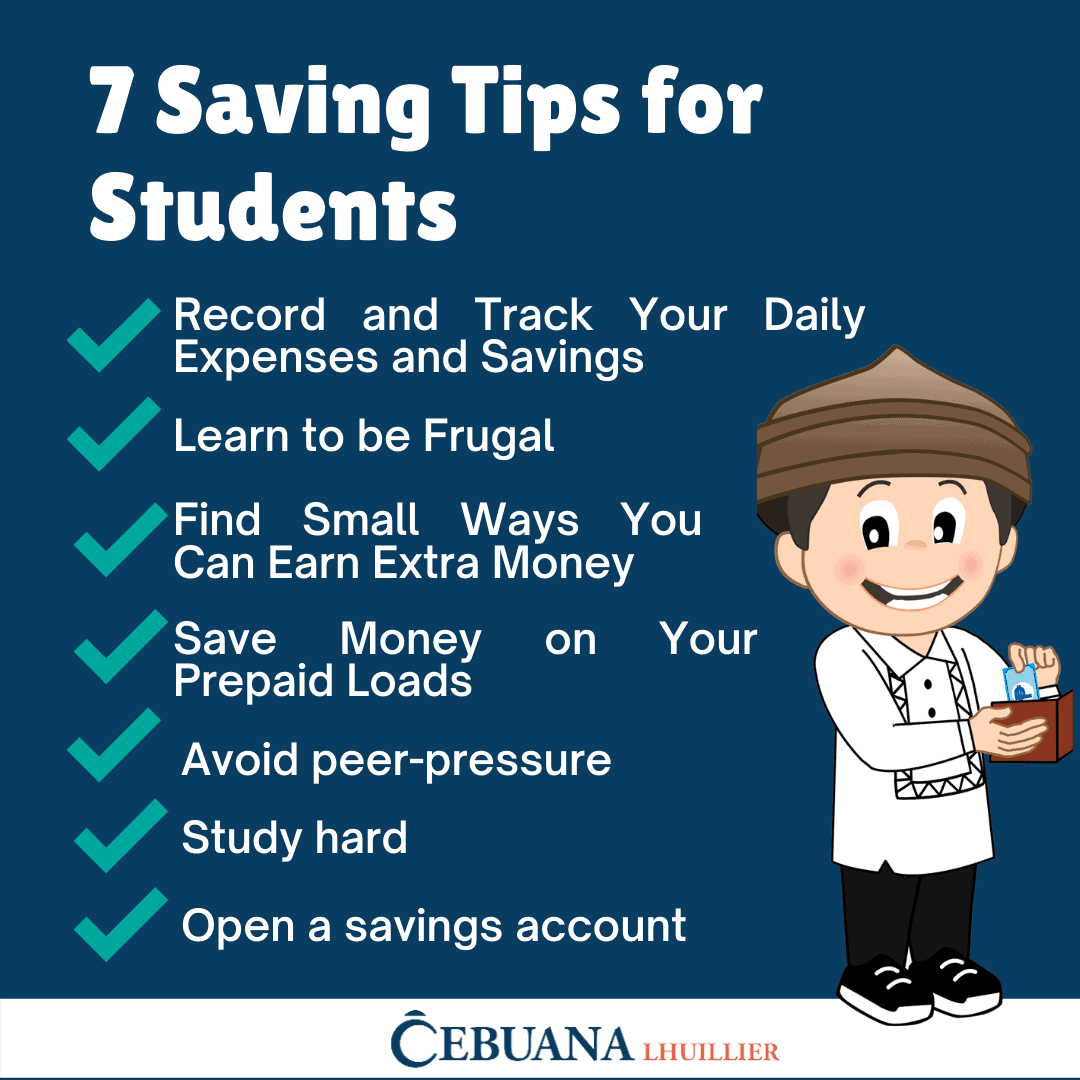

Saving money can be a struggle.

According to BangkoSentral ng Pilipinas’ latest Financial Inclusion Survey, only 29% of Filipinos have a dedicated savings account. This means, more than half of Filipinos find it difficult to save money.

But saving money is an important step to reach financial freedom. Failure to save money as early as now, can hinder you to live the life of your dreams in the future.

If you need more understanding on what saving money is and its importance, this post is for you.

What is saving?

Saving means putting aside money for later use.

When you save, you put the money at rest. You put it on a safe place readily available in case you already need to use it or for emergencies. People save money for food, for emergency situation, for a vacation, for an equipment, etc.

Everyone should save money as it is part of the fundamental elements of a sound financial plan.

Why Should You Save Money?

Here are a number of reasons why you should save money:

- Saving can give you peace of mind

Saving money empowers you to live life free of the worry of tomorrow.

Think about it — without savings, how will you survive a sudden financial storm? If you lose your job, will you be able to pay for your monthly bills? A medical issue in the family? A needed car or home repair?

Putting away money for a nest egg gives you the peace of mind that you are always ready for such situations. And the more money you save, the more secured you will feel.

1.Saving money can help you reach personal milestones

Your savings will help you achieve each of the personal milestones you have. When you have savings, you can be guilt-free in pursuing what you really want. You can treat yourself to a new clothing every now and then. You can spend for your dream travel destination. You can go after your passion projects or even start a business!

2.Saving money can prepare you for major life events

There are different events in a person’s life that’s worth not just the celebration but also the preparation. For instance, wedding and childbirth.

If you’re planning to get married next year, then you better start saving money today. Same when it comes to having babies. You want to make sure you have the money to pay for the delivery and a startup fund to provide for the baby’s needs after birth.

Even occasions such as milestone birthdays or anniversaries count. These events aren’t cheap so it’s important to save money for them.

3.Saving money can help you avoid debt

Saving money is not only to cover your everyday expenses, pay for unforeseen situations, and prepare for the future. With proper savings to rely on, you can also avoid getting into debt.

There are two kinds of debt in this world. We have what we call “good debt” and “bad debt”.

Good debts are debts that can potentially generate income or increase your net worth in the future. The best examples of good debts are buying a camera to start your photography business, getting a loan to start your own business or obtaining a house and lot to be sold or rented out.

Opposite to good debts are the bad debts. These are debts you get by purchasing depreciating assets or satisfying your wants. For example, credit card debt that piled up.

You can use your savings to buy your wants instead of impulsively swiping your credit card.

4.Saving money can empower you to financial independence

Financial Independence is defined as a state of having sufficient personal wealth to live, without having to work actively for basic necessities. And one crucial step to achieve this is to save money.

The earlier you save money the better it would be for your finances. Follow the formula of Expenses – Savings = Expenses. Make sure that you automatically save a portion of your income as cash reserve for future or emergency use.

Remember, saving money is important because it allows you to have better financial security. Having a set aside money would mean peace of mind should the unexpected happen. Learning how to save means valuing all your hard-earned money and becoming aware of where your priorities should be.

If reading this post convince you to start saving money, then it’s time to open your own savings account. No worries because you with Cebuana Lhuillier Micro Savings you only need Php 50 to get started.