How the Micro Savings App Empower Filipinos to Save Money

Introduction In the fast-paced world we live in, saving money can often be challenging, especially for low-income individuals who may struggle to set aside funds for the future. This is

Introduction In the fast-paced world we live in, saving money can often be challenging, especially for low-income individuals who may struggle to set aside funds for the future. This is

Introduction Microlending has become a powerful tool for empowering small businesses and individuals who need financial assistance but do not have access to traditional bank loans. In the Philippines, where

For a long time, insurance coverage was a privilege enjoyed almost exclusively by well-to-do Filipinos. However, thanks to Jean Henri Lhuillier, the man behind the success of microfinance leader Cebuana

Cebuana Lhuillier Bank, the banking arm of Cebuana Lhuillier, the Philippines’ leading microfinance service provider, proudly announces the grand opening of its latest branch in Davao. Located at PJL Compound

By: Jed Flores With an unwavering dedication to improving the lives of Filipinos, Cebuana Lhuillier played a pivotal role in the recent “Lab For All: Laboratoryo, Konsulta at Gamot para

To revolutionize the entry-level jewelry market in the Philippines, Cebuana Lhuillier has announced a strategic partnership with Sparkles.ph, an innovative startup jewelry company. Through this partnership, both companies aim to

In a world of endless possibilities, Cebuana Lhuillier Finance Corporation (CLFC) stands as a beacon of hope, offering a myriad of products and services tailored to uplift the lives of

Cebuana Lhuillier, the leading provider of money transfer services in the Philippines, has recently launched Pera Central—a revolutionary campaign in the money transfer segment cementing the Cebuana Lhuillier brand as

PARTNERS AGGREGATOR ASPAC EMEA USCAN MONEYGRAM TRANGLO SDN BHD. NEW YORK BAY PHILIPPINES, INC REMITLY INC. WESTERN UNION PINOY EXPRESS HATID PADALA SERVICES, INC. AFTAB CURRENCY EXCHANGE LIMITED PAYPAL PTE

CEBU, Philippines — Cebuana Lhuillier has entered into a partnership deal with fintech firm Advance, to expand its micro-finance products to providing financial assistance to employers for their workers’ salary

Two years after its transformation into an insurance brokerage firm, Cebuana Lhuillier Insurance Brokers Inc. (CLIB) bagged the Domestic Broker of the Year – Philippines award at the Insurance Asia

The Philippine Blu Boys seek to make an impact when they compete in the 2023 Men’s Softball Asia Cup in Kochi, Japan starting Sunday, June 25. Six countries are battling

Cebuana Lhuillier Bank (CLB), the banking arm of PJ Lhuillier, Inc., reopened its Nasugbu branch in a more central location that is more accessible to micro, small, and medium enterprises

The Philippine Blu Boys blanked Hong Kong, 8-0, to forge a battle for the bronze medal and remain in the hunt for a World Cup berth in the 2023 Men’s

There is no stopping Cebuana Lhuillier, the undisputed leader in the Philippines’ micro financial services industry, in its pursuit of financial inclusion and financial mobility for Filipinos with the launch

Cebuana Lhuillier has announced the integration into the Stellar blockchain network. This partnership reinforces its venture into blockchain based payment services. The partnership with the Stellar network allows customers to

Promo duration: February 1 to April 30, 2024 FULL MECHANICS Transaction Type Client Type Entries Bagong Sangla New CIF 3 entries Lipat Sangla/Dormant Pawner 3 entries Existing Pawner 2 entries

In the world of finance and microfinance, one name has consistently risen above the rest: PJ Lhuillier, Inc. (PJLI). As the esteemed parent company of Cebuana Lhuillier, PJLI and its

Accident, Illness and Third Party coverages for you and your dog! Product Details BASIC PRIME Premium P1,100 P2,400 Coverage 1 year Max Quantity Max 1 policy Coverage Details Pet Age

Personal Accident Insurance Perfect for Drivers Product Details Premium P260 Coverage 1 year Max Quantity Max 1 policy Coverage Details Age Range 18-64 years old Benefit Accidental Death, Disablement &

Personal Accident Insurance Perfect for Employees Product Details Premium P320 Coverage 1 year Max Quantity Max 1 policy Coverage Details Age Range 18-64 years old Benefit Accidental Death, Disablement &

Get up to P30,000 protection for the contents of your home Product Details Premium P300 Coverage 1 year Max Quantity Max 1 policy Benefits Fire Php 30,000 Robbery Php 10,000

Up to P25,000 coverage on accidents and more Product Details Premium P100 Coverage 1 year Max Quantity max 5 policies Coverage Details Age Range 7 to 70 years old Benefit

Instant P10,000 short-term coverage for accident Product Details Premium P10 Coverage 1 month Coverage Details Age Range 18 to 70 years old Benefit Accidental Death P10,000 Accidental Dismemberment & Disablement

Get a one-time cash assistance for any health emergency! Product Details 5K 10K 20K Premium P560 P925 P1,275 Coverage 1 year Max Quantity Max 1 policy Coverage Details Age Range

Get an affordable LTO-accredited CTPL for as low as P300.40 Product Details Motorcycles/ Tricycles Private Cars Light/Medium Trucks Heavy Trucks & Private Buses Premium 300.40 610.40 660.40 1,250.40 Coverages

Get a one-time cash assistance for in-patient and out-patient dengue diagnosis Product Details Premium P400 Coverage 1 Year Max Quantity Max 1 policy Coverage Details Age Range 1 year old

1. All clients who will send or claim their Western Union international money remittance at any Cebuana Lhuillier branch will earn an e-raffle entry for every successful transaction. 2. Lucky

Introduction As various parts of the Philippines are hit by multiple strong typhoons all year round, many Filipino families are left with no house, clothes, or food. Most of the

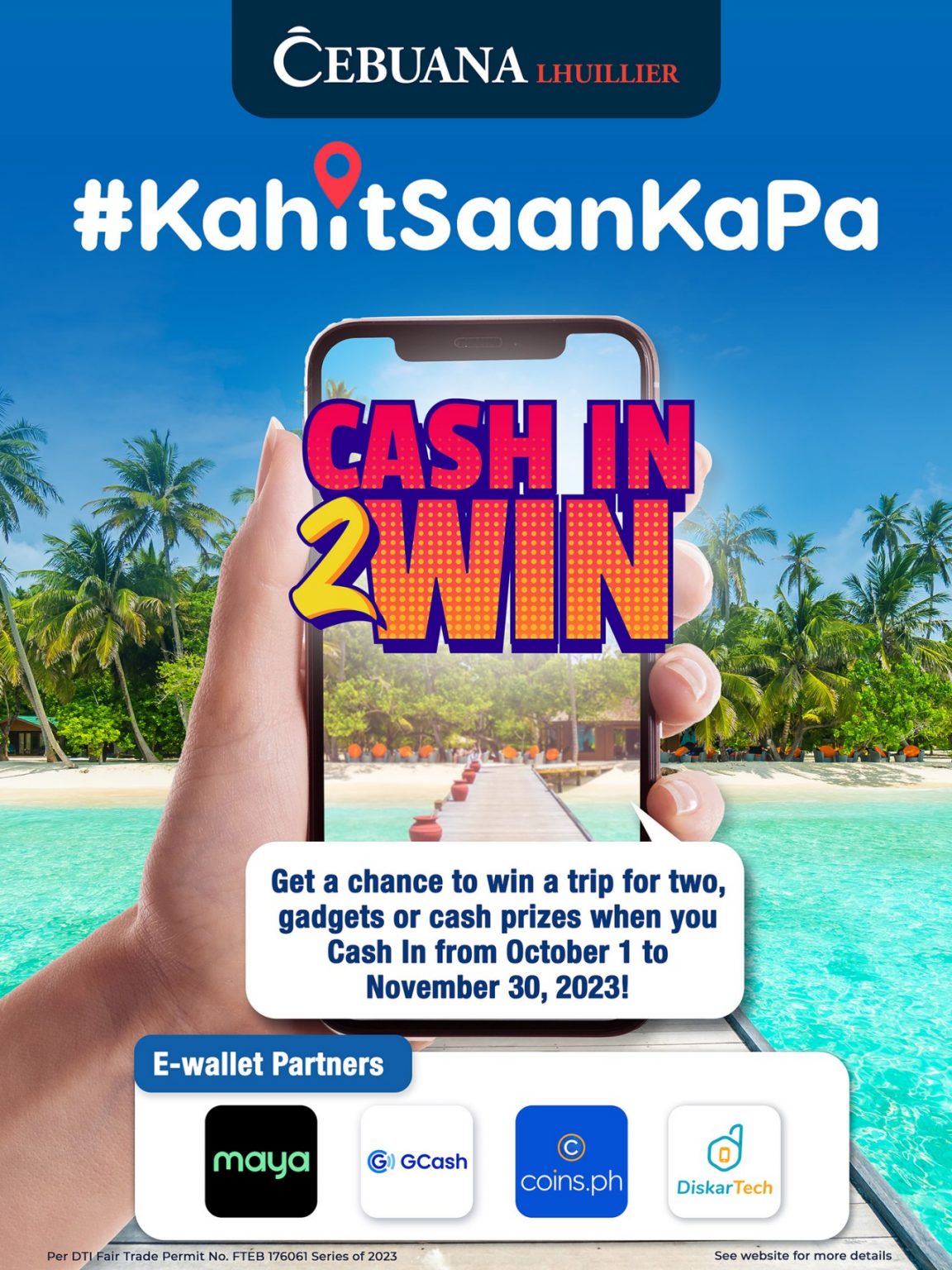

COMPLETE MECHANICS 1. All clients who will cash in or cash out to any e-wallet partner (GCash, Coins.PH, MAYA, Diskartech, and CebEx)at any Cebuana Lhuillier branch and Peralink authorized agent

COMPLETE MECHANICS 1.Must be a registered eCebuana app user.2.Must transact to any of the following within the promo period: Monthly Draw Grand Draw Draw Cut-off dates Draw Date Time of

1. All clients who will cash in or cash out to any e-wallet partner at any Cebuana Lhuillier branch or authorized retail agents will earn an e-raffle entry for every

Health card with up to P150,000 coverage for viral & bacterial illnesses and accidents. Product Details Premium P3,000 Coverage 1 year Max Quantity 1 active unit per insured Coverage Details

For your 24/7 health teleconsultation needs and more! Product Details Premium P2,500 Coverage 1 year Max Quantity Max 1 policy Coverage Details Age Range 7 years old to 70 years

For only P50, get up to P150,000 coverage for accidents, fire and illnesses Product Details Premium P50 per policy Coverage 4 months per policy Max Quantity Max 5 policies Coverage

Depending on your insurance plan, you may visit a Cebuana Lhuillier, Cebuana Lhuillier Financial branch or via online

To update your policy, please send an email via [email protected]

Yes, visit our Online Shop to purchase for a loved one Or visit a Cebuana Lhuillier branch along with the person you would like to insure.

Business hours of branches vary. Click here to check the branch business hours.

We need to test the item you submit for pawning so that we can give the proper appraisal value for your item.

Cebuana Lhuillier’s insurance is available via online, our physical stores & our retail partners. You can visit one of our physical branches on online branches to purchase your insurance. Click

Table of Contents Introduction Why You Should Remit Money Through Cebuana Lhuillier Convenient Services Exclusive Perks Accessible Locations Customer-Centric Staff Money Remittance Services at Cebuana Lhuillier Domestic Remittance International Remittance

COMPLETE MECHANICS This electronic raffle promo is open to all clients who will claim their international remittance sent through partners abroad in any of Cebuana Lhuillier’s 2,500+ branches nationwide. Promo

Congratulations sa IPONalo Raffle Promo winners! 1st Draw Winners R1A R1B R2A R2B R3 R4A R4B R5 2nd Draw Winners R1A R1B R2A R2B R3 R4A R4B R5

Saving money is such an integral part of one’s personal finance. It means valuing all your hard-earned money and becoming aware of what your priorities should be. But did

Nakikiisa ang Cebuana Lhuillier sa NPC, Fintech Alliance, Philippine Finance Association and the Non-Bank Financing Sector sa kanilang kampanya laban sa illegal practice ng online lending apps.

COMPLETE MECHANICS 1.This is open to all clients who will participate on Cebuana and Western Union Anniversary. 2.Here’s how to join: a.Use our official Cebuana and Western Union Facebook Frame.

Mechanics: 1. The promotion period is from August 1 to 15, 2021 2. Open to all registered members of the Cebuana Lhuillier 24k Rewards Program except employees and families of

PROMO MECHANICS This e-raffle promo will run from July 15, 2021 to December 31, 2021. This is open only to clients of Cebuana Lhuillier branches. For every purchase of CTPL

PROMO MECHANICS 1.This electronic raffle promo open to all clients who will send or receive their Western Union international remittance through any of Cebuana Lhuillier’s 2,500+ branches nationwide. 2.Promo will

Cebuana Lhuillier nabbed 13 distinctions from the 13th Annual Golden Bridge Awards, which recognizes global industry leaders for their outstanding business programs and innovations. The company received the highly

Mechanics: 1.The promotion period is from July 6 to 29, 2021. 2.Open to all registered and verified members of the Cebuana Lhuillier 24k Rewards Program except employees and families of

Introduction For most people around the world, financial security is difficult to achieve. Most individuals end up spending a large percentage of their wages to pay for bills and everyday

Introduction Saving money is difficult for most people because monthly wages are often just enough to cover everyday expenses and bills. Even if individuals can set aside a small amount

PROMO MECHANICS: The promo will run from: July 1-December 31, 2021. This promo is open to all Cebuana clients who will purchase five (5) ProtectMAX in a single transaction during

1.Promo duration is from June 15, 2021 to August 31, 2021 only. 2.This promo is open to all Cebuana Lhuillier branches and partners nationwide. 3.All clients who will transact Domestic

Saving money can be a struggle. According to BangkoSentral ng Pilipinas’ latest Financial Inclusion Survey, only 29% of Filipinos have a dedicated savings account. This means, more than half of

There is no doubt that saving money is important. The sooner you start to save money, the more you can save. In this post we are giving 15 tips and

Saving money as a student can be difficult. Most college and high school students are living on a tight budget, depending only on the allowance they get from their parents.

Mechanics: The promotion period is from June 7 to 22, 2021. Open to all registered and verified members of the Cebuana Lhuillier 24k Rewards Program except employees and families of

Introduction Whether you are purchasing gifts or settling bills, an online payment system is the most convenient way to complete your transactions. You no longer have to worry about leaving

Introduction Saving money is one thing people aim to do but is often difficult to commit to. While banks and other financial institutions offer several options to help individuals start

Introduction Have you ever wondered why there are more pawnshops than banks in the Philippines? This is attributable to the reality where pawnshops provide a wide range of financial services

Introduction With the increasing number of overseas Filipino workers (OFWs) globally, money remittances have been constantly boosting our country’s economy. This has been an ongoing trend in our recent history.

Promo Mechanics: 1.)Ang promo na ito ay available sa lahat ng Cebuana Lhuillier Branches Nationwide simula May 15 hanggang August 14, 2021. 2.)Ang promo na ito ay bukas para sa

Congratulations sa winners ng GINTONG 24k PAPREMYO! Marami pang prizes ang naghihintay sa inyo kaya magregister na sa 24k.cebuanalhuillier.com FOR FREE! GRAND DRAW WINNERS SHARON MANOOY BRANZUELA JENEVAVE R.

FULL MECHANICS Promo duration is from May 15 to August 15, 2021. All clients who will payout remittance from the US through Quikz in Cebuana Lhuillier branches located in Metro

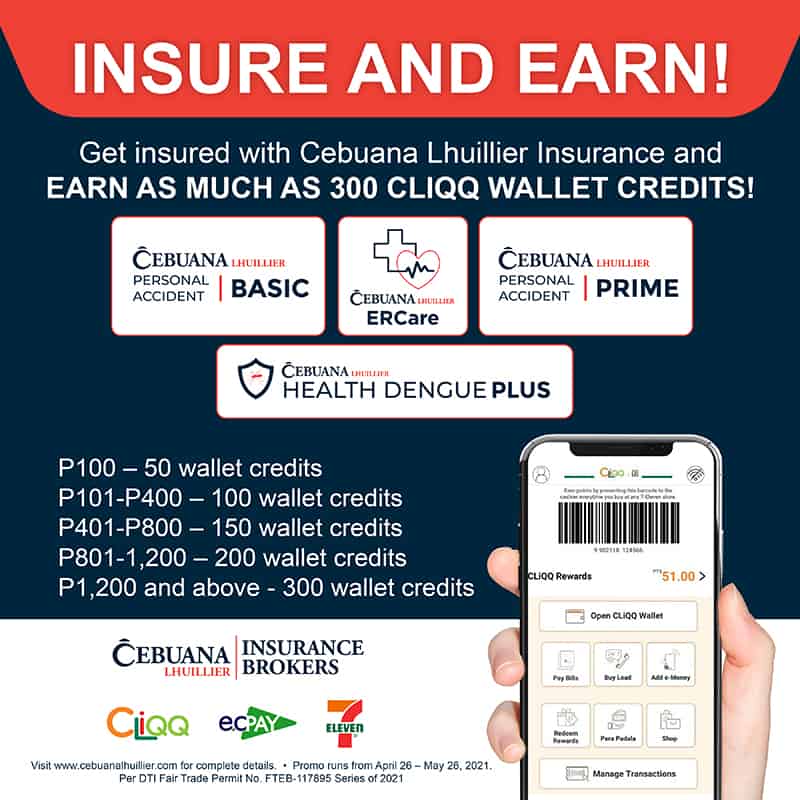

PROMO MECHANICS Promo will run from May 1, 2021 to March 31, 2022. For every purchase of any insurance product at any participating platform, for a premium of: 399 and

Congratulations sa winners ng SANGLA BLOWOUT! Marami pa kaming papremyo para sa inyo kaya basta sangla, ipa-Cebuana! 1st raffle draw winners: R1A R1B R2A R2B R3 R4A R4B R5 2nd

PROMO MECHANICS Promo period will run from April 26, 2021 – May 26, 2021. For every minimum purchase of insurance, client will be entitled to free CLIQQ wallet credits which

Promo Mechanics: Promo is open to all new prenda and renewal clients of Mindanao only, regardless of amount. Promo duration is April 15-July 15, 2021. For every successful transaction, the

This promo is open to all customers for the following Prenda Transactions: New Prenda , Renewals OMEE to regular and Lipat Sangla. Exclusive to Western Visayas, Romblon, at Central Visayas

Promo Mechanics: Exclusive to 100 Cebuana Lhuillier Branches in Central Luzon. All qualified clients will receive the following item and services from April 15 – July 15, 2021: FREE Cebuana

Promo Mechanics: The promo is open to all pawning transactions, except redemption. Locations: Batanes, Cagayan Valley province, Isabela, Quirino province, Nueva Vizcaya, CAR, Ilocos Sur, Ilocos Norte, Pangasinan & La

Promo Mechanics: 1. The promo is open to all clients with New Prenda and/or Renewal transactions. Locations: Bohol Cebu Biliran Samar Leyte Masbate Promo duration is from April 15 –

Promo Mechanics: 1. The promo is open to all clients with New Prenda and Renewal transactions. Promo duration is from April 15 – July 14, 2021. Locations: Manila Mandaluyong San

“Never leave for tomorrow what you can accomplish today.” You may have heard of that quotation and its various versions before. It’s very true, especially in our society today, when

The sudden occurrence of the COVID-19 virus caught everyone off guard during the first quarter of 2020. Just when you thought it was going to be another “walk in the

The COVID-19 vaccine is finally on its way, albeit, without any exact date. Since the first quarter of 2020, we’ve all been wondering about the existence of this wonder drug

It’s now the second month of the year. While January 2021 may have been the doorway we’ve all been waiting to enter since the first quarter of 2020, February 2021

Business ideas usually come and go, and yet, there are those which would stick with you for the most part. Do you ever find yourself randomly thinking about opening up

The Valentine’s season is among us. In spite of the ongoing pandemic, we Filipinos still find a way to lighten up the mood of our loved ones. After all, we

In spite of the current pandemic, we Filipinos still made sure to send our love and support to our loved ones. We made sure that we are always here to

2020 has ended and we are finally at the pinnacle of a brand new year. 2021, as many people hope, may be the fresh start that we’ve all been craving

2021 is finally upon us! Admittedly, 2020 has been a tumultuous year. People went through a rollercoaster ride of emotions, physical stress, and health scares, all brought about by the

We are always given a choice to invest our resources in various endeavors. These resources may include (but are not limited to) time, money, effort, and even ideas. Depending on

2020 was such a mess of a year, wouldn’t you agree? We have the burden of the pandemic on our backs; we’ve been ravaged by storms, we even had to

COVID-19’s impact is something that all of us were not able to predict, even beyond our wildest dreams. Before the pandemic hit, everyone was going through their daily routines, minding

Promo Mechanics The discount for fund transfer is available to all eCebuana mobile app users and Micro Savings Account Holders only. The transfer rate will be discounted to Php 10.00

Change – We all love that word. We may all come from different lifestyles, varying family backgrounds, and segregated beliefs, yet, there is one thing that unites us all, the

Out of darkness, there is always a ray of light called hope. When you think about it, the pandemic is one of the worst things to happen this year. Yes,

Christmas is right around the corner. All around the globe, people are already organizing how they’d celebrate this year’s Yuletide season. Of course, as luxurious and eye-catching our neighboring countries’

The COVID-19 pandemic impacted 2020 in ways which we were not able to imagine. People lost their lives; many lost their jobs, for others, their livelihood. The virus reached Philippine

The holiday season is finally upon us. In spite of the fact that this has been a very challenging year for everyone, we Filipinos always believe in the spirit of

The holiday season is upon us, and finally, we have something to celebrate about after all of the challenges we’ve hurdled this year. Indeed, 2020 is a year that would

Throughout the years, Cebuana Lhuillier has provided its long-time patrons with various remarkable services. Not to be limited to just pawning and appraisal, they are also heralded by their money

Microfinance services giant Cebuana Lhuillier has expanded its Cebuana-from-Home online platform to include pawning services as it seeks to provide greater safety and security for its customers who are adapting

In August of 2020, business tycoon Warren Buffett bought shares in the Canadian mining company Barrick Gold Corp., reinforcing the value of gold, whose price soared above $2,000 per troy

Microfinance services giant Cebuana Lhuillier has expanded its Cebuana-from-Home online platform to include pawning services as it seeks to provide greater safety and security for its customers who are adapting

As required by Bangko Sentral ng Pilipinas (BSP), clients who engage in a financial transaction with covered institutions for the first time shall be required to present the original and submit a clear copy of at least ONE (1) valid photo-bearing identification document issued by an official authority. For our clients’ convenience, Cebuana no longer requires submission of the photocopied ID. IDs are captured using a webcam in all branches. Clients are also required to submit an updated photo and other relevant information whenever the need for it arises.

Forms of identification accepted are the following;