Unprepared – a word which would best describe everyone when COVID-19 first hit our shores. Yes, we’ve been hearing news about the virus since the beginning of 2020, but the tough realization came at a rapid pace around the middle of March. Many Filipinos did not expect the viral infection to spread that fast, not even by today’s strict travel and hygiene standards. Of course, almost everyone’s first reaction towards the virus was panic, fear that anyone of us may be infected anywhere, anytime. Some were even preparing themselves for the inevitable, stating that “it isn’t a matter of how, but when.”

This doesn’t mean that no one has a fighting chance against the virus, of course. No, as a matter of fact, as of this writing, 11,453 people had already recovered, with only 1,290 casualties in record. However, the positive cases are still up by 41,830, which begs the question, “How unprepared were we before the virus even hit our nation?” Were we really that unperceptive towards international news? Were we too complacent, not believing that such a rampant virus would hit Philippine waters? Alas, it would be too late to contemplate on that. After all, the best that we can do right now is to make the most out of what we have, and what we have may not be enough to support us for the unforeseeable end of the quarantine period.

So, the question is, what can we do to protect our finances during the pandemic? How may we survive our family with whatever’s left of our budget and remaining finances? The answer? By availing a good insurance service, of course.

What are the advantages of having an insurance during the quarantine period?

1) Helps lower your medical expenses.

Let’s get this out of the way first, the most efficient way to save during the pandemic would be to reduce your expenses, unfortunately, medical expenses in the Philippines would always be at an all-time high. At least having an insurance would help cut your medical cost, enabling you to set aside a few amounts even after the whole ordeal.

2) Insurance coverage isn’t limited to you and you alone.

Depending on your availed insurance package, some would include your family and loved ones within the same coverage, thus, cutting down on their medical expenses as well. Think of it as an extension of your love and concern for them. No longer would you have to worry about rushing anyone of them towards the nearest hospital if the need were to arise, you have your insurance to cover for them.

3) Insurance companies usually update their coverages.

Some, if not most insurance companies would usually update their coverage packages, hence, even if COVID-19 were a fairly new virus strain to begin with, any infection by the said virus would still be covered by your chosen package. Of course, you’d still have to survive the ordeal and hope for the best if worst comes to worst, but at least your insurance would cover the expenses for you, after which your only concern would have to be about your recovery.

Okay, now that we’ve learned about the advantages of having an insurance during the pandemic, you may ask, “Are there any good and affordable recommendations out there when it comes to insurance?” Well, look no further than Cebuana Lhuillier’s ProtectMAX.

What is ProtectMAX?

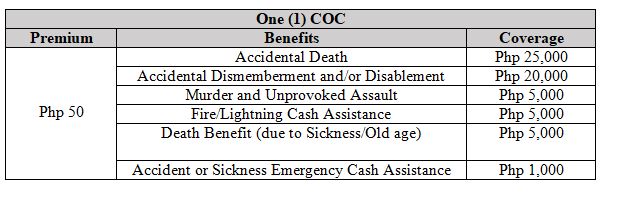

Cebuana Lhuillier’s ProtectMAX is a microinsurance product designed for individuals aged 7 to 70 years old with Death Benefit, Accident or Sickness Emergency Cash Assistance, Accidental Dismemberment and/or Disablement, Murder and Unprovoked Assault and Residential Fire Reconstruction cash assistance. For as low as P50, each certificate is valid for four (4) months from the date of issuance and can be availed up to a maximum of 5 certificates per insured.

Simply put, it is your very affordable alternative to those other well-known, yet costlier insurance packages.

Okay, such micro insurances usually allow me to have a beneficiary. Is my family qualified to be some of them?

No worries, they absolutely are. The qualified beneficiaries are your legal spouse, your kids who are of legal age (18 years old), your parents (which includes your mother and father), and your siblings (should be of legal age as well, married or single would still count).

As you can see, the list of beneficiaries isn’t really very limited, and it is understandable, as Cebuana Lhuillier is very much aware for the average Filipino’s need for a good insurance that would cover them in times of need, especially during the quarantine period.

What are the Premiums?

You just need to pay P50. That’s it, no tricks or gimmicks. For as low as P50, you may avail this amazing Microinsurance.

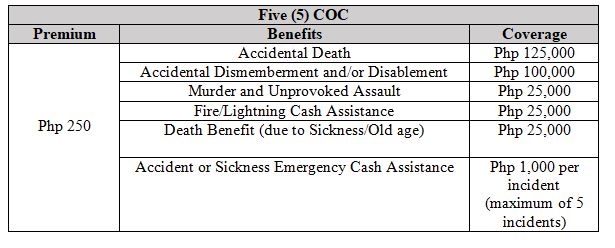

Of course, that’s not the only available premium. For just the price of P250, you may acquire a higher coverage:

Regardless of the premium that you’d avail, you’re sure to find value for your money and security for the future of your family. But even that would just be the tip of the iceberg, as the claiming process itself isn’t even difficult, unlike other establishments who are offering their insurance services. For Cebuana Lhuillier’s ProtectMax, the process would entail the following:

The Claiming Process:

1) In the event of a claim, the claimant shall submit the complete claim at any Cebuana Lhuillier branch nationwide.

2) Cebuana Lhuillier Branch Personnel shall review the completeness of all claim documents and submit to Cebuana Lhuillier Insurance Solutions (CLIS) (depending on the type of claim) for claims evaluation and approval; the review shall be done in accordance with the guidelines of Pioneer Insurance and Surety Corporation (PISC).

3) CLIS will submit final advice, within 48 hours to the BP and claimant the status of the claim.

a. If a claim is approved, CLIS Head Office will pay the claimant in advance thru Pera Padala.

b. If the claim is Denied, CLIS Head Office shall send letter of denial to the claimant.

For the requirements, be sure to transact with authorized Cebuana Lhuillier personnel for more information.