Summer is finally here, and it is the perfect opportunity for us to spend time with our family. While it may be fun to go on an out-of-town trip with them, precautionary measures should be taken in order to ensure that the house we’re going to leave behind wouldn’t be a fire hazard. You have the scorching heat to thank for this, and while it may seem likely that a natural disaster couldn’t be stopped, its causes and effects are a different story overall. Prevention will always be better than cure, which is why we have prepared four precautionary measures for your home during the summer:

1) Check all of the wirings.

The common cause of fire in homes and establishments is faulty wiring. Before you leave for the summer, be sure to check all of your house’s wirings. If your house has a ceiling passage, then check that all the lighting sockets are in place. See to it that no mouse nibbles are on the wires and that no rubber strips are loose. Even a slight cut on the outer parts of your wires can cause a spark, so you must not leave your wiring unchecked.

2) Check the condition of your kitchenware.

Most specifically, your LPG. Even the simplest gas leak may cause insurmountable amounts of damage in property. Always remember that fire incidences do not claim only a particular set of item, as it also ravages all your personal belongings. The fact that you’ll be leaving home with no one to check on your property while you’re gone only means that you should make sure that everything is in place. Check that the LPG hose is properly attached, that there are no holes on the surface. You may apply a mix of dishwashing soap and water in order to detect any unusual air bubbles coming out of the tank.

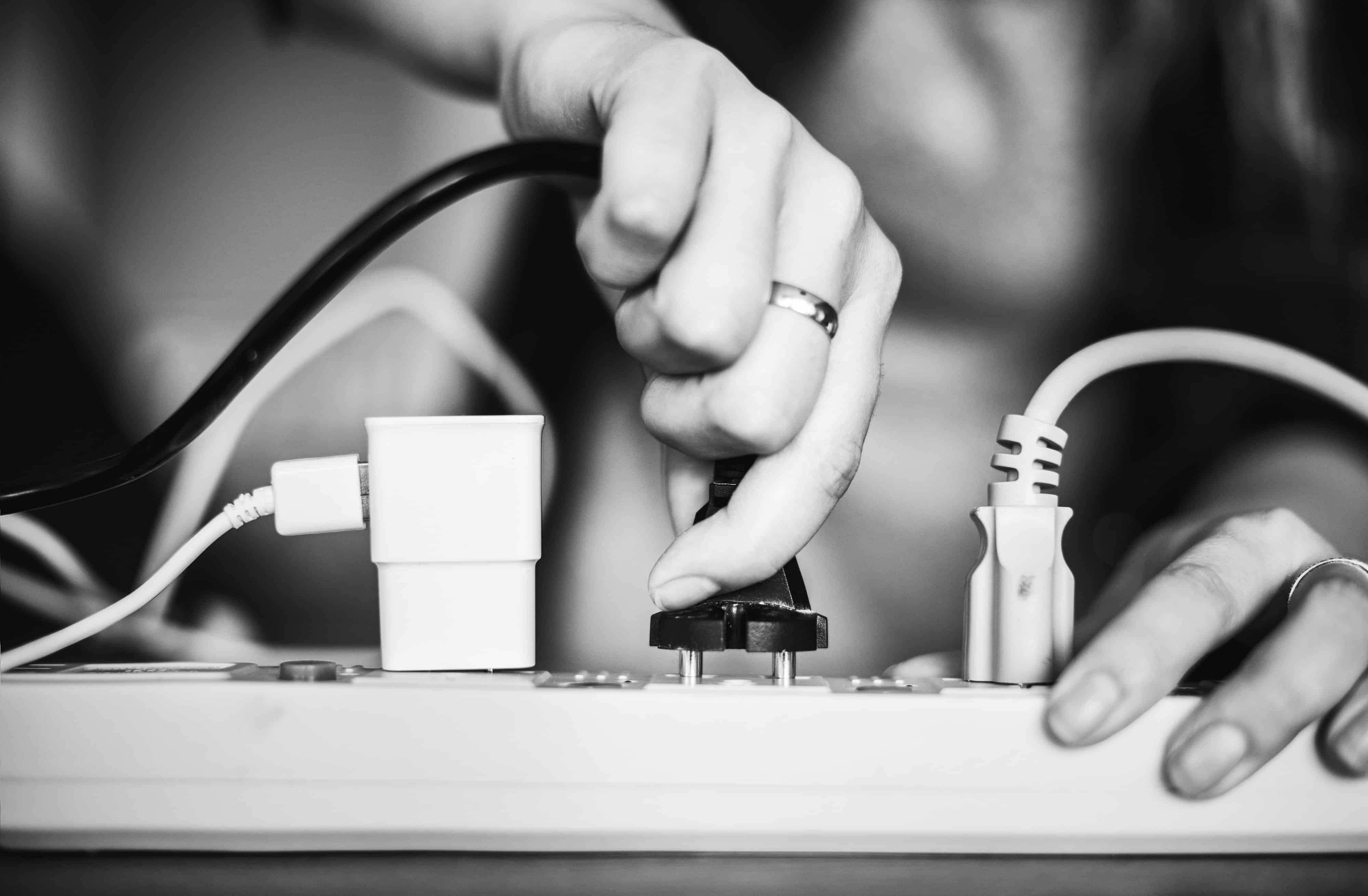

3) Unplug everything before you leave.

Okay, so your wirings are in place, no nibbles, no loose sockets, etc., but did you unplug everything before you left? Never leave any of your appliances plugged in while you’re away. This is like hitting two birds with one stone; you’d be able to avoid overloading your electrical appliances while saving a lot on your bills when you get back. Appliances, like the television, refrigerator, and electric fans still consume electricity even when they’re turned off.

4) Ask a neighbor to check your home from time to time.

So you’ve managed to tick all of the boxes, wirings, kitchenware, and all appliances are unplugged, but alas, natural disasters are always unavoidable, especially during the summer season. In that case, ask a well-trusted neighbor of yours to check on the house from time to time while the whole family’s away. Tell them that you’ll only be away for a short while and that they wouldn’t even need to monitor it every day, only a couple of times a week. A well-trusted and fast-thinking neighbor would not only be able to alert you when something goes wrong, but they may also save your home if ever something occurs out of the blue.

With all of those in mind, one main way of protecting your home from fire hazard is availing Microinsurance, that offers protection to buildings and residential dwellings including their contents against perils of fire, lightning and other allied perils such as earthquake, typhoon and flood.

You may be wondering which establishment would be best for availing microinsurance. Look no further than Cebuana Lhuiller, which offers affordable insurance products to help Filipinos avail of financial services and privileges. They have innovative microinsurance products and services that promise to minimize impact of distress and misfortune on one’s financial position in case of any unfortunate circumstances. Feel free to visit your nearest branch for more information.