Recognizing the need to raise MSMEs’ knowledge on disaster resilience, the Department of Trade and Industry (DTI) continuous to conduct regional business forums on disaster resilience as well as business continuity planning (BCP) workshops across the country.

According to the DTI, micro enterprises are adversely impacted by disasters, suffering the longest period of business disruption whenever disaster strikes. As such, efforts to teach MSMEs about business continuity planning must be intensified.

To date, the DTI through the Bureau of Small and Medium Enterprise Development (BSMED) has conducted eleven (11) regional business forums participated in by 2,685 MSMEs. Complementing these forums are disaster resilience seminars and conferences organized by DTI regional offices.

In a recent forum held in Zamboanga region, DTI regional MSME development division chief Lowell Vallecer said MSMEs should be innovative and resilient. “In cases of calamities, they must know what to do and to rise as soon as possible” Vallecer said.The forum, under the theme“enhancing innovative and resilient MSMEs,” revolved around the challenges confronting MSMES in Zamboanga Peninsula including strengthening MSMEs’ resilience against disasters.

Working with partners

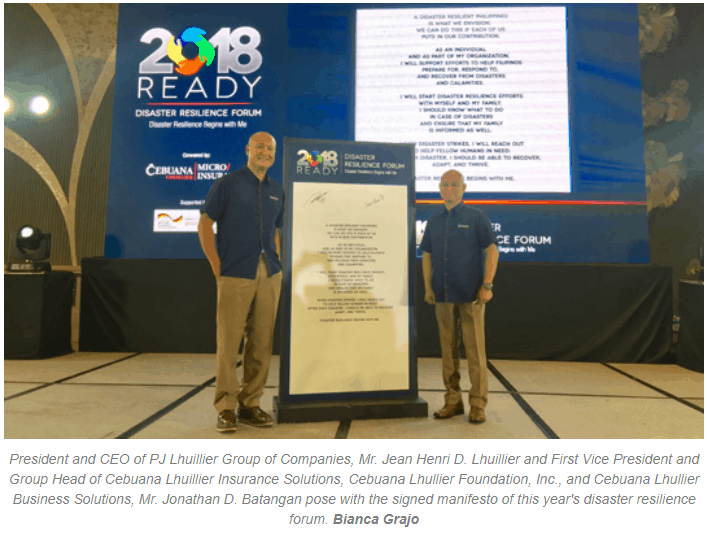

Seeking to create most meaningful impact on strengthening MSMEs’ disaster resilience, the DTI works with stakeholders from the government, private sector, NGOs, academe, and LGUs. One of the agencies that DTI works with is Cebuana Lhuillier Insurance Solutions (CLIS)which serves as key resource on the role of microinsurance in building disaster resilient communities.

“CLIS, as one of our regular speakers, provides insights on the role of microinsurance in building disaster resilient communities. It is also one of our partners in the Promotion of Microinsurance Disaster Risk Insurance (MicroDRI) for MSMEs in the Philippines project. The organization is helpful in developing the design of affordable microinsurance products for MSMEs,” DTI BSMED said.

In July 26, 2018,Jonathan D. Batangan, First Vice President and Group Head, PJ Lhuillier, Inc., spoke at the DTI’s Business Forum on SME Development and Disaster Resilience in Legazpi City. He stressed the importance of equipping MSMEs with the right information and tools in order that they may be ready to respond to and recover from disasters.

“Unfortunately, amid growing threats of disasters, many micro and small entrepreneurs remain unprepared. They don’t have any business continuity plan. They have no insurance to protect themselves from risks to their businesses. Hopefully, through DTI’s efforts to integrate disaster resilience in MSME programs, we can help more MSMEs become disaster resilient,” Batangan added.

MSME Resilience Core Group

DTI is one of the members of the MSME Resilience Core Group (MSME RCG). Formed in 2016, the MSME RCG is actively involved in implementing the SME Resilience Roadmap and Action Plan, with the following themes: (1) Enhancing SME general and disaster risk data, (2) Disaster risk reduction and management and business continuity management awareness and training, (3) Tailored disaster-risk financing for SMEs, and (4) SME inclusion in disaster risk reduction and management, and climate change adaptation policies, planning, and local institutions.

sources:

Cebuana Lhuillier’s interview with DTI-BSMED, Philippine News Agency, Manila Bulletin