Taking care of kids at early age may be stressful for a parent, but it’s also one of the most rewarding experiences ever. You may scold them, discipline them, teach them what’s right and wrong, but at the end of the day, they will always be the cuddliest part of the household. Playtime, meal time, storytelling hour, all of these would be an enjoyable activity with your kids, however, you should not forget one of the most important lessons you may teach them at an early age, financial management. It is common knowledge by now (even to first time parents) that the best time to teach kids something very important is from an early age. There are various studies proving this theory, most notably:

“Some evidence suggests that young children do have episodic memories of their infancy but lose them later. A six-year-old, for instance, can remember events from before her first birthday, but by adolescence, she has probably forgotten that celebration. In other words, young children can likely make long-term-like memories, but these memories typically fade after a certain age or stage of brain development. Memories made in later childhood and beyond are more likely to stick because the young brain, especially the hippocampus and the frontoparietal regions, undergoes important developmental changes that improve our ability to bind, store and recall events.”

Now, do not be discouraged by one of the mentioned facts above, that toddlers tend to forget information somewhere past adolescence, the thing is, a lesson that is taught over and over again has a higher chance of being retained in the long run, due to the fact that repetitive information can overcome the fading memory of youngsters when continuously fed to them on a daily basis. Any important lesson in life is as important as being taught to your kids at an early age, but out of all the vital things, the way they should handle their finances should be one of them.

The Candy Parable

Of course, this doesn’t mean that you should allow your toddlers to hold a huge amount of cash at a very early age, but rather, teach them the main concept of saving, handling, and managing limited resources such as money. You may start out, not by coins, but by candies. Younger kids tend to learn more if you were to interpret the lesson via something that they can definitely relate with. Using a candy would not only catch their attention, it would also retain it. Start out by giving them one or two candies, and then, tell them that it would be the only candy that they’ll be given for the whole week, and that they should “budget” how they’re going to consume it. Let them know that they can’t eat the whole lot within the day, otherwise, they wouldn’t be given any further pieces anymore.

Now, you may be wondering, “Even if I were to teach my kids consistently, how can I be sure that they’ll be able to retain those lessons while growing up?” Well, the thing about teaching your kids how to manage their resources while growing up is that it isn’t merely a vocal lesson about how to do things the right way, it’s also about experiencing the lesson itself. Case in point, the candy parable. Further evidence on toddler memory studies states that:

“For parents who worry that their toddler will not remember their special early years together, a memory is essentially a unit of experience, and every experience shapes the brain in meaningful ways. Specific memories may be forgotten, but because those memories form the fabric of our identities, knowledge and experiences, they are never truly or completely gone.”

Think of it as a way of schooling them, but instead of having a seat down class, this would be more of a practical activity.

What’s the point of teaching them at an early age?

Teaching them about the value of money and the hard work done behind the scenes to acquire them would mold their outlook towards their future as whole. This doesn’t mean that you’ll open their eyes towards the luxuries that money can buy, no, as a matter of fact, it’s the opposite. It’s all about the basic needs that money would be able to purchase, and that overspending would actually put people in more trouble that they can handle. Let them know of a human being’s basic needs. According to American Psychologist, Abraham Maslow, we all have five of them:

- Physiological needs – these are biological requirements for human survival, e.g. air, food, drink, shelter, clothing, warmth, sex, sleep.

- Safety needs – protection from elements, security, order, law, stability, freedom from fear.

- Love and belongingness needs – after physiological and safety needs have been fulfilled, the third level of human needs is social and involves feelings of belongingness. The need for interpersonal relationships motivates behavior

- Esteem needs – which Maslow classified into two categories: (i) esteem for oneself (dignity, achievement, mastery, and independence) and (ii) the desire for reputation or respect from others (e.g., status, prestige).

- Self-actualization needs – realizing personal potential, self-fulfillment, seeking personal growth and peak experiences. A desire “to become everything one is capable of becoming” (Maslow, 1987, p. 64).

Notice that three out of five can be attainable with the help of family, friends, and loved ones, so we will not focus on that. Instead, we will go back to the topic at hand, proper financial management. Both the first and second factors are attainable with cash in tow. The very first need is what basic needs are in general, food, drink, shelter, clothing, etc. Even if you were to attain the four other needs, if you do not have access to the first few ones, then you would definitely not survive.

As children grow, they will realize more about the lessons that they’ve learned at an early age, the things that you’ve taught them. And while you’re orienting them, let them know that they may encounter mistakes along the way, but learning doesn’t really stop when they do, a mistake is just the starting point for a new lesson.

Banking at an Early Age

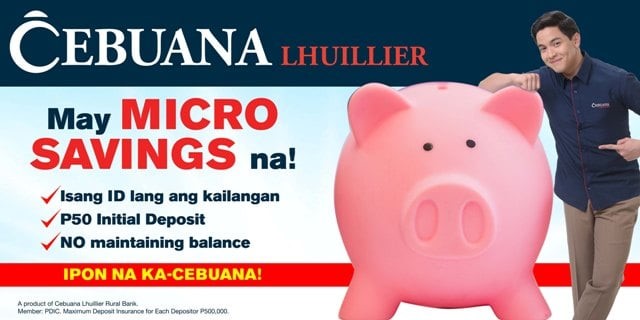

The thing about learning is that, it doesn’t always have to be boring. Many parents role play with their kids in order to have both quality time and family time. Role play the setting of a bank, for example. Let them know of the various scenarios involved whenever a person saves (or even overspends). Show them through role play the cons and pros of managing their money for the future. Better yet, when they’re already age seven (7), feel free to apply them for a “junior account.” Here is something we may recommend, none other than Cebuana Lhuillier’s Micro Savings service. It aims to provide easier banking access to Filipinos. The product is almost the same with any regular savings account in the Philippines and doesn’t require a maintaining balance.

Filipino citizens as young as 7 years old are even qualified to open an account, which can be considered as a “kids savings” or “junior savings” account. They can open a Micro Savings account with the help of their parent/guardian as they need to provide a valid ID together with the child’s student ID.