Families who live near esteros, low-lying coastal areas, in neighborhood most-prone to fires, and other places vulnerable to catastrophic events, Filipinos who are barely able to pay for their daily meals, individuals who can’t afford to pay for their bills when hospitalized – these are some of the people who Cebuana Lhuillier believes most deserve to benefit from its microinsurance donation project called OurHelp.

Cebuana Lhuillier announced that it has started working with partners in identifying beneficiaries for the OurHelp program. “Since the launch of OurHelp in July this year, we have already partnered with 3 organizations, and continue to partner with more – so we can cover as many beneficiaries as possible,” said Jonathan D. Batangan, PJ Lhuillier Group of Companies First Vice President and Group Head.

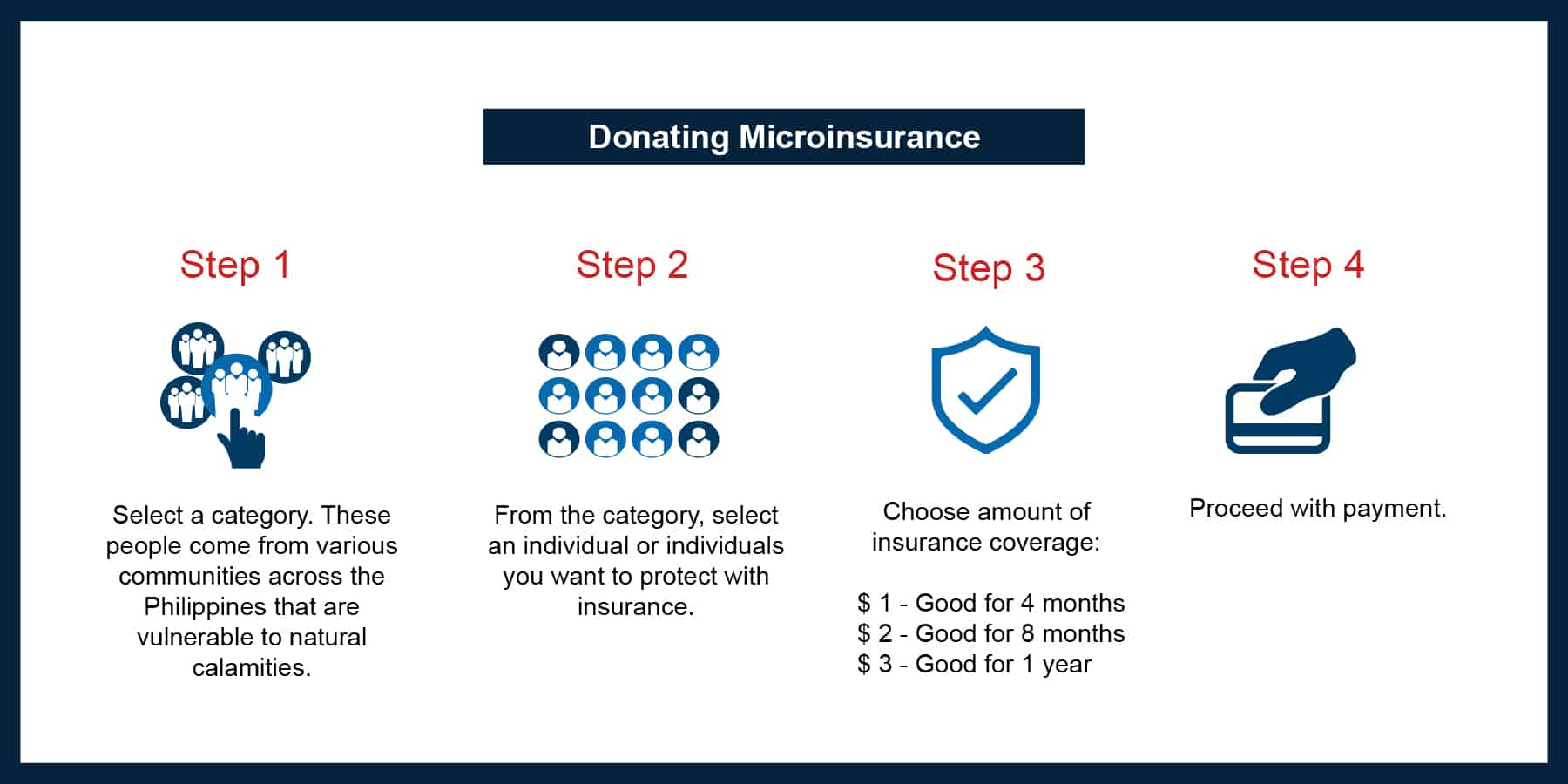

OurHelp is the first and pioneering donation platform that intends to help communities through insurance coverage. It features an online donation platform where donors can ensure an individual or communities who would not have access to or means of getting insurance coverage. For as low as one dollar (US$1) or fifty-three pesos (PhP53), donors can help underprivileged individuals be protected from financial challenges when unexpected and/or difficult incidents happen, such as disasters.

Initial set of beneficiaries

One of Cebuana Lhuillier’s partners, Caritas Manila, has helped them zoom in their search.

“We are targeting church volunteers who are poor and reside in areas that are high-risk to disasters such as the Sto. Niño de Baseco Parish in Tondo, Manila. The church volunteers spend and offer their 3Ts – time, talent and treasure – to Caritas without asking or expecting anything in return,” said Gilda Avedillo, Preventive Health and Disaster Management Program Manager at Caritas Manila Inc. – Damayan Program.

Batangan is optimistic that the program can help those who need insurance protection the most. “We are happy to be able to come up with an effective means to help marginalized communities in times of disasters. OurHelp is a platform that could help individuals rise up after a calamity. Through this program, more and more communities will be protected with the help of kind-hearted donors all over the world,” he said.

Beneficiaries of “OurHelp” gets microinsurance that covers death due to illness, accidental death, dismemberment and disability unprovoked murder and assault, and fire cash assistance.

The program also aims to create an impact to the community by giving a portion of every 1-dollar donation to the community basket and allocating it to scholarship programs implemented by the Cebuana Lhuillier Foundation.

Role of Microinsurance

Recognizing the role of the microinsurance industry in building disaster resilient communities, Cebuana Lhuillier has been actively engaging in efforts that will help Filipino families better prepare for, respond to, and recover from calamities. OurHelp was launched at the 2018 READY: Cebuana Lhuillier Disaster Resilience Forum held at Shangri-La at the Fort in July this year. It is an offshoot of the company’s National Protektado Day, a campaign that highlighted the importance of microinsurance and helped insure one million Filipinos in 2016.

In a speech given by the Deputy Insurance Commissioner Dorothy Calimag in the Cebuana Lhuillier’s disaster resilience forum, she expressed that microinsurance can contribute to the Philippine economy and will help secure lives and properties among high-risk sectors. She also cited the significance of developing microinsurance suitable for the marginalized communities.