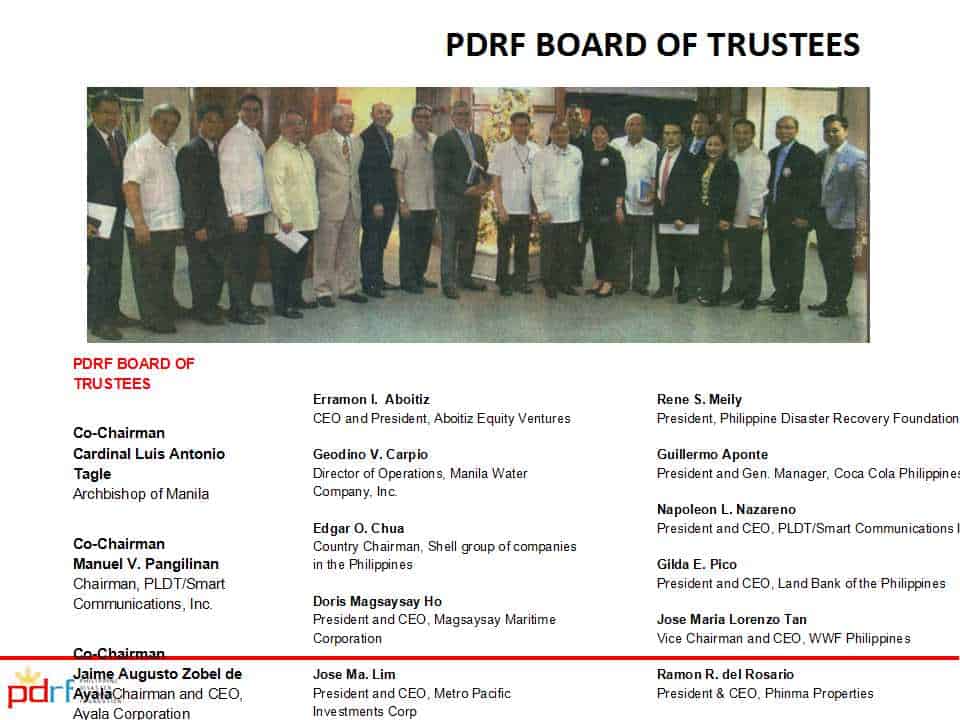

Keynote speaker of the forum was Insurance Commission Hon. Emmanuel F. Dooc, while the other speakers were National Disaster Risk Reduction and Management Council Civil Defense Administrator and Executive Director Undersecretary Alexander P. Pama; Department of Social Welfare and Development Disaster Response and Assistance Management Asst. Bureau Director Felino O. Castro V; Philippine Disaster Resilience Foundation President Rene “Butch” Meily; ABS-CBN Lingkod Kapamilya Foundation Managing Director Susan Bautista-Afan; ASEAN Insurance Council Chairman Michael F. Rellosa; Project NOAH Executive Director Dr. Alfredo Mahar Francisco A. Lagmay; and Habitat for Humanity Philippines Western Visayas Regional Head Retired Major General Carlos B. Holganza.

Microinsurance as Tool

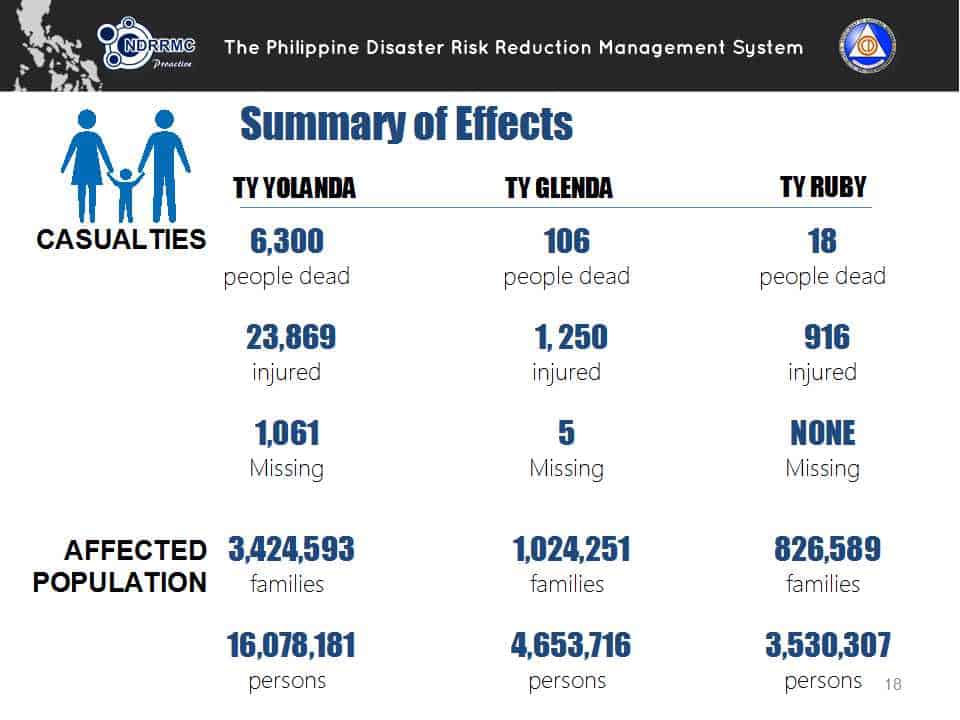

Citing true stories of Typhoon Yolanda survivors who were able to bounce back after the disaster, the forum also highlighted the role of microinsurance as a key tool in disaster preparedness.

“We believe that microinsurance is one of the best existing tools to mitigate the impact of natural disasters. In the aftermath of Typhoon Yolanda, the microinsurance sector settled some P500 million claims involving more than a hundred thousand claimants,” Lhuillier said.

“We believe on the possible assistance that microinsurance can offer to policy holders post disasters. That is why, we have been continuing our efforts in reaching more communities, especially those in the far-flung areas and those that are most vulnerable to disasters, to educate them with the benefits of microinsurance and encourage them to be covered,” he added.

Through Cebuana Lhuillier Insurance Solutions (CLIS), the insurance arm of Cebuana Lhuillier, the company has been taking trailblazing initiatives to foster microinsurance especially now that CLIS has obtained ISO Certification. With the support of its insurers, CLIS has already covered more than 5 million Filipinos and settled P140 million claims.

“So far, we have already deployed Microinsurance-on-wheels in different parts of the Philippines; developed the first microinsurance-dedicated app for Android phones called MicroPinoy; forged important partnerships with various organizations to push for microinsurance even more; we have been creating innovative and tailor-fit microinsurance products for the specific needs of our countrymen—all these efforts directed towards increasing the number of microinsurance coverage among Filipinos that will ultimately help them prepare against disasters,” Lhuillier said.

Co-organized by the Insurance Commission (IC) and the GIZ (Deutsche Gesellschaft für Internationale Zusammenarbeit) Regulatory Framework Promotion of Pro-Poor Insurance Markets in Asia (GIZ-RFPI Asia), the forum coincides with the observance of January as Microinsurance Month.

Cebuana Lhuillier Microinsurance advocates for disaster resilience; commits to support initiatives to build disaster resilient communities

Gearing up for the onslaught of possible disasters and calamities this 2016, Cebuana Lhuillier Microinsurance has pledged to bolster disaster resilience in the Philippines and promote disaster preparedness among Filipinos during the 2016 Ready: Disaster Resilience Forum – The Role of Microinsurance in Building Disaster-Resilient Communities held on January 27, 2016 at Makati Shangri-La Hotel.

Stressing the importance of personal readiness and security to alleviate massive losses and damages during disasters, Cebuana Lhuillier President and CEO Jean Henri Lhuillier urged attendees to understand their possible roles in disaster management.

“Calamities and disasters impact everyone, especially the poor and most vulnerable communities.

Everyone has a role to play in building Filipino communities’ resilience against disasters and calamities, and Cebuana Lhuillier Microinsurance believes everyone must be empowered to prepare themselves against these kinds of crises, thus, we decided to embark on this mission for our country and for our people,” he said.

Known for advocating education and sports development for the youth, Cebuana Lhuillier has long been helping Filipinos uplift their lives through its microfinancial solutions services and various CSR programs.

“This time, we would like to instigate a whole new advocacy that would benefit a larger number of Filipinos. Today, we are giving our full commitment to contribute to our country’s disaster resilience through the microinsurance products and services we offer in Cebuana Lhuillier and by actively promoting it for public awareness,” he added.

Collaborative Effort

During the forum, Lhuillier also encouraged multi-stakeholder partnerships and collaborations among organizations that share the same objective of building disaster-resilient communities.

“We recognize the importance of having a collaborative effort and support from relevant institutions to achieve the most impactful end result. Through this forum, we hope to open more doors for possible partnerships and encourage more organizations to join our mission—hand-in-hand,” he said.

Presented in three parts—Ready to Initiate, Ready to Collaborate, and Ready to Innovate—the disaster resilience forum is spearheaded by Cebuana Lhuillier in an attempt to emphasize the importance of preparedness and provide means on how Filipinos can rebuild their lives after such events.

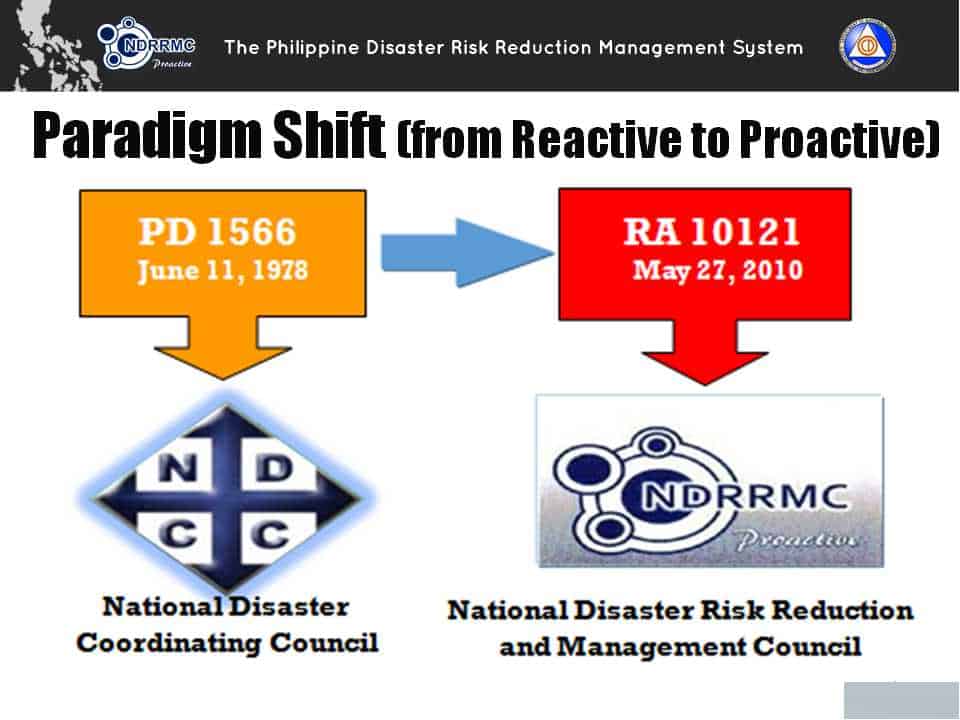

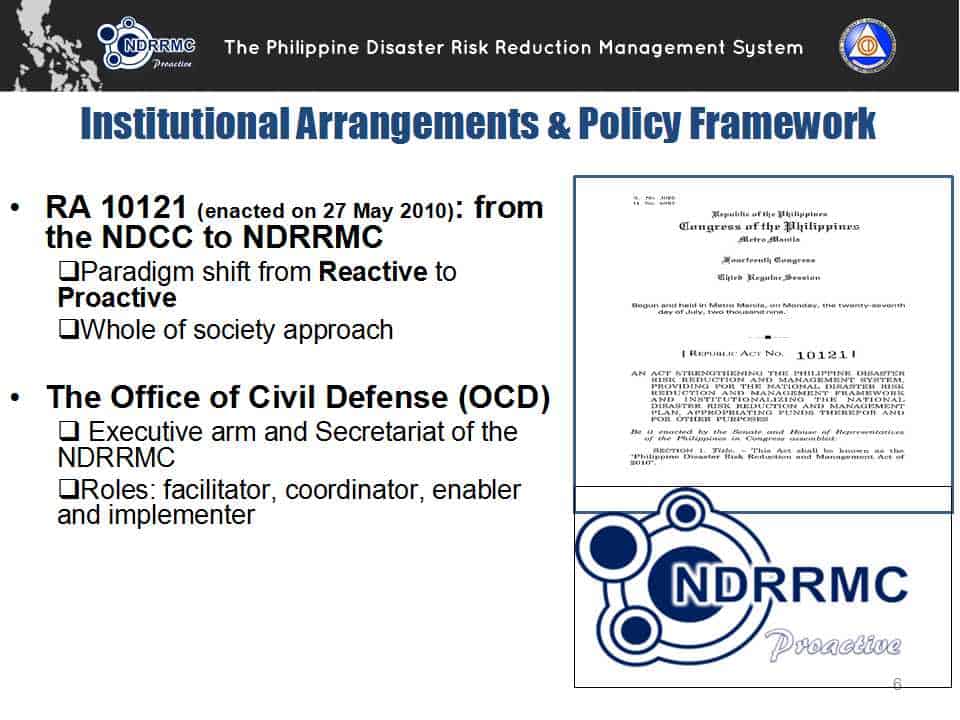

Keynote speaker of the forum was Insurance Commission Hon. Emmanuel F. Dooc, while the other speakers were National Disaster Risk Reduction and Management Council Civil Defense Administrator and Executive Director Undersecretary Alexander P. Pama; Department of Social Welfare and Development Disaster Response and Assistance Management Asst. Bureau Director Felino O. Castro V; Philippine Disaster Resilience Foundation President Rene “Butch” Meily; ABS-CBN Lingkod Kapamilya Foundation Managing Director Susan Bautista-Afan; ASEAN Insurance Council Chairman Michael F. Rellosa; Project NOAH Executive Director Dr. Alfredo Mahar Francisco A. Lagmay; and Habitat for Humanity Philippines Western Visayas Regional Head Retired Major General Carlos B. Holganza.

Microinsurance as Tool

Citing true stories of Typhoon Yolanda survivors who were able to bounce back after the disaster, the forum also highlighted the role of microinsurance as a key tool in disaster preparedness.

“We believe that microinsurance is one of the best existing tools to mitigate the impact of natural disasters. In the aftermath of Typhoon Yolanda, the microinsurance sector settled some P500 million claims involving more than a hundred thousand claimants,” Lhuillier said.

“We believe on the possible assistance that microinsurance can offer to policy holders post disasters. That is why, we have been continuing our efforts in reaching more communities, especially those in the far-flung areas and those that are most vulnerable to disasters, to educate them with the benefits of microinsurance and encourage them to be covered,” he added.

Through Cebuana Lhuillier Insurance Solutions (CLIS), the insurance arm of Cebuana Lhuillier, the company has been taking trailblazing initiatives to foster microinsurance especially now that CLIS has obtained ISO Certification. With the support of its insurers, CLIS has already covered more than 5 million Filipinos and settled P140 million claims.

“So far, we have already deployed Microinsurance-on-wheels in different parts of the Philippines; developed the first microinsurance-dedicated app for Android phones called MicroPinoy; forged important partnerships with various organizations to push for microinsurance even more; we have been creating innovative and tailor-fit microinsurance products for the specific needs of our countrymen—all these efforts directed towards increasing the number of microinsurance coverage among Filipinos that will ultimately help them prepare against disasters,” Lhuillier said.

Co-organized by the Insurance Commission (IC) and the GIZ (Deutsche Gesellschaft für Internationale Zusammenarbeit) Regulatory Framework Promotion of Pro-Poor Insurance Markets in Asia (GIZ-RFPI Asia), the forum coincides with the observance of January as Microinsurance Month.

Be on the Right Track: 7 Things You Need to Know about Personal Finance

Handling money could be a tricky thing, so you have to make sure that you are aware of your personal finances. Otherwise, other people might take advantage of you.

There are 7 important things you need to know about Personal Finance—and you’ll find them all right here!

-

Make sure that you earn more than you spend

Let’s put it this way: What do you think will happen if you spend more than what you earn? Easy—you won’t be able to balance your finances, and soon enough you will find yourself in a pool of debt—and that’s not really something you want to happen.

-

Save early and it will turn into a habit

As with most things in life, the earlier you start, the easier you adopt the habit. It’s the same with saving money

If you started saving money way back in grade school—even by just using a piggy bank—you’d apply the habit for most of your life. The money that you save could be used for emergency funds—which everyone really needs! You don’t have to save too much—just save a little each day and you’ll surely have enough money to get you through the rainy days!

-

Be diverse

This means that you shouldn’t put your money in one place alone. The thing about life is that you never really know what’s going to happen—and putting your money in a single place is a no-no because there’s also a tendency that you might lose them all at once.

Therefore, make sure that you put your money in at least two banks—and even in separate wallets, if you can!

-

Protect yourself from phishing/scam artists

So many people end up being victimized by scam artists who ask for their credit card or bank account details online. You can protect yourself by making sure you change your PIN from time to time, and that you do not use the same passwords for all your email/online accounts. Always review bank statements, and don’t give credit card and extreme personal details to others unless absolutely necessary.

-

Save up for the rainy days

The thing with people is that they are so scared of scenarios that put their lives in danger—but they really don’t do anything about it. Therefore, you have to make sure that you could get money somewhere when emergencies come up.

Invest in emergency insurance funds, disability insurance, health insurance, and even homeowners insurance if you can. What matters is you make sure that you won’t end up with nothing—especially during emergencies.

-

Make use of automated savings

Automated savings means that for each paycheck you receive, a part of it would automatically go to a savings account. This way, you won’t have a hard time putting the money on your own to the account—and you won’t be tempted to use it, too!

-

Track your credit standing

This is all about how companies or lenders would trust you if ever you’d need help from them one day. This would also show you how you’ve been spending, and how much credit you can have. To check, you can try talking to your bank as they may have available data.

Be knowledgeable about personal finance and you’ll have a hassle-free, financially stable life!

Image Source:

http://www.iqsintl.com/index.php/franchise-opportunities/earning-potential/

http://theodysseyonline.com/memphis/saving-money-for-college-students/223569

http://www.survivinggrays.com/make-extra-money-as-a-medical-student-resident/

https://vulcanpost.com/75041/scam-striping-naked-for-sad-and-lonely-beauty/

http://www.livingrichcheaply.com/2014/05/14/how-much-is-in-your-wallet/

http://www.coffeusa.org/when-banks-cost-you-money/

http://en.yelp.com.ph/biz/cebuana-lhuillier-para%C3%B1aque

2016 Ready: Disaster Resilience Forum – The Role of Microinsurance in Building Disaster-Resilient Communities

Session 1A: Building Disaster Resilient Communities

Session 1B: Disaster Risk Reduction Programs

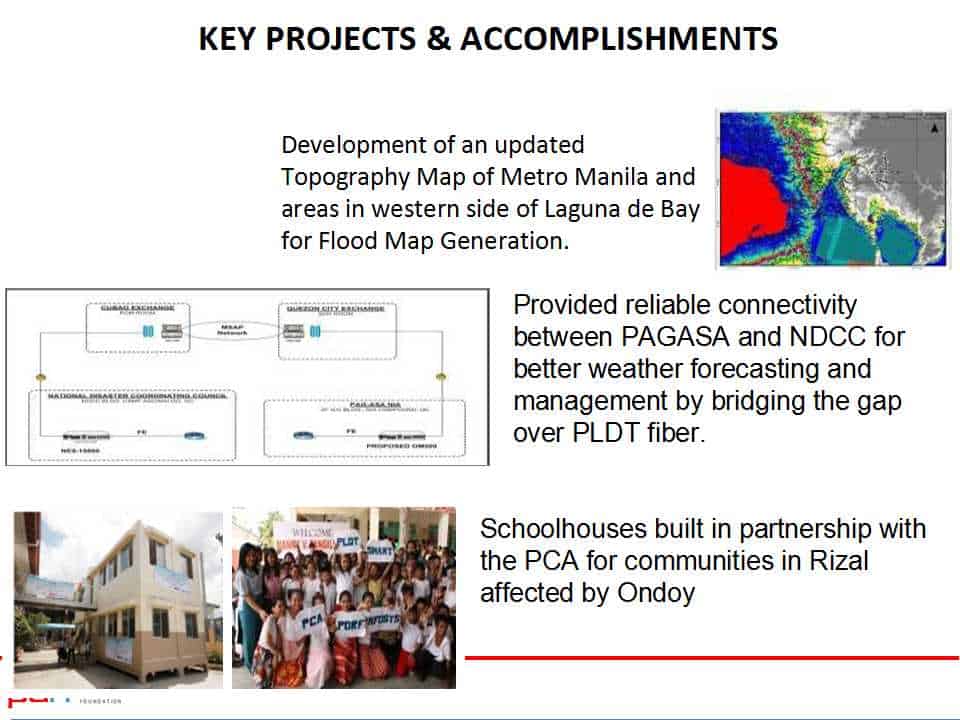

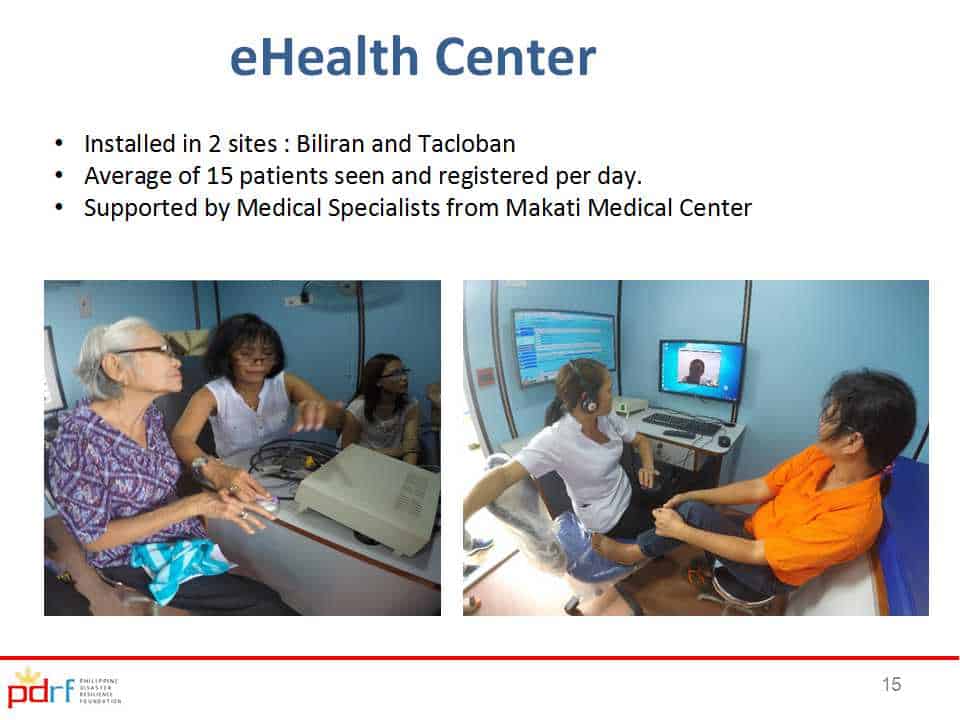

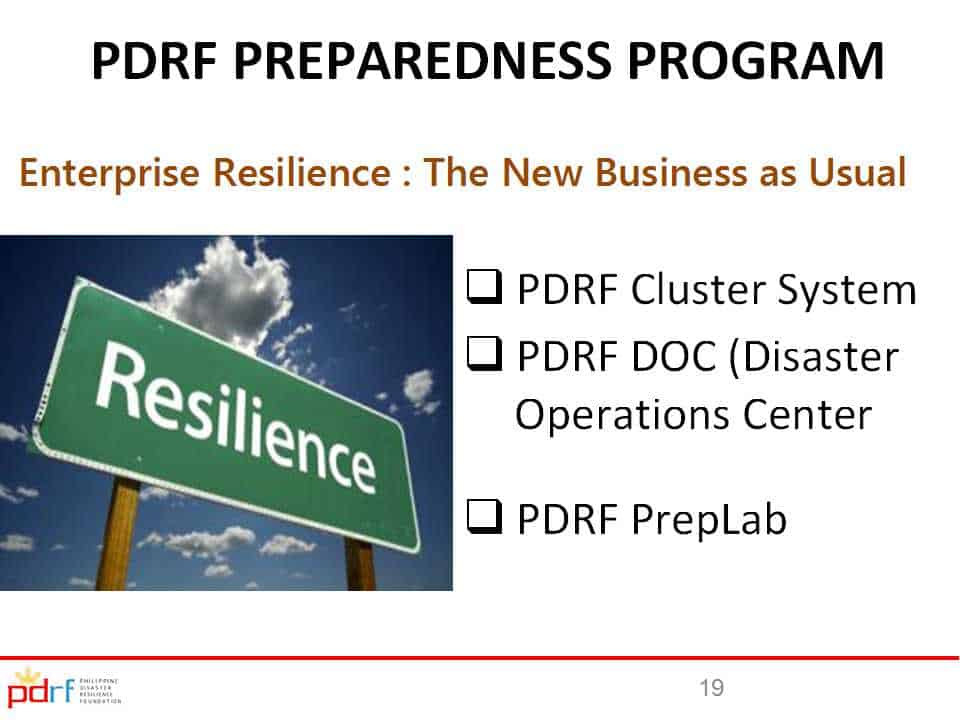

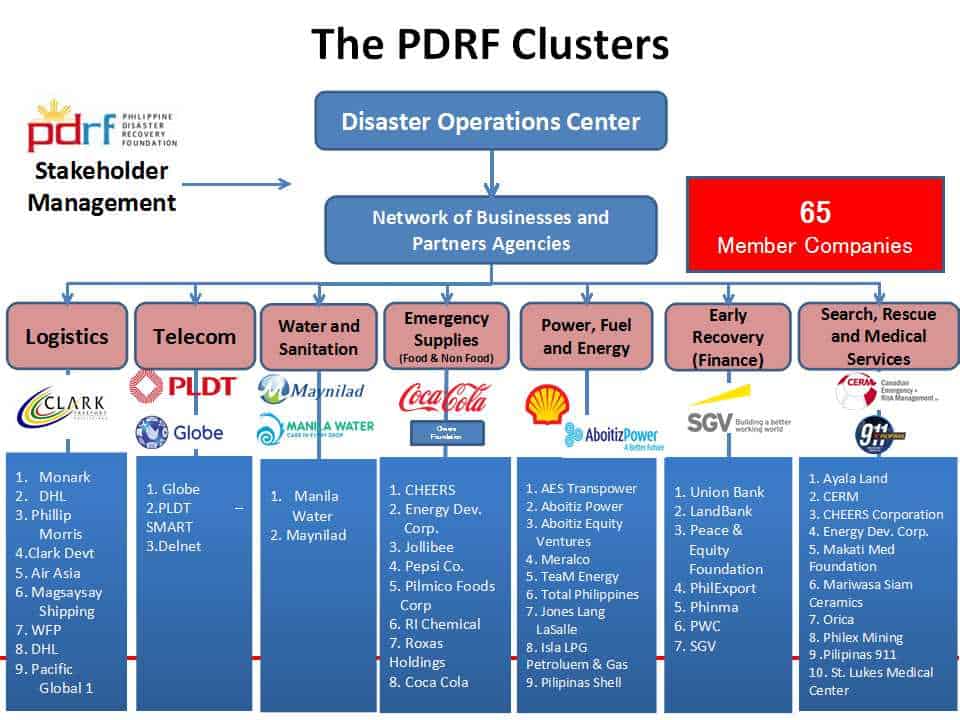

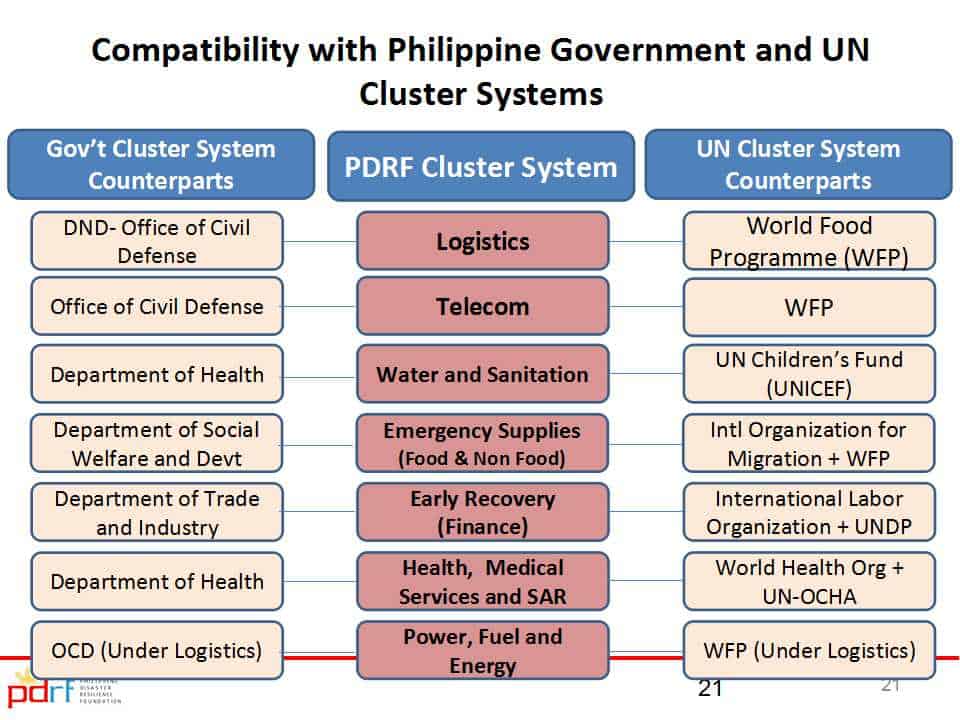

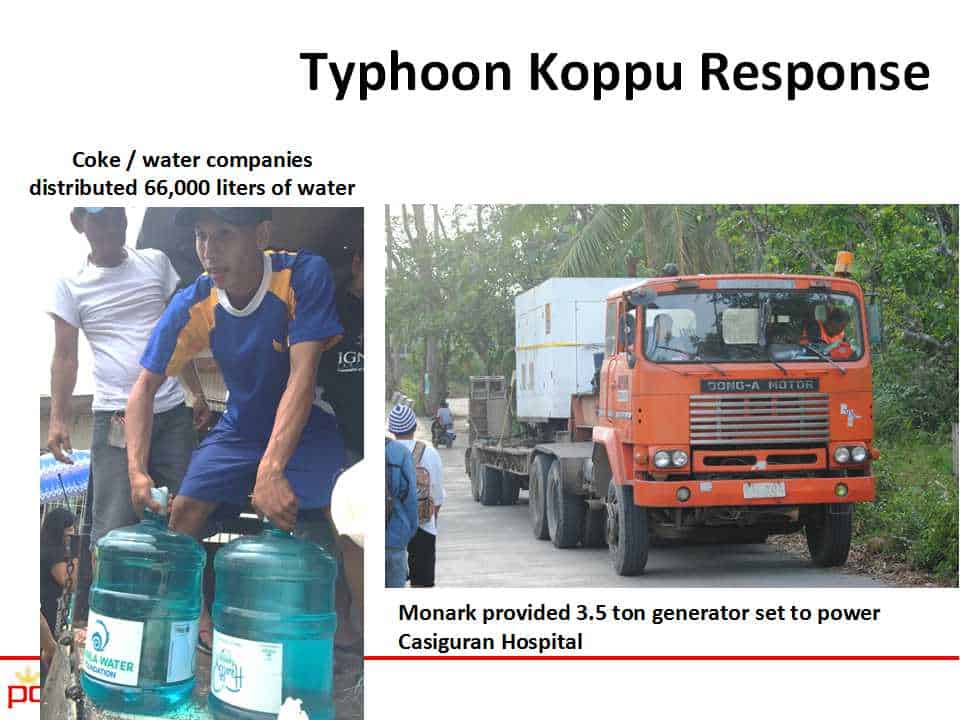

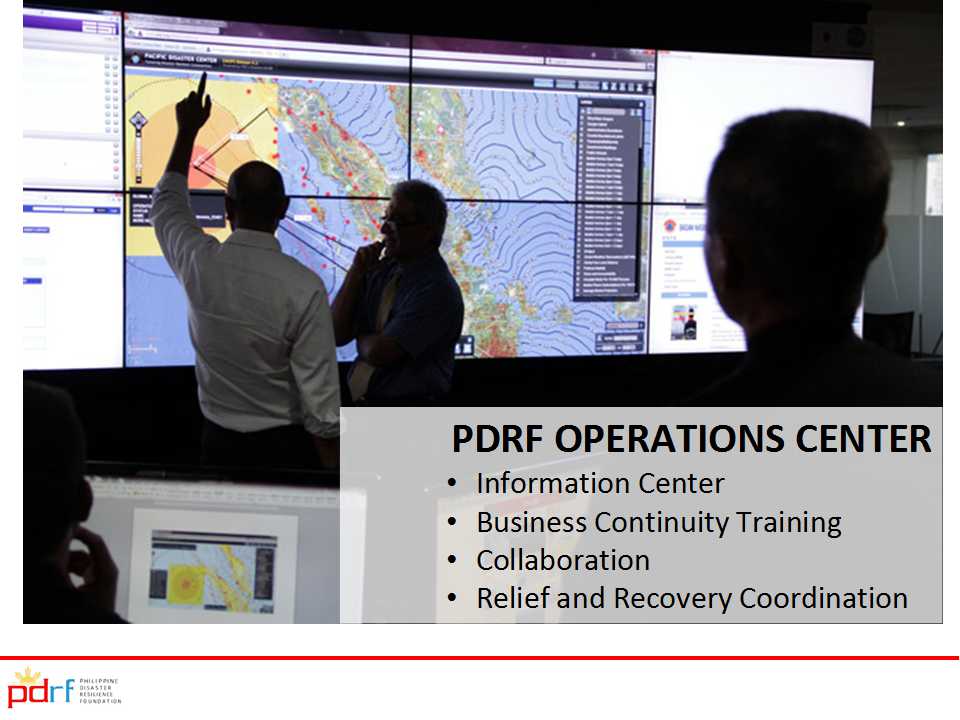

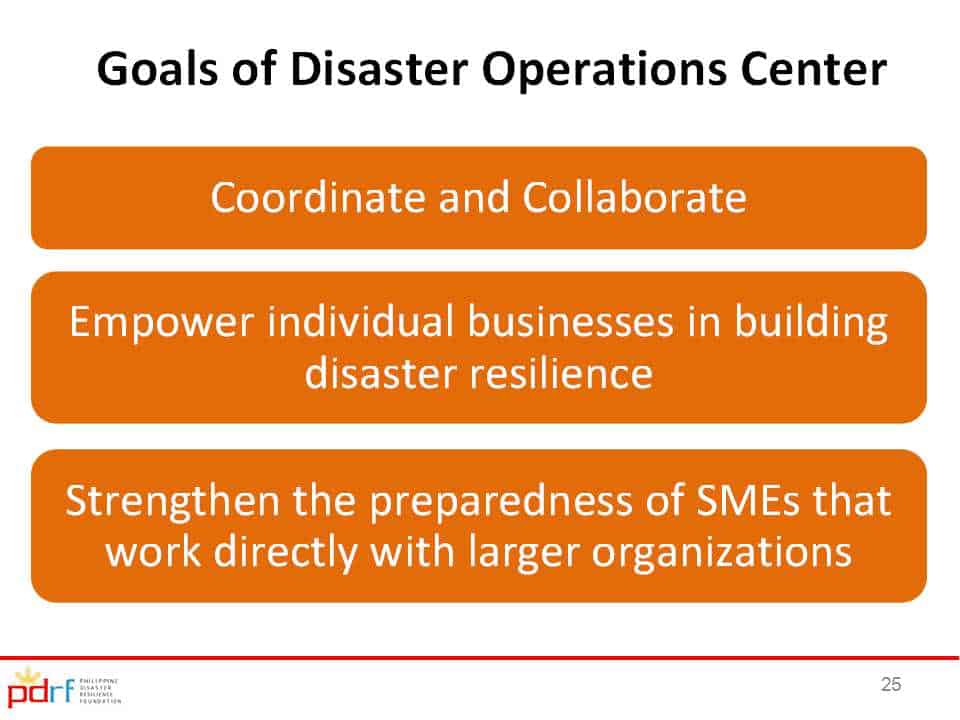

Session 2A: Philippine Disaster Resilience Foundation

Session 2B: READY TO COLLABORATE: How can Businesses be Partners in Disaster Resilience

Session 2C: Relevance of Disaster Risk Financing to ASEAN

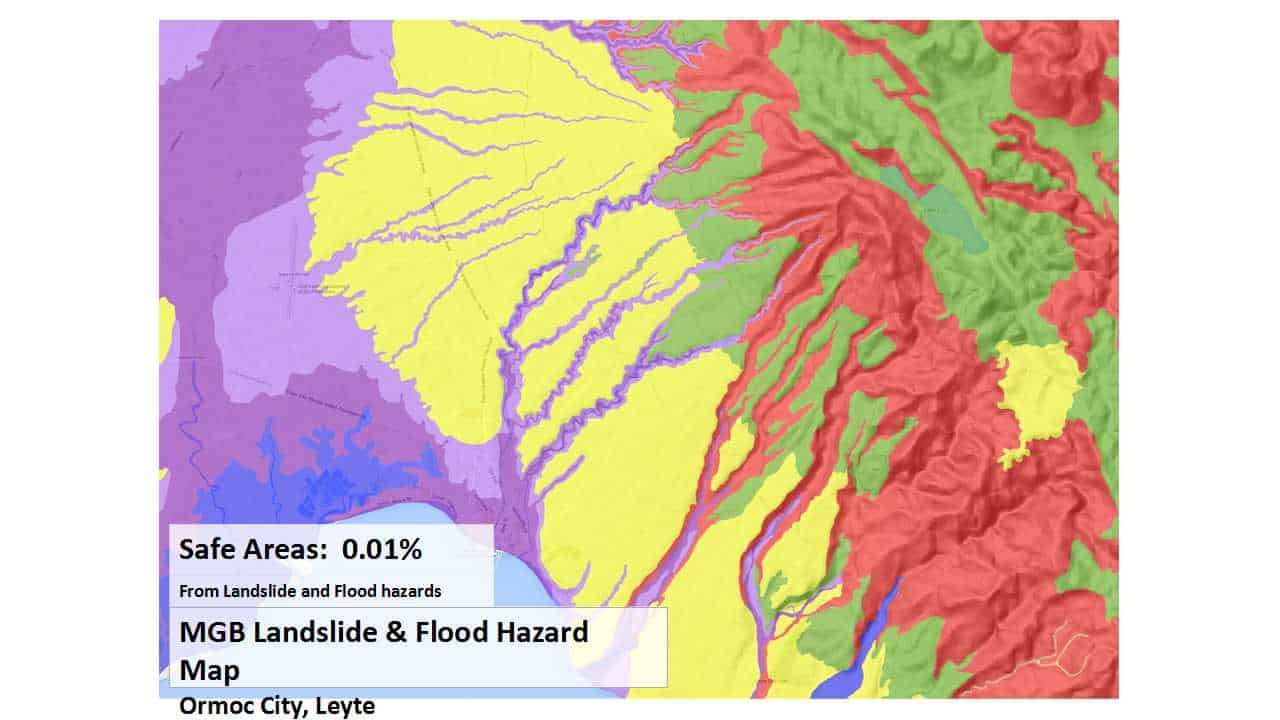

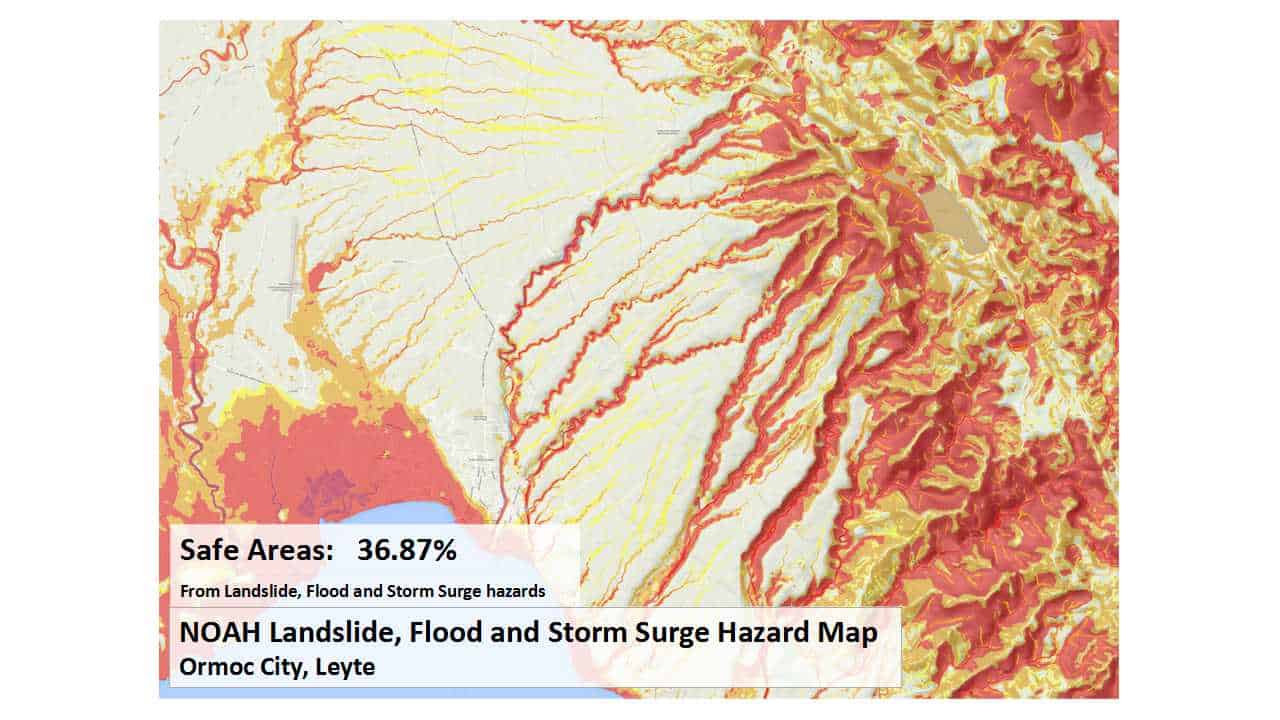

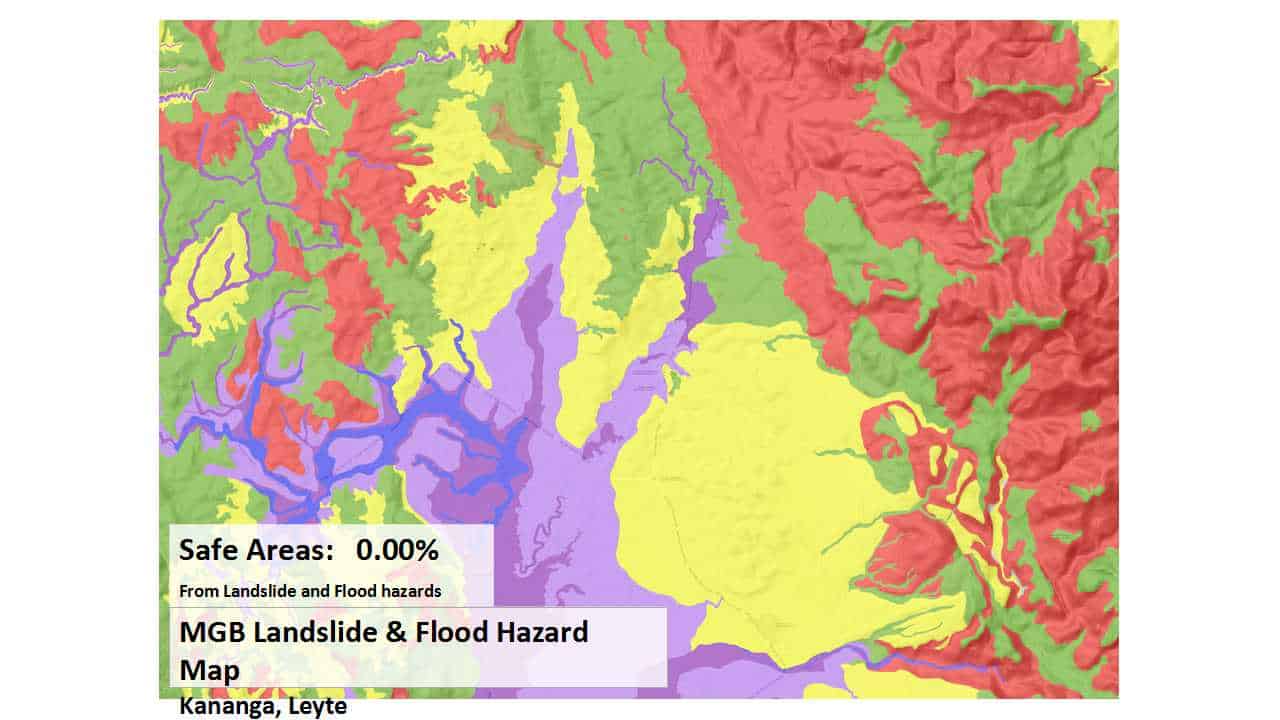

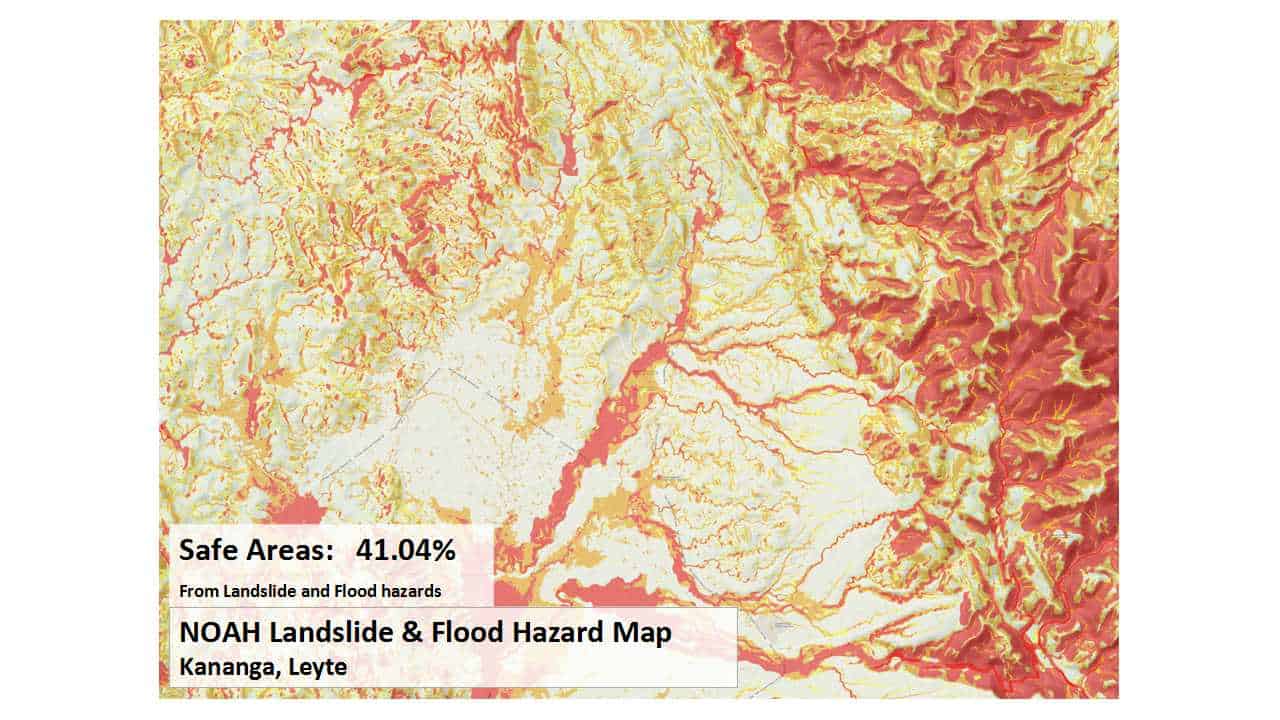

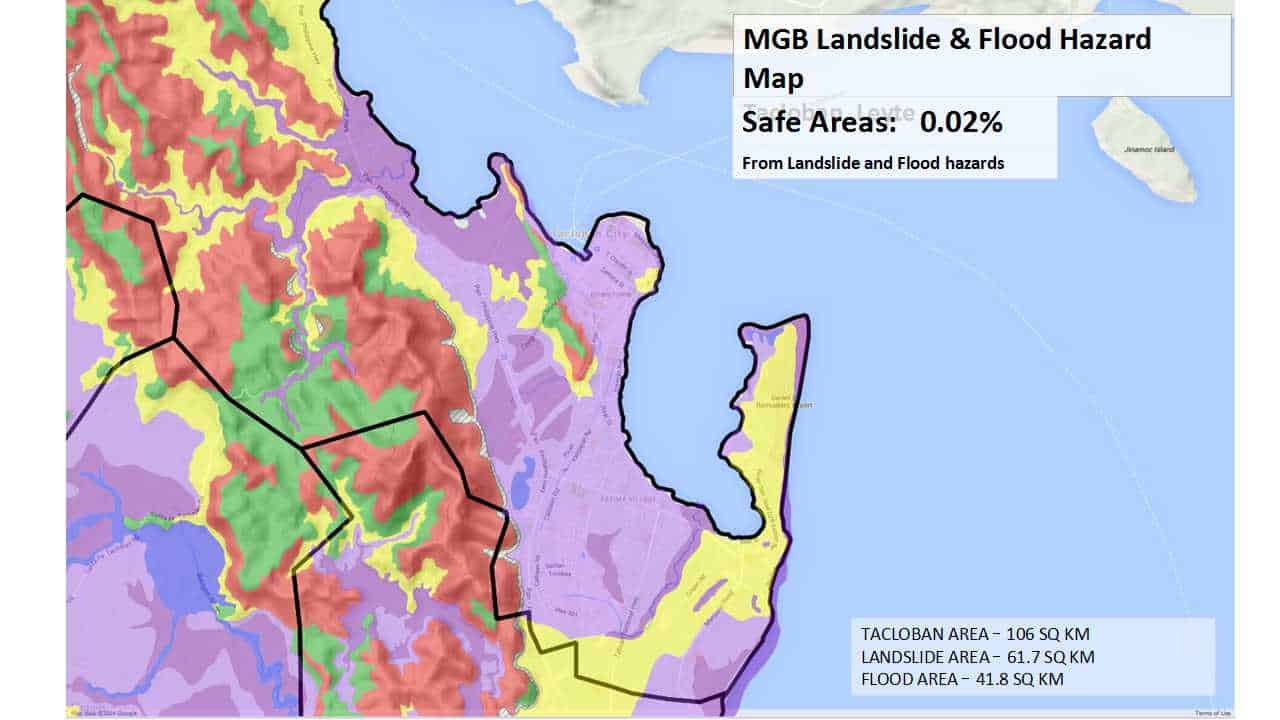

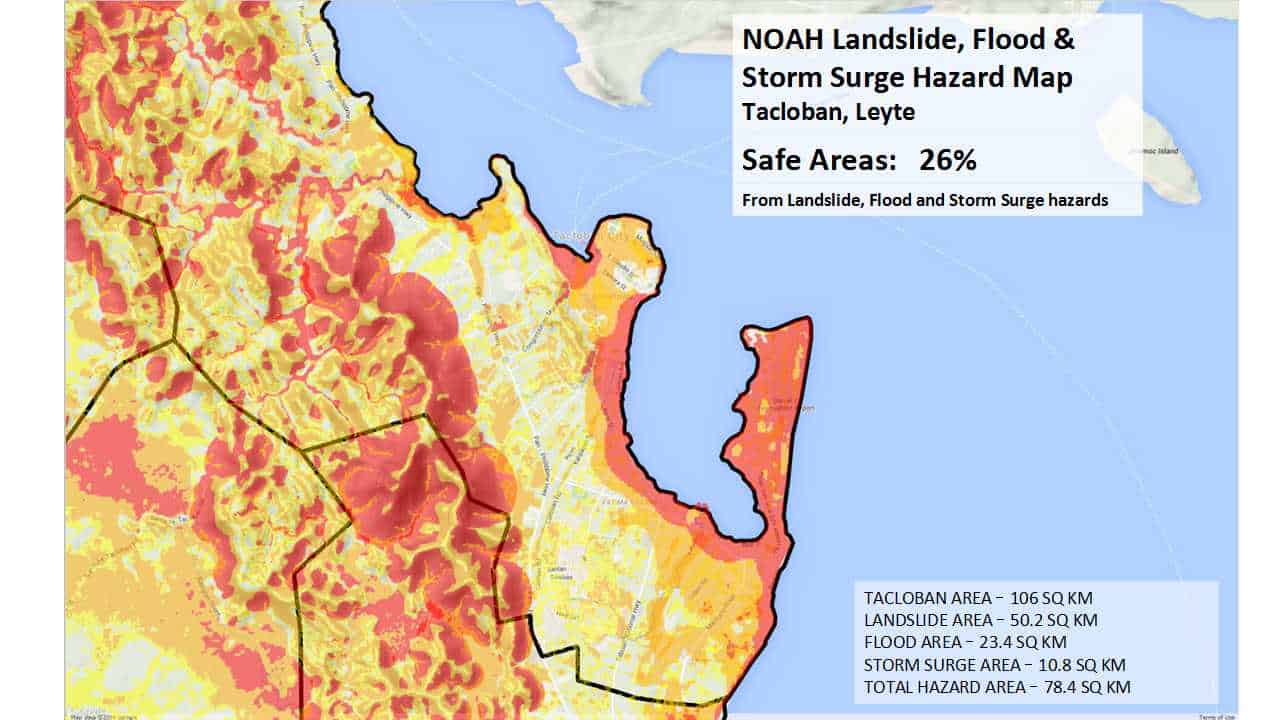

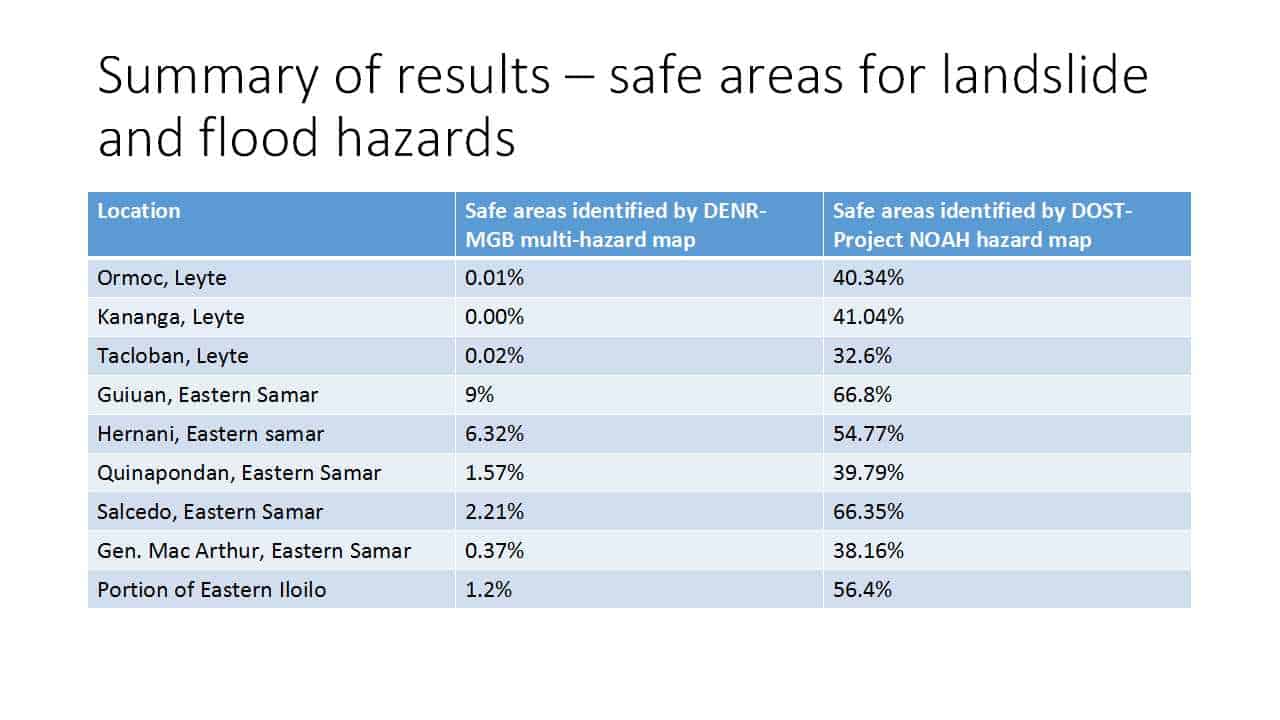

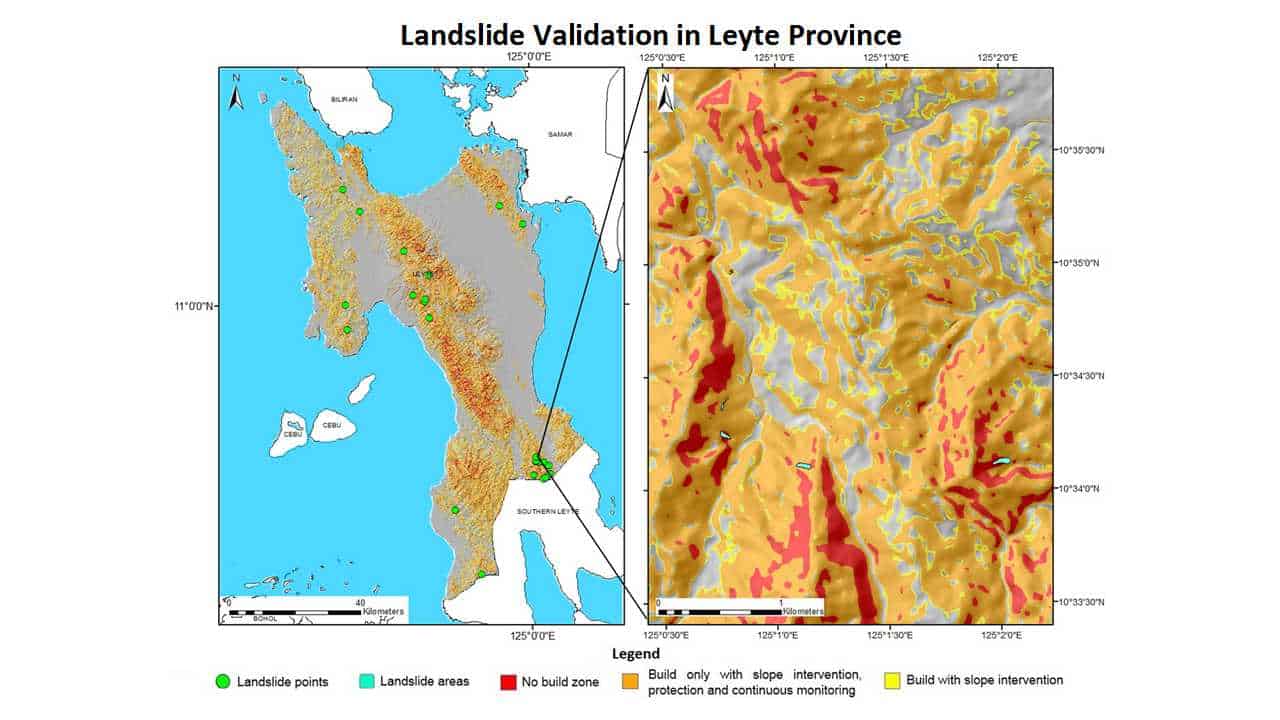

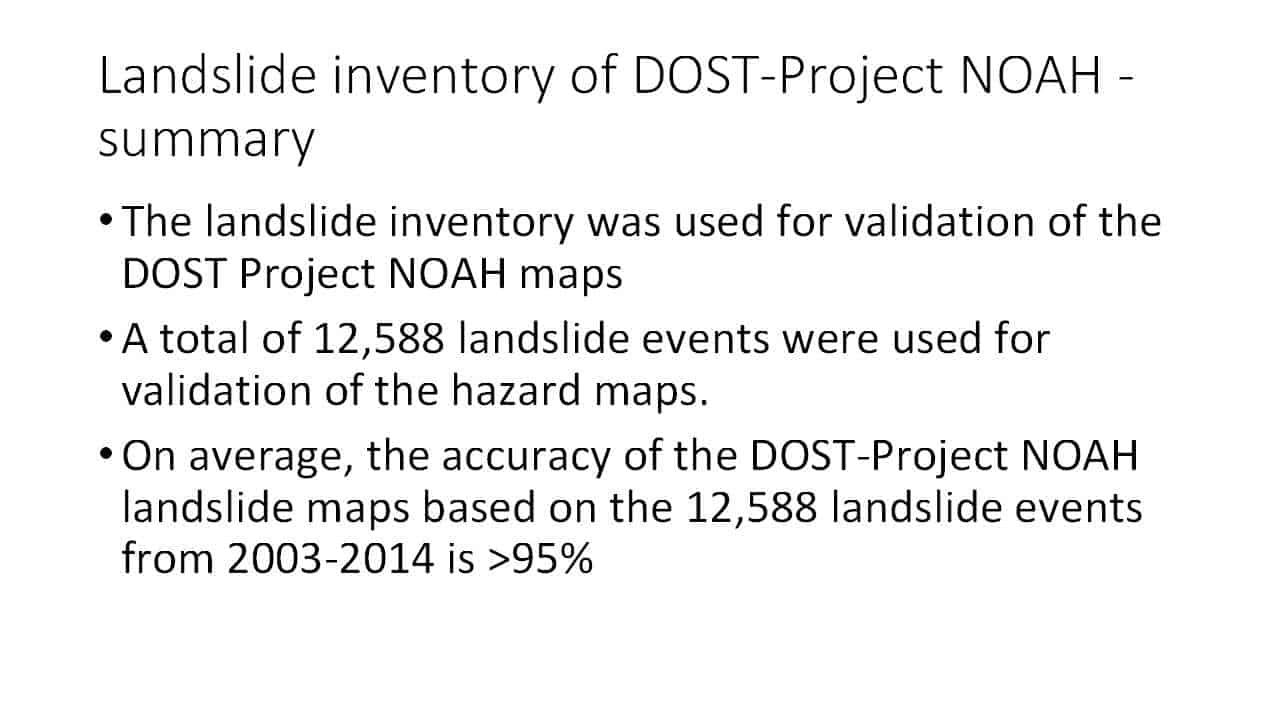

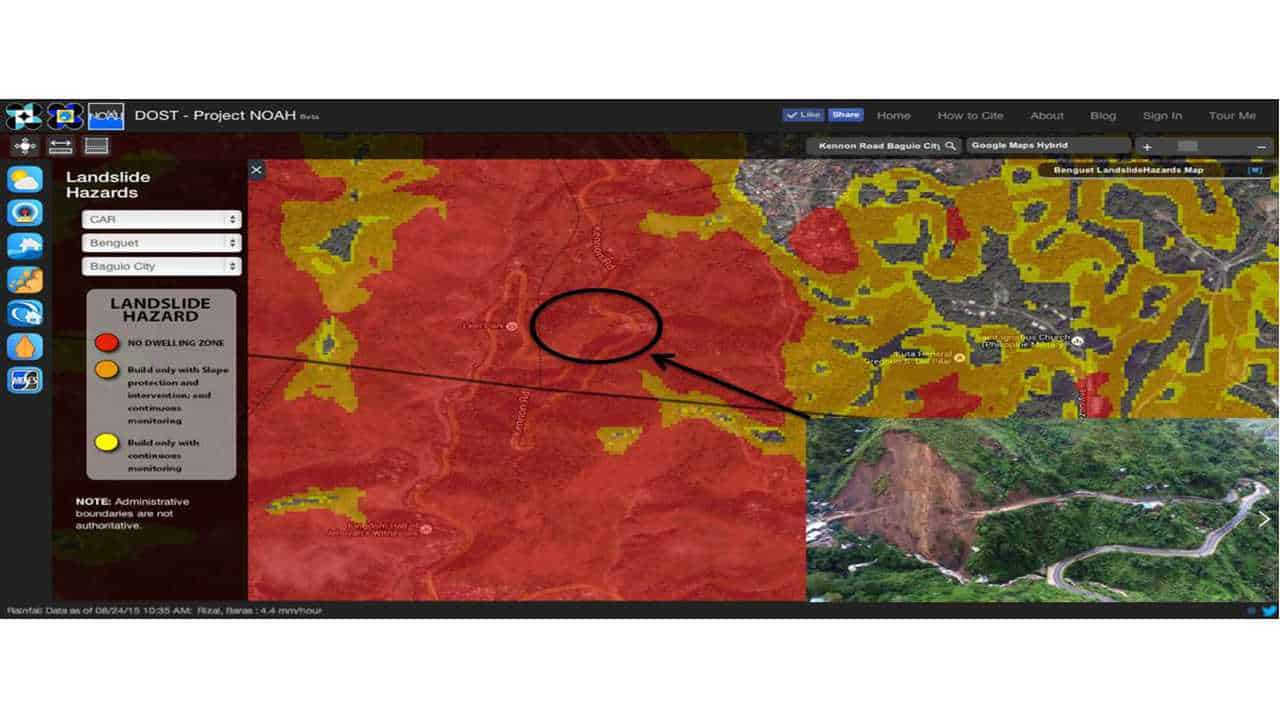

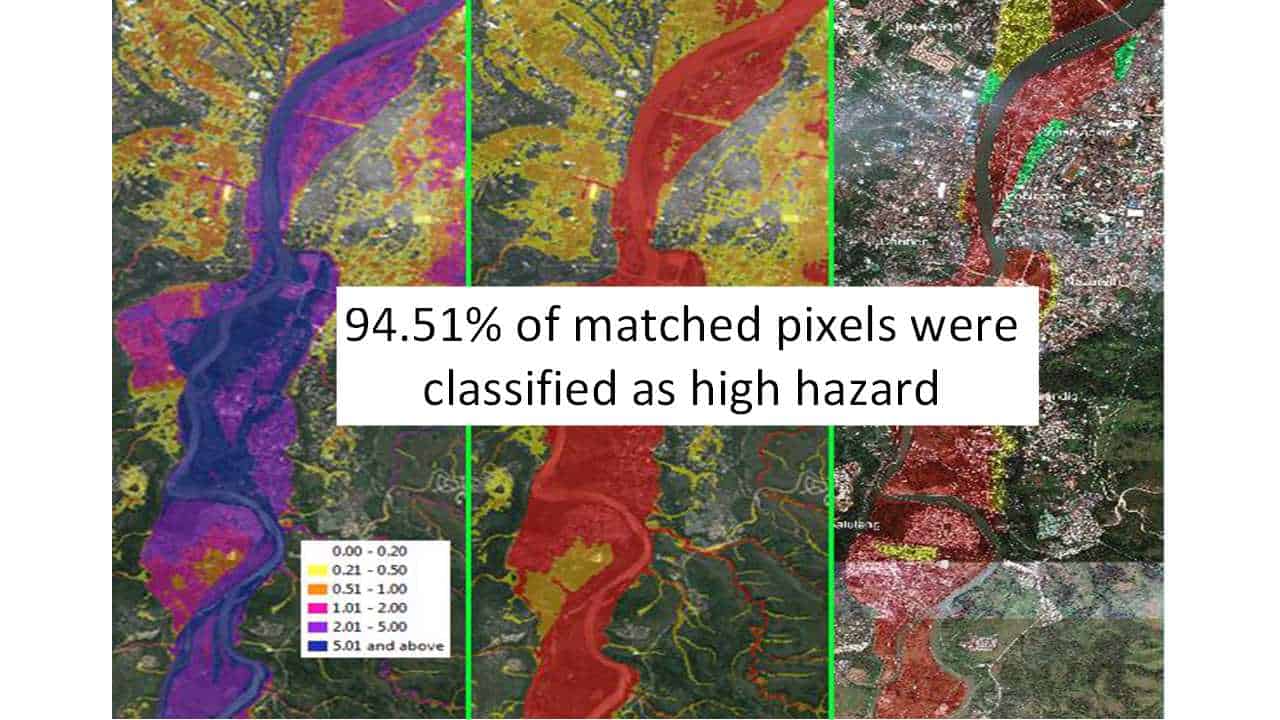

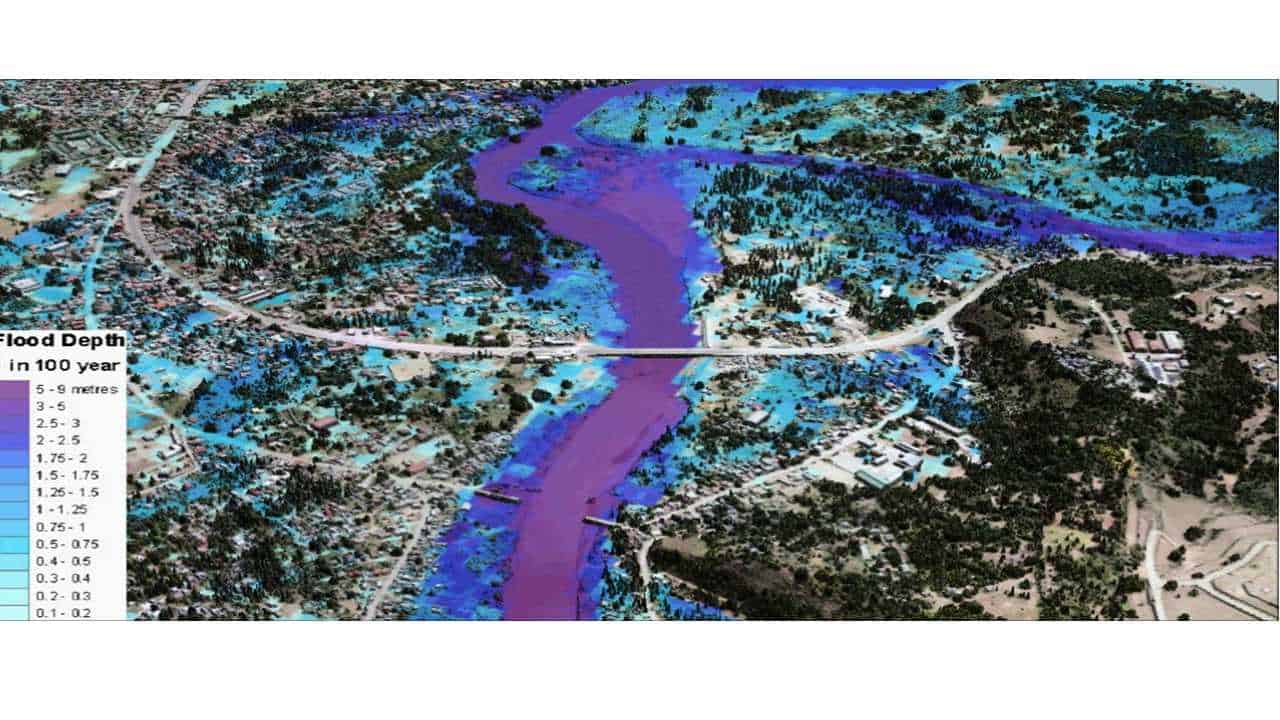

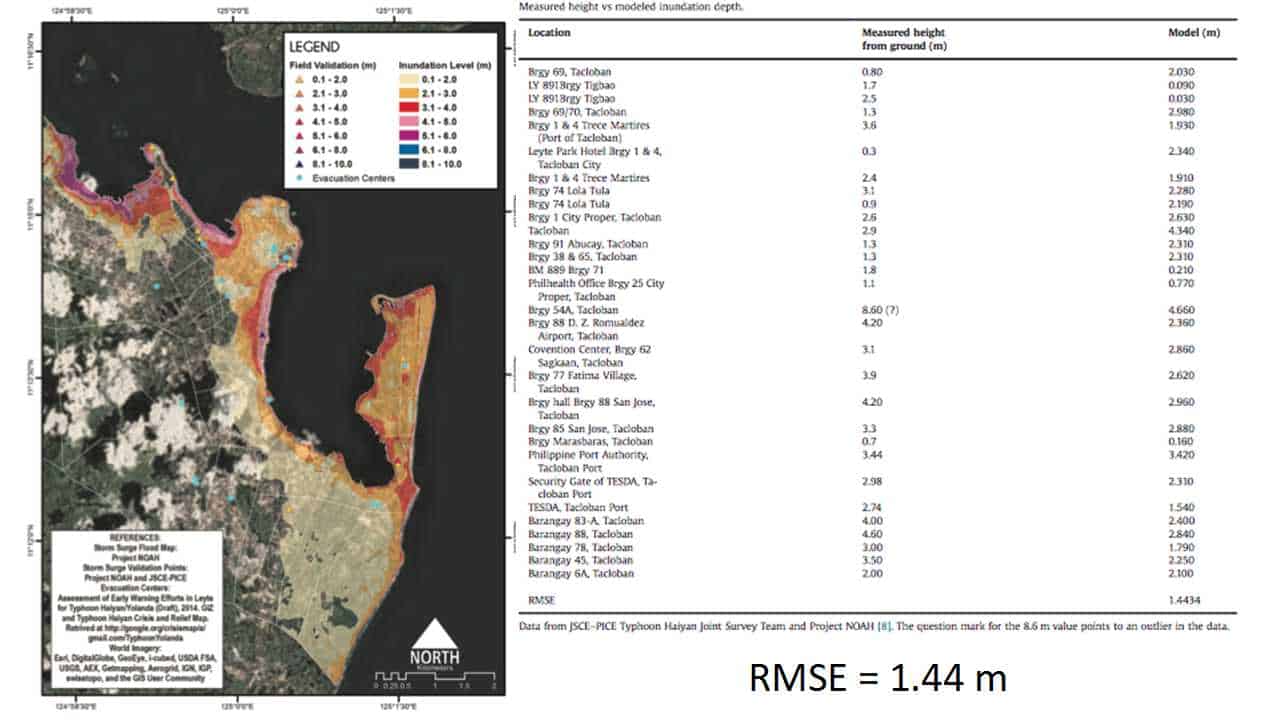

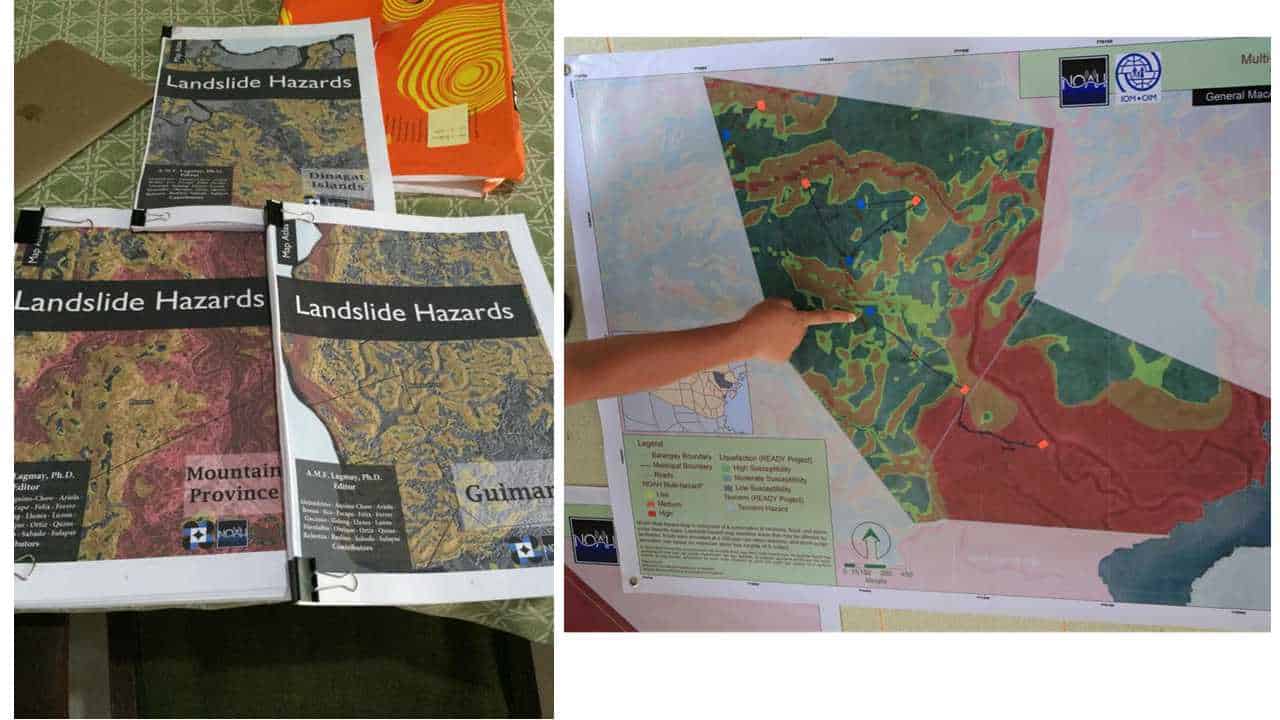

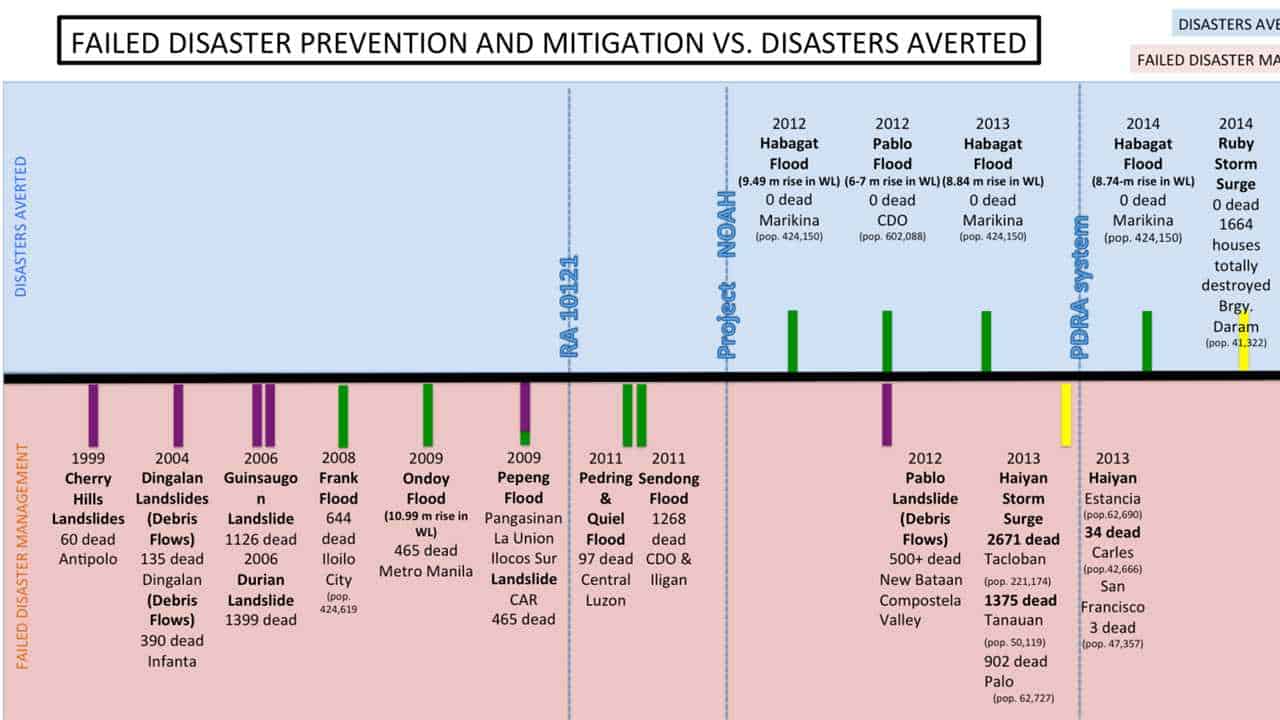

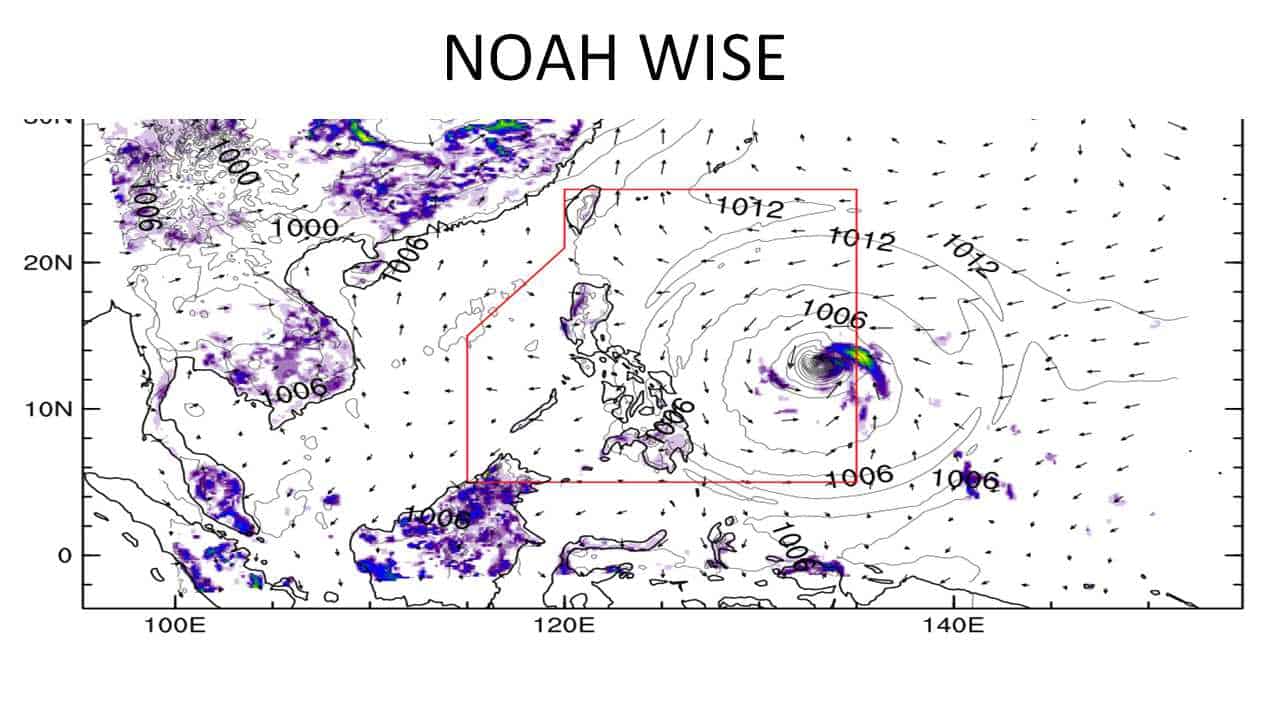

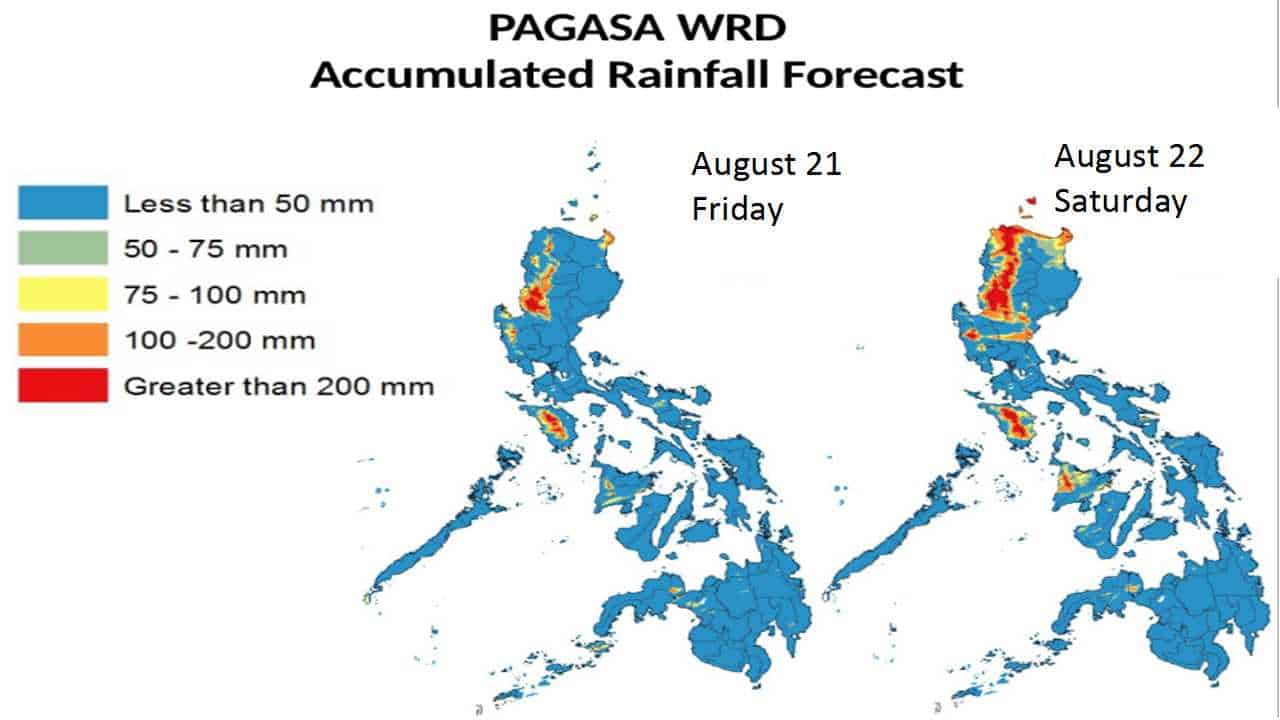

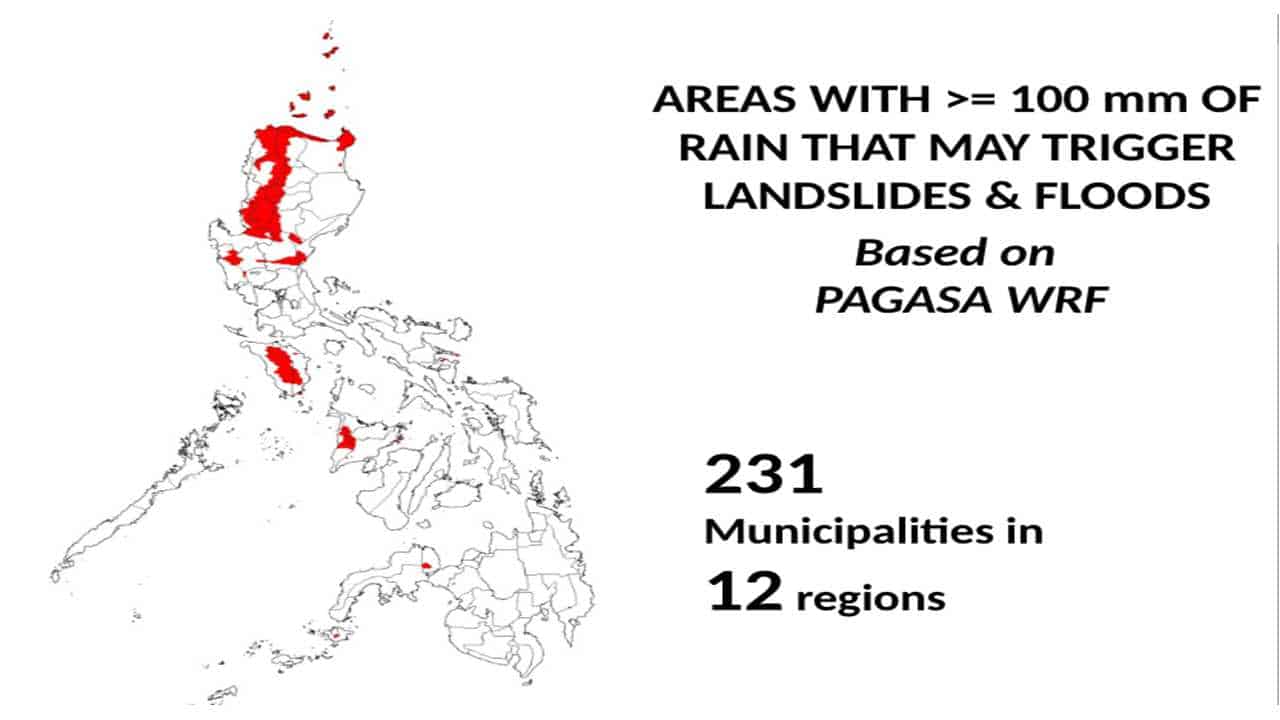

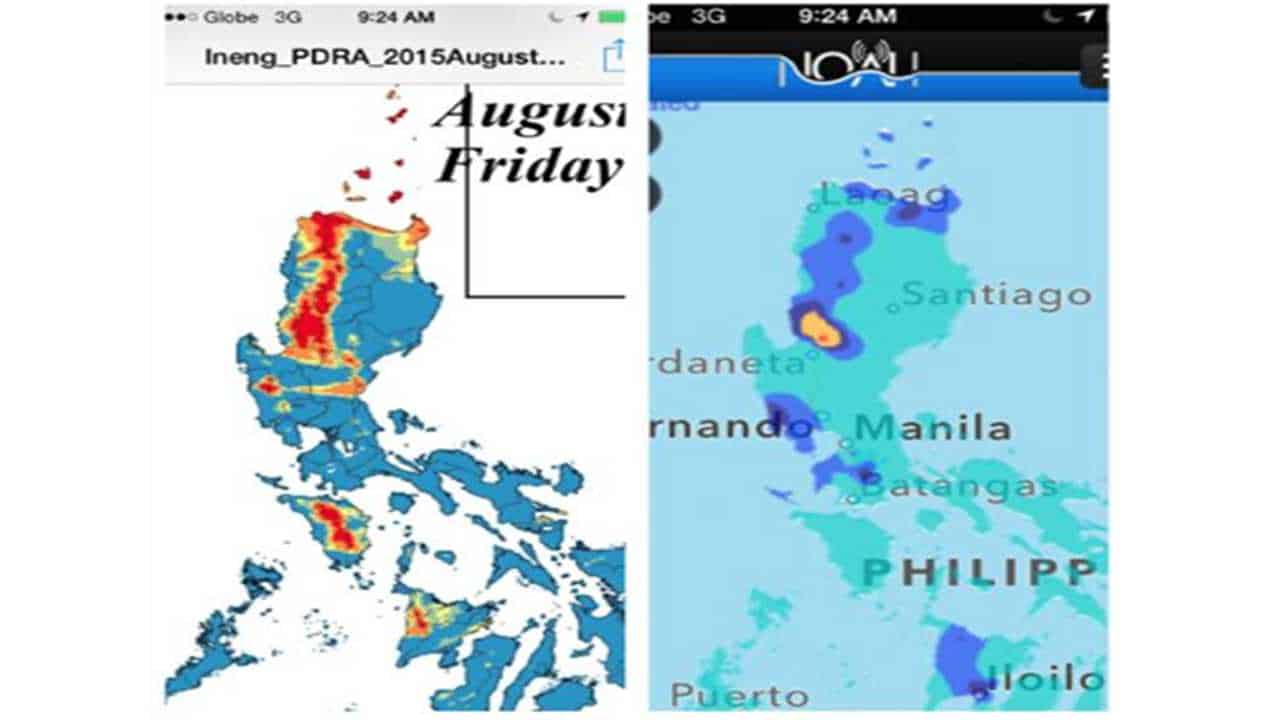

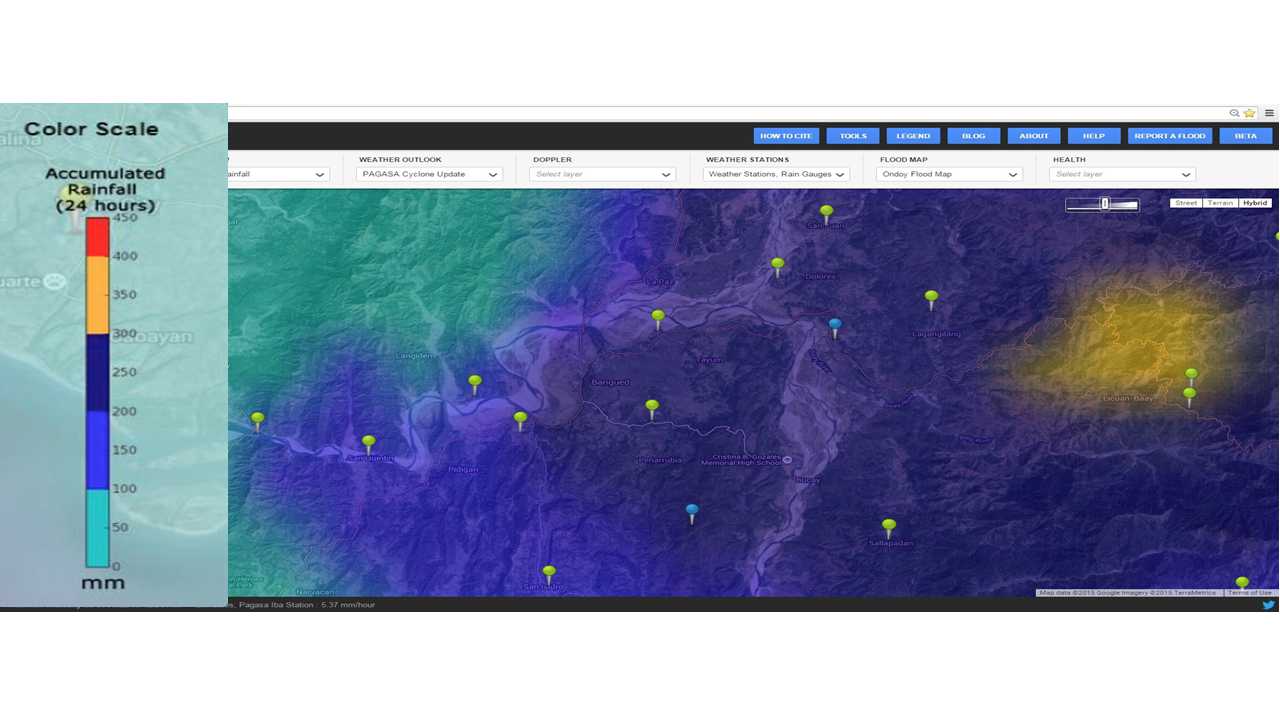

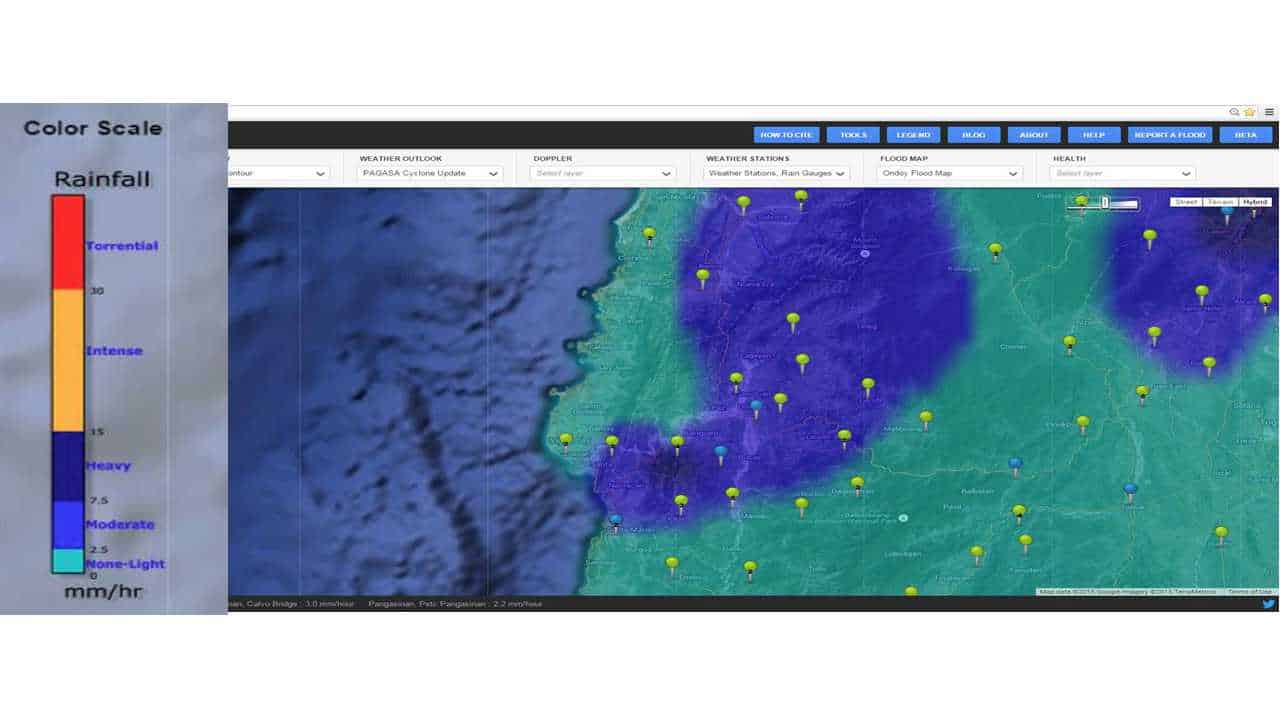

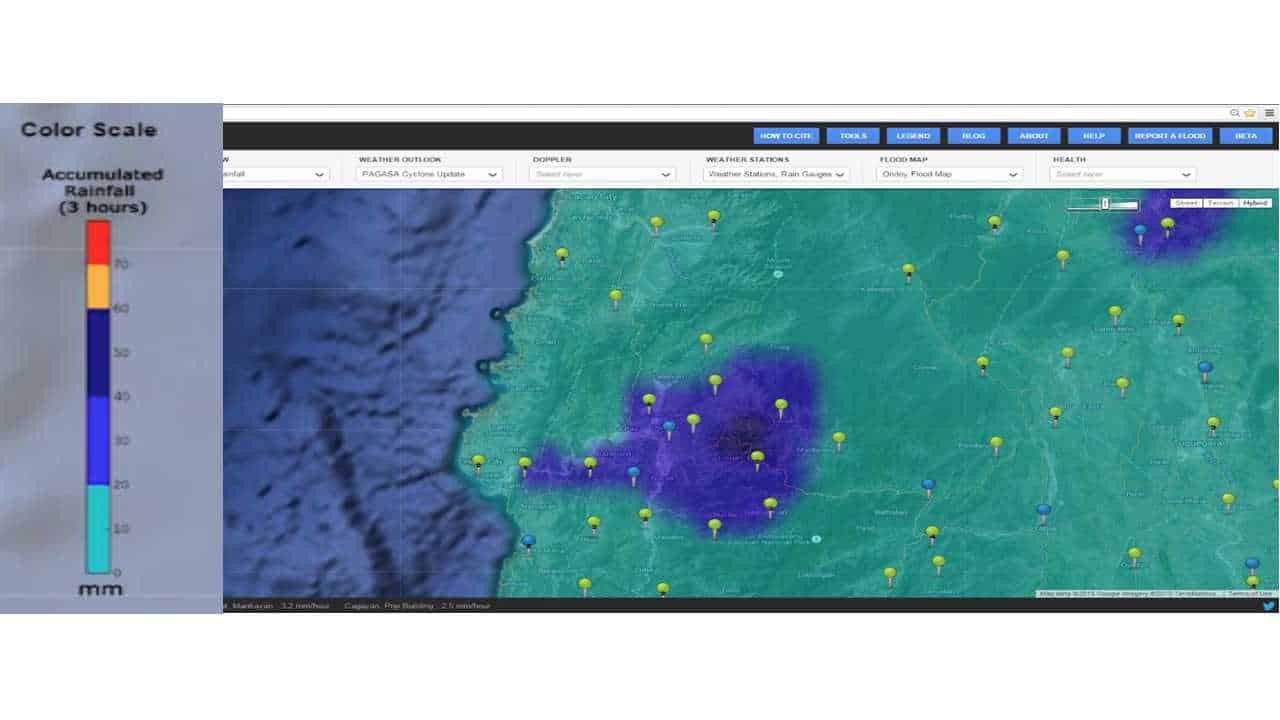

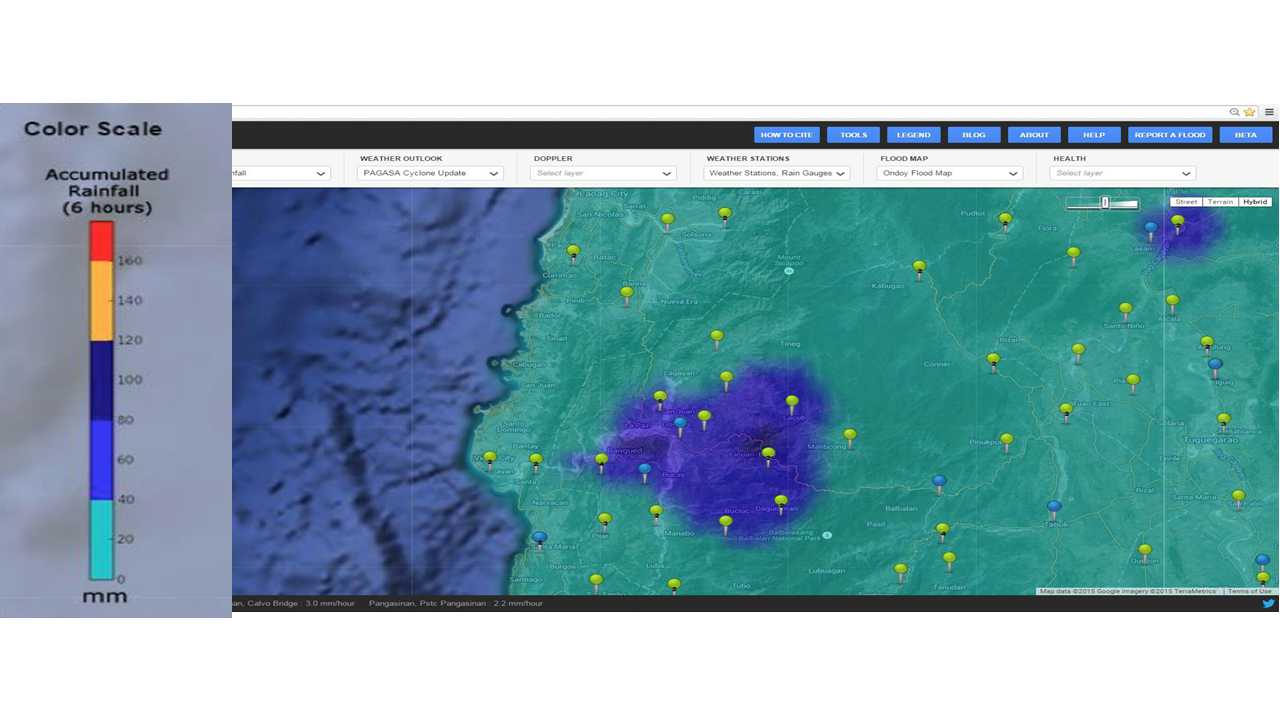

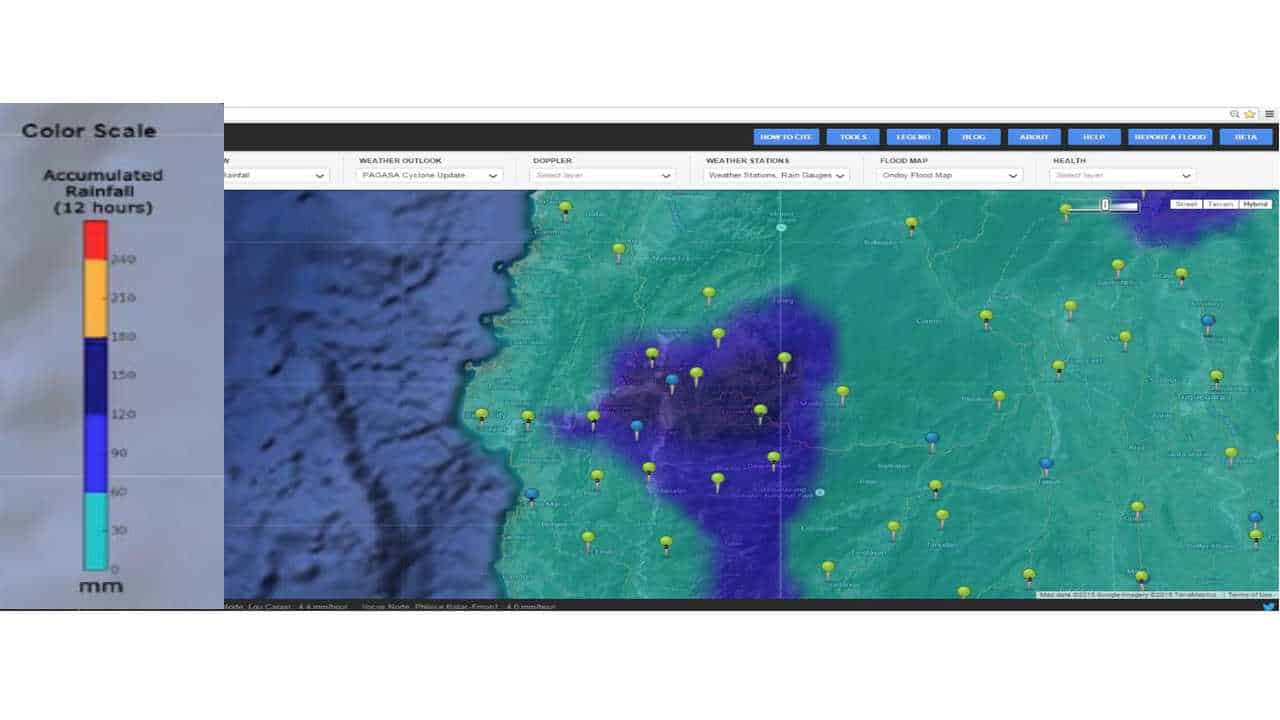

Session 3B: Project NOAH building resilient communities

CLIS goes to Sta. Cruz for ACP claims pay-out

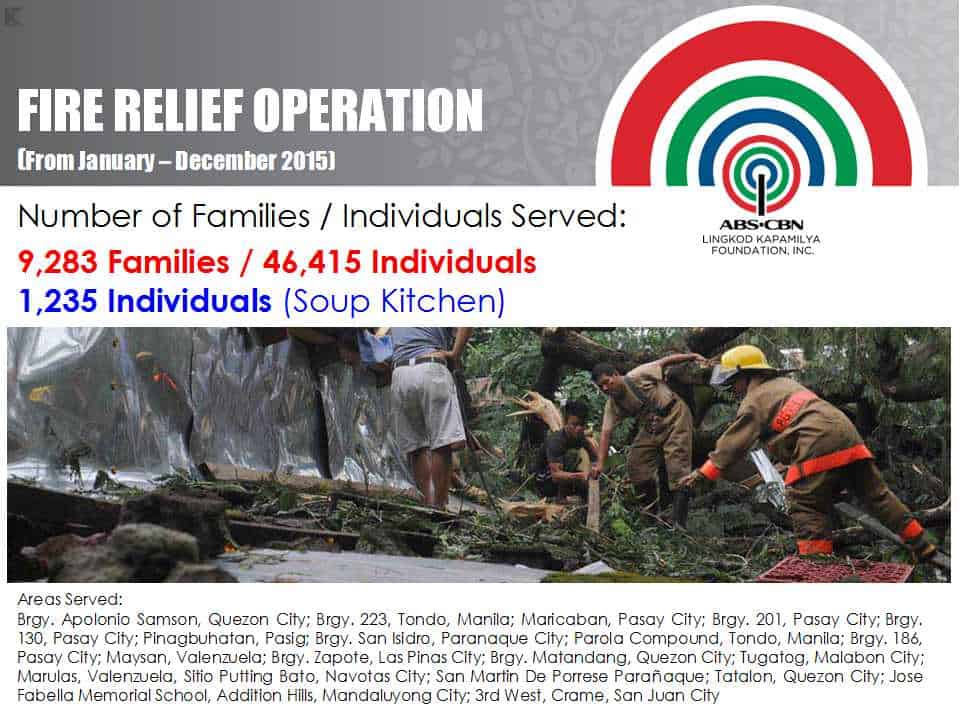

Manila – A huge fire occurred in Quezon Boulevard, Sta. Cruz, Manila last December 4 leaving 196 families homeless, according to the barangay report.

Personnel from Cebuana Lhuillier Insurance Solutions, led by Claims Supervisor Ramon Gonzalez, together with representatives from insurance partner Pioneer Insurance, rushed to the site in the evening of the same day to enlist possible Alagang Cebuana Plus insurance claimants and answer queries to facilitate prompt claims processing.

To date, five ACP Fire Cash Assistance claims have been paid out to the fire victims amounting to a total of Php80,000. In the future, CLIS aims to settle claims on-site as part of its initiative to further increase the trust and confidence of the insuring public in Cebuana Lhuillier.

Cebuana Lhuillier To Hold Disaster Resilience Forum

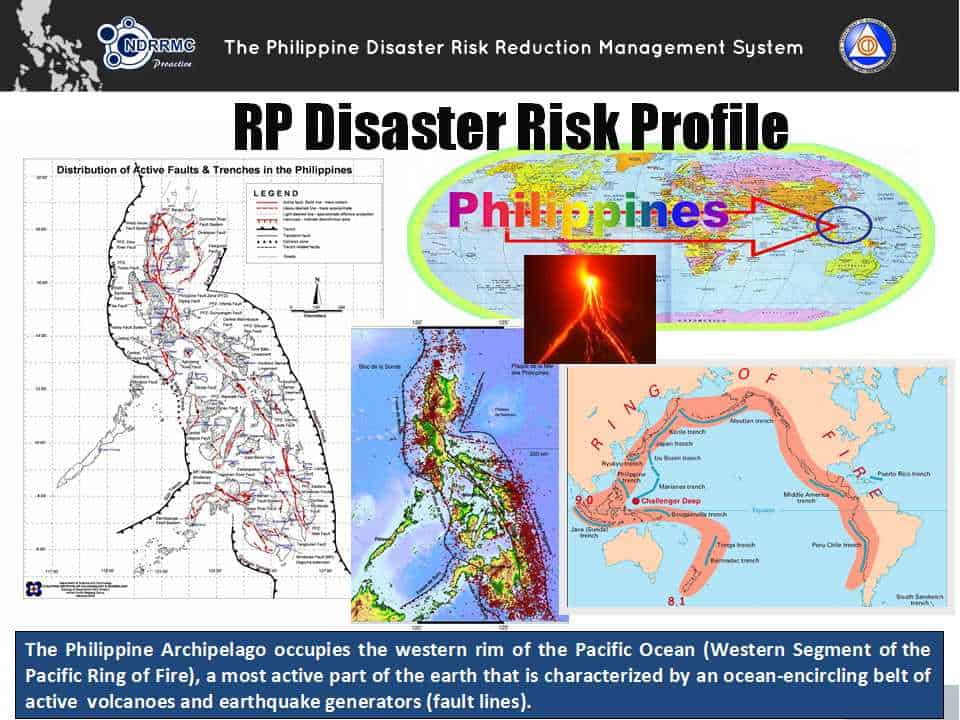

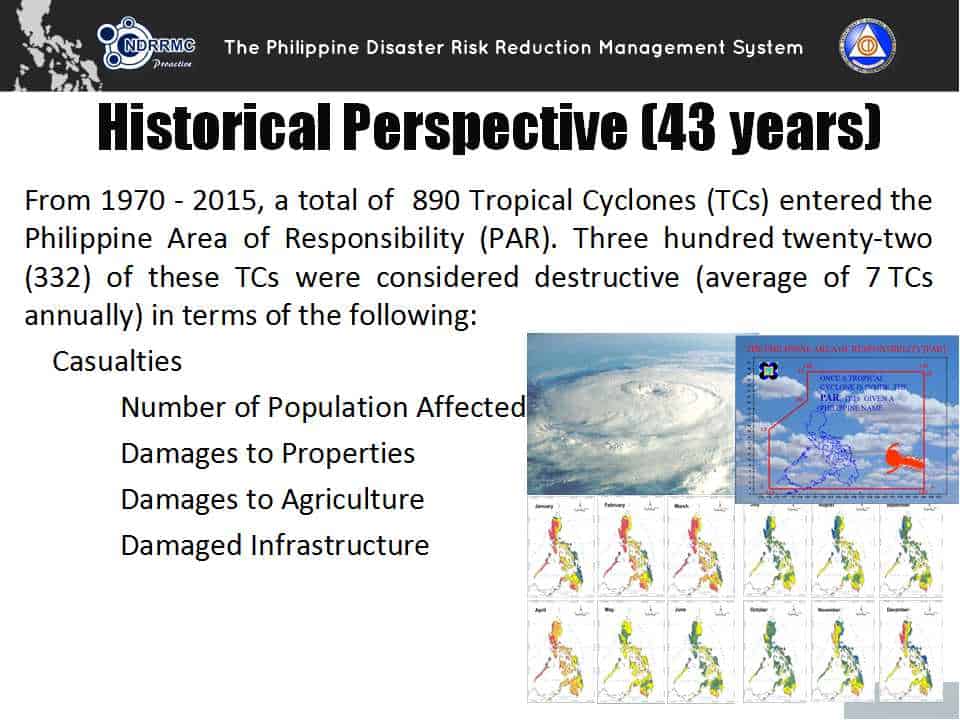

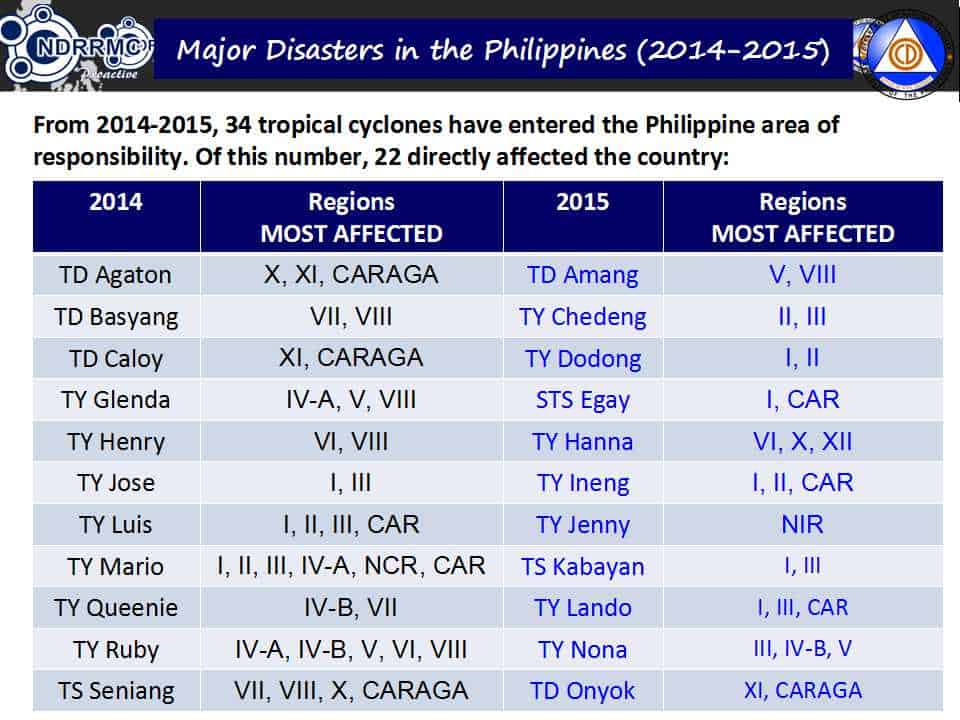

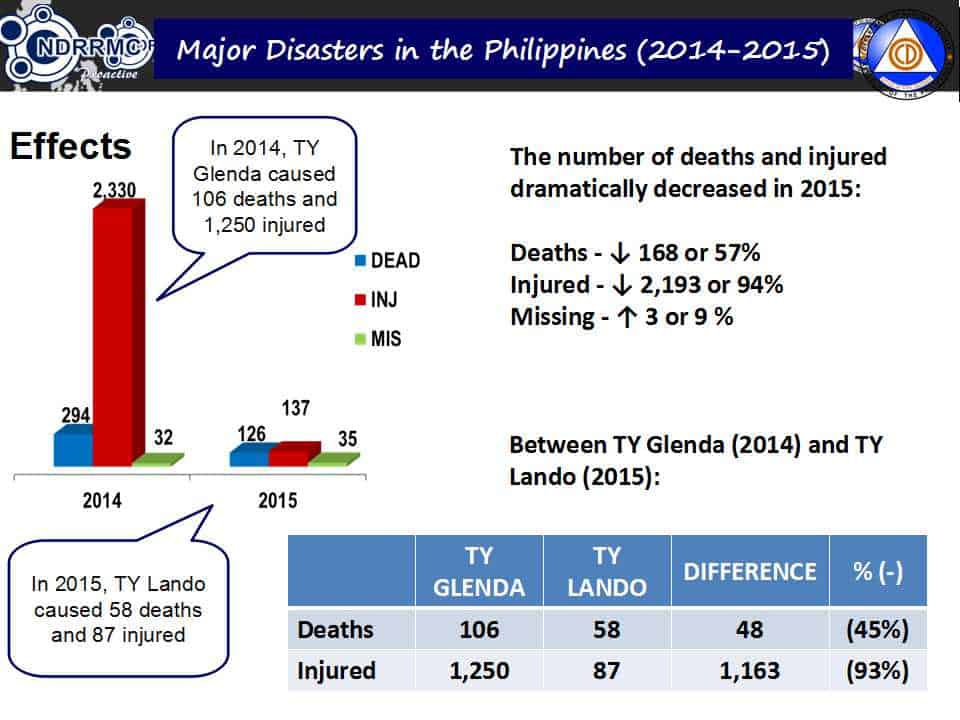

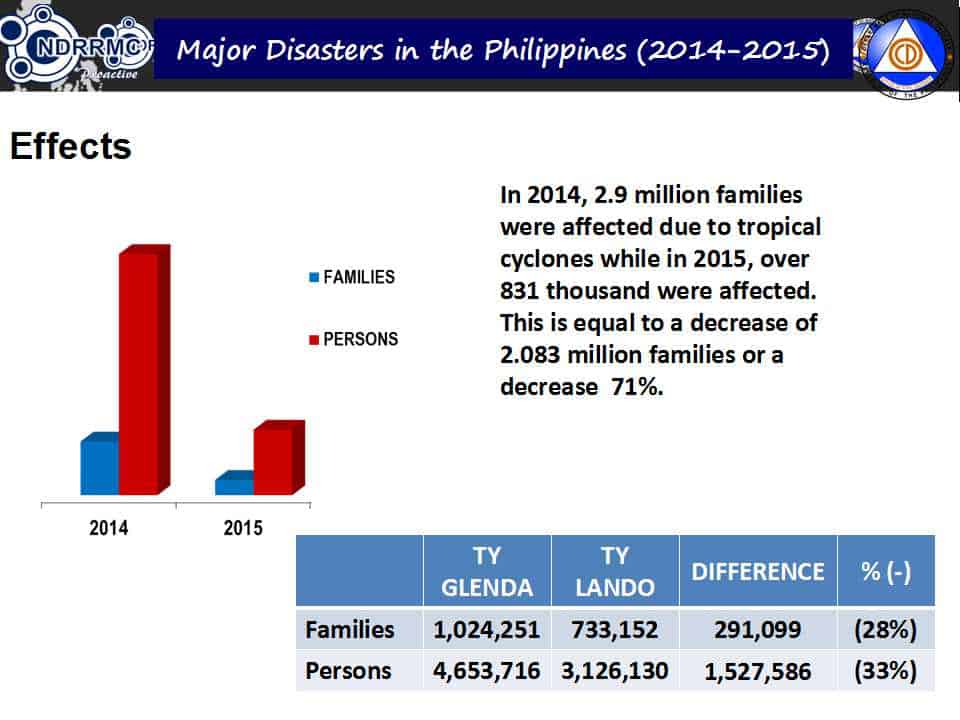

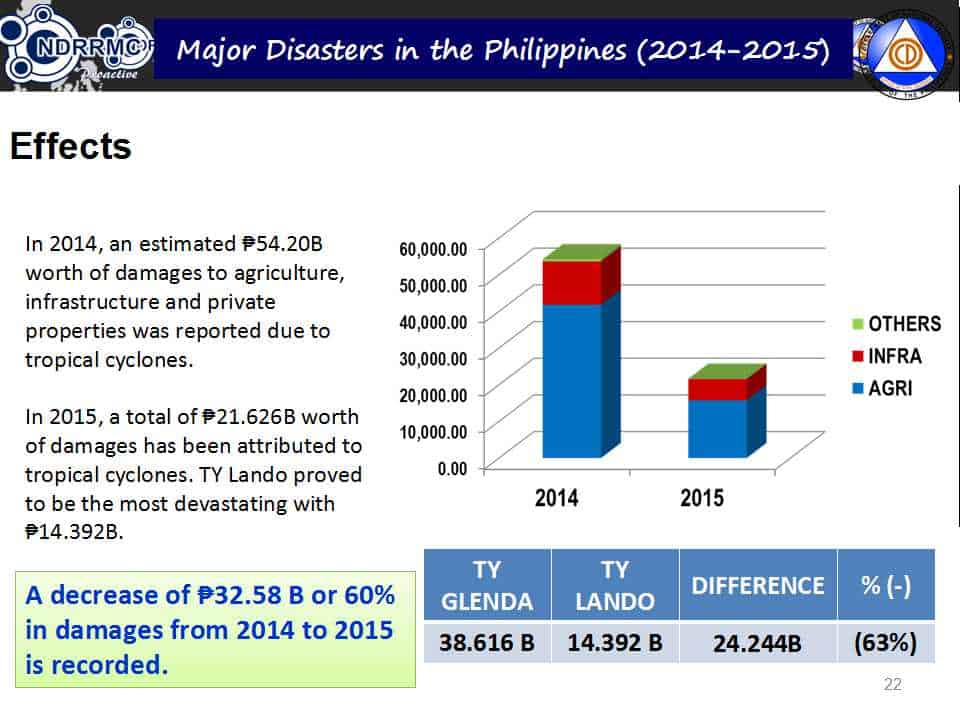

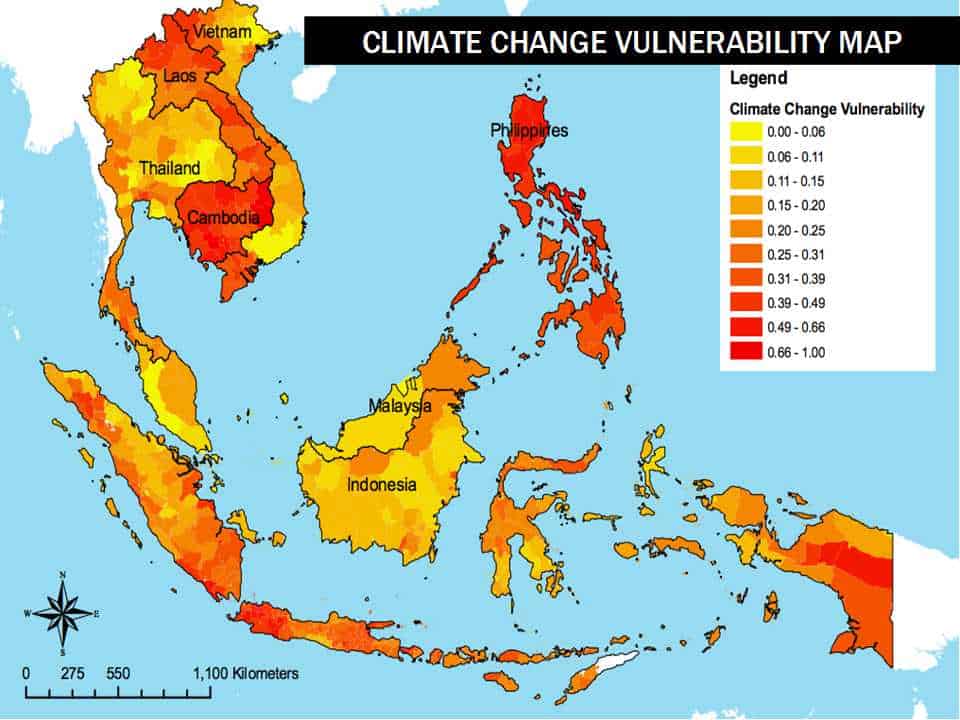

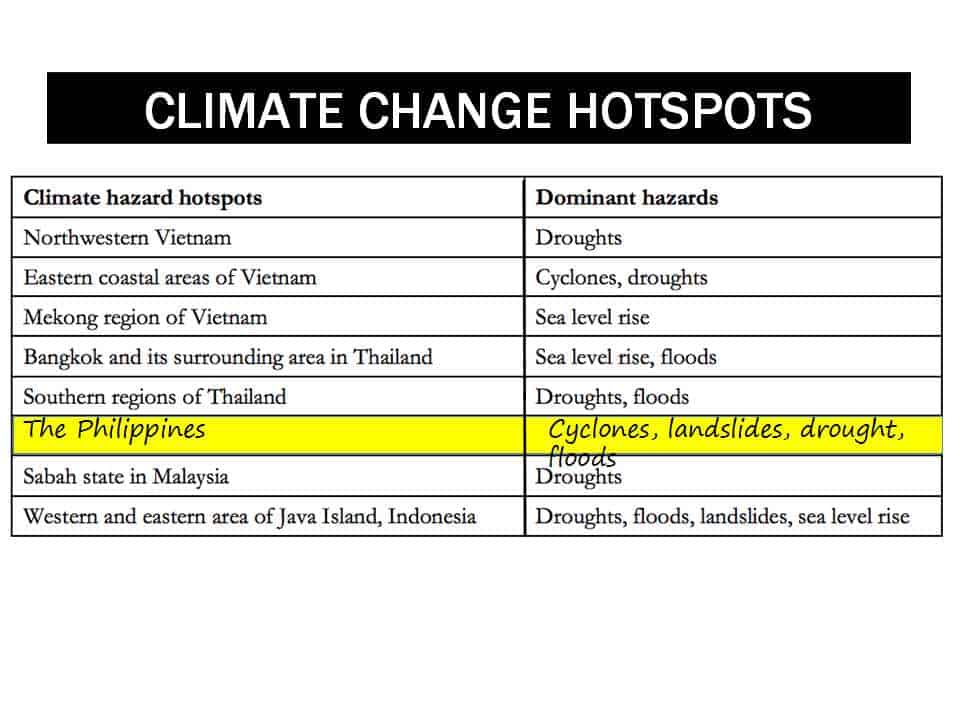

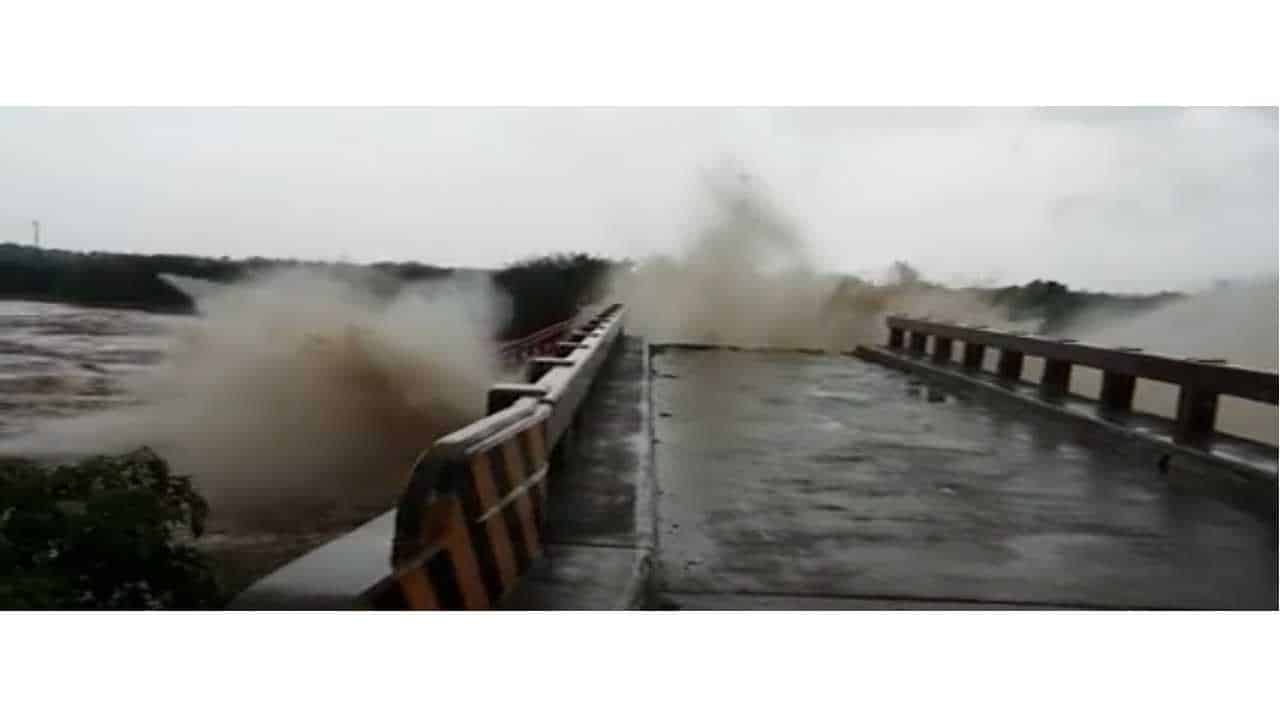

The Philippines is hit by calamities year in and year out. As a result, thousands of Filipinos suffer from the effects of such disasters, claiming the lives of individuals, rendering families homeless, and leaving a trail of devastation that takes years to restore.

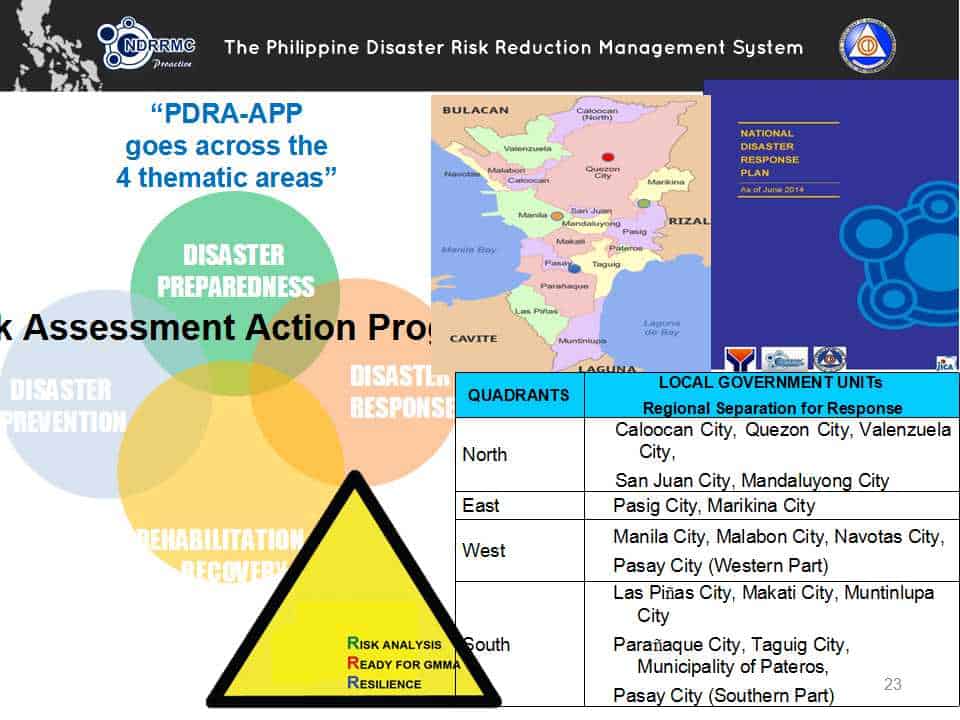

In the hopes of alleviating the negative impact of these occurrences, a disaster resilience forum will be held this January 27 in Makati City. The event, called ‘2016 Ready: Disaster Resilience Forum – The Role of Microinsurance in Building Disaster-Resilient Communities’, is being organized to help prepare Filipinos for imminent dangers and to spread information in order to minimize, if not completely avoid, damages in the event of calamities. Highlighting the importance of microinsurance in a vulnerable country such as the Philippines, the forum aims to help educate and empower the public by presenting ways people can protect themselves and how they can take part in getting their community equipped with the necessary tools, practices, and knowledge to become more disaster-resilient.

Leading the movement is Cebuana Lhuillier Insurance Solutions, which has been actively offering aid to distressed individuals and communities through relevant insurance products and services as well as community outreach programs. At any given time, there are more than 6 million Filipinos covered by the ISO-certified company through its rich portfolio of products. Its premiere microinsurance offering, the Alagang Cebuana Plus (ACP), made available in partnership with Pioneer Insurance, has given otherwise uninsured individuals, especially the poor, financial security in times of need. ACP has settled more than P140 Million claims to date.

“It has been our commitment to answer to the call of the public in times of need, and this is one of the best ways that Cebuana Lhuillier can come to the aid of Filipinos. Our countrymen are constantly faced with challenges brought about by different calamities and, although we already have that indomitable spirit that allows us to cope with such difficulties, we still need to equip ourselves with practical knowledge and tools to lessen the impact of these events. That’s why we at Cebuana Lhuillier are organizing this forum. We felt the need to work with different stakeholders and increase awareness so we can all be prepared,” said Cebuana Lhuillier’s President and CEO, Jean Henri Lhuillier,

Organized in the observance of January as Microinsurance Month, the disaster resilience forum is supported by The Insurance Commission, the government agency fully promoting microinsurance under the Department of Finance, and Deutsche Gesellschaft für Internationale Zusammenarbeit or GIZ, which specializes in international development advocating pro-poor protection, The event is also made possible through partnerships with media outlets Philippine Daily Inquirer, Business Mirror, and Insurance Philippines.

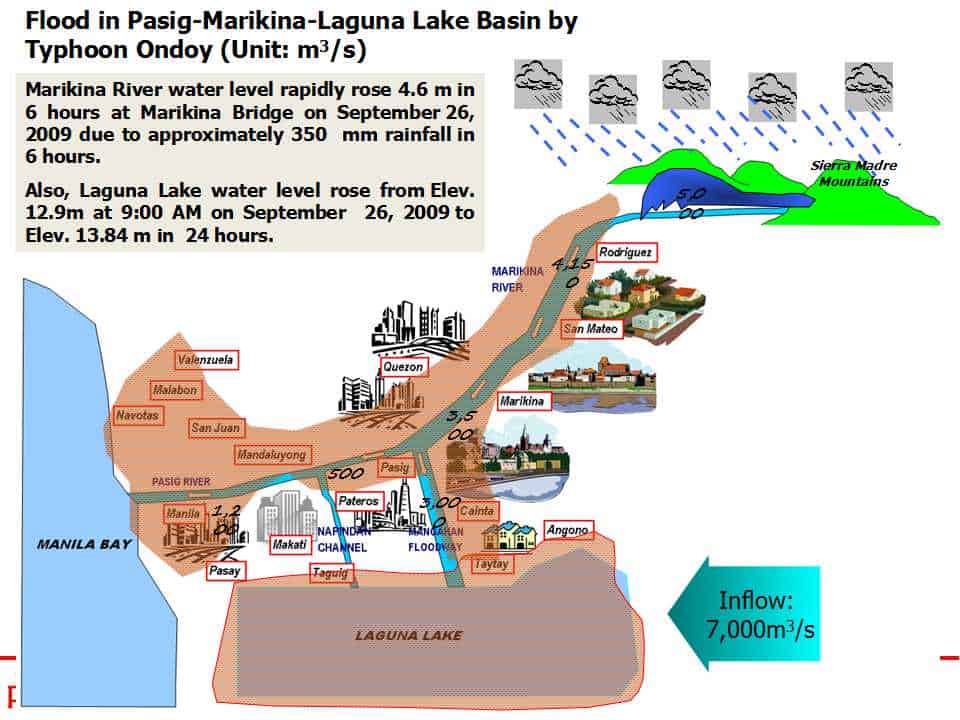

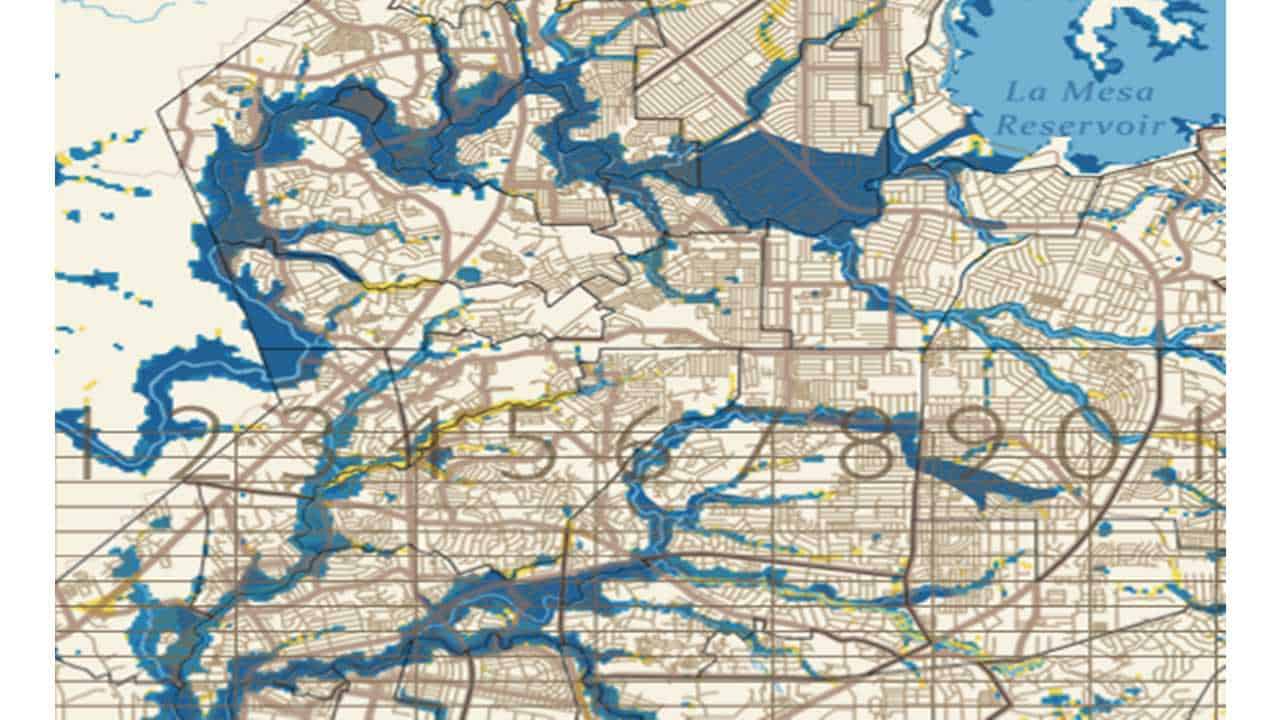

Touching on the Marikina Valley Fault and the country’s susceptibility to disasters, CLIS General Manager, Jonathan Batangan, stressed the need for such event, saying, “This forum is very timely as there have been talks about ‘the Big One’ and the occurrence of more severe and more frequent natural disasters such as Typhoon Yolanda. We should have already learned our lessons and are prepared for any eventuality, but the reality of it is, many communities are not yet equipped with adequate knowledge especially on how to face these uncertainties. We hope that this forum will provide a venue to exchange ideas to foster disaster resiliency and encourage individuals, organizations and communities to be more pro-active in ensuring their security and protection in these vulnerable times. With enough preparation, we can face the challenges ahead with more hope and certainty.”

ASAPHIL Intercollegiate Baguio Leg Opening